The job market: Stuck in neutral?

The economy added 195,000 new jobs in June, but the unemployment rate didn't budge

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The economy added 195,000 new jobs in June, the Bureau of Labor Statistics reported Friday, beating analysts' expectations and continuing the trend of steady, if modest, job growth. The unemployment rate, however, remained at a stubborn 7.6 percent.

The bureau also revised April and May's reports to include 70,000 more jobs than previously reported.

The White House, while careful not to overplay the significance of the report, seized on it as