When planning a wedding, should you pay cash or credit?

Credit cards offer big-time rewards. But they also might lead you toward a debt-filled future

Figuring out who, exactly, is financing your wedding is one of the most crucial parts of setting a wedding budget.

Gone are the days of the bride's parents paying for her wedding; these days, most couples pay for at least part of their weddings themselves. According to TheKnot.com 2012 Real Weddings Study, 90 percent of couples take on some of the cost, covering 42 percent of total expenses, on average.

Which leads us to the cash versus credit debate.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Even those of us who have been dreaming about our weddings may not have been saving for them for nearly as long. As you consider the wedding you want, it can be very tempting to pay for part of it — or most of it — with a credit card. But should you?

IN DEFENSE OF CASH

Paying in cash can make it easier to track spending. If you check your bank account regularly, you'll see exactly how much you're spending, and in real time. (You can also create a Wedding Folder in the LearnVest Money Center to track exactly how much you're spending in that category.)

If you know you're going to be shelling out for your wedding, you'll also want to create a Savings Goal and designate a set amount of your paycheck toward wedding expenses each month. That way you won't feel stretched when the bills roll in.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You won't have to worry about going into debt to pay for your wedding. Of course, if you pay for your wedding in cash and then pay for your groceries with credit, that doesn't count! But staying debt-free as you begin your marriage is the biggest reason to pay in cash.

There is no good reason to put a party — even a really good one that involves all your family and friends and loads of champagne — on your credit card if it means you'll still be paying it off when it's time to celebrate your first anniversary. And besides, there are ways to cut back and still have your dream wedding.

So what's the downside of paying in cash? Well, even if you have a solid plan for saving up for your wedding, the initial deposits can be steep, and not every couple has thousands of dollars lying around to cover them. If you are hoping to book the perfect venue and buy your dress as soon as you get engaged, you may find yourself struggling to find room in your paycheck to cover the cost of the deposits.

And that's when your credit cards might start looking mighty tempting.

IN DEFENSE OF CREDIT

Using credit cards can protect you if things go wrong. Hiring people you know very little about to do things you know even less about has risks, and sometimes, vendors just don't work out. Putting deposits on your credit card will likely afford you protection in the event of a problem with a vendor.

You can make off like a bandit with rewards. If you are able to put big wedding charges on your credit card and pay them off immediately, going that route with a rewards card can earn you some great bonuses. Hello, honeymoon!

Using a single card can make tracking relatively easy. If you wait until the end of the month to check your statement, you may be surprised by what you see ("Did I really spend $200 at Hobby Lobby? Oh right, I remember …"), but keeping charges to one card and checking your balance regularly isn't terribly difficult to manage.

WHERE WE STAND

When it comes to wedding budgets, it's best to figure them out once you've done some initial research, but before you've fallen in love with All the Things. So before you book anything, talk numbers and discuss the pros and cons of each way of paying with your significant other.

No matter which method you choose, we recommend setting guidelines for paying for wedding items. If you decide to do a combination of cash and credit, agree on exactly how much you're comfortable spending with each, how you plan to save for the wedding, and when you'll write checks to vendors or make credit card payments. Without a firm plan in place and a way of holding yourselves accountable, it's too easy to lose track and go into debt.

While we certainly love gorgeous wedding details, we'd never advise a couple to go into debt just to have a beautiful wedding. If you can afford to pay the charges off right away, using a credit card can offer certain benefits. But if you don't have the cash to pay off the balance in full each month, resist the urge to finance your wedding. (And don't let your parents or future in-laws use their credit cards to pay for your wedding, either!) Taking on additional debt at the onset of your marriage in order to keep up with the Joneses doesn't bode well for your relationship.

More from LearnVest...

-

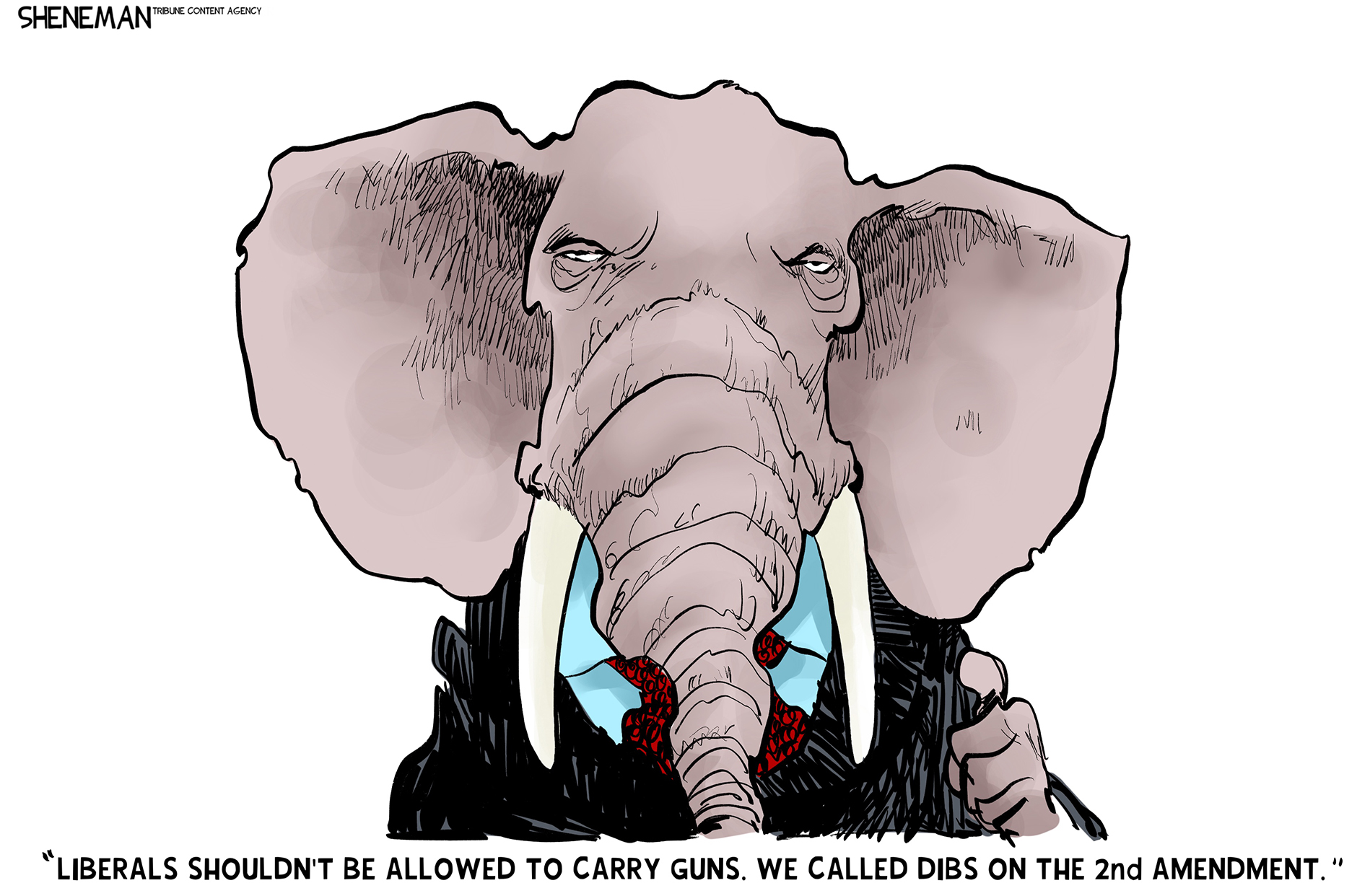

Political cartoons for January 29

Political cartoons for January 29Cartoons Thursday's political cartoons include 2nd amendment dibs, disturbing news, and AI-inflated bills

-

The Flower Bearers: ‘a visceral depiction of violence, loss and emotional destruction’

The Flower Bearers: ‘a visceral depiction of violence, loss and emotional destruction’The Week Recommends Rachel Eliza Griffiths’ ‘open wound of a memoir’ is also a powerful ‘love story’ and a ‘portrait of sisterhood’

-

Steal: ‘glossy’ Amazon Prime thriller starring Sophie Turner

Steal: ‘glossy’ Amazon Prime thriller starring Sophie TurnerThe Week Recommends The Game of Thrones alumna dazzles as a ‘disillusioned twentysomething’ whose life takes a dramatic turn during a financial heist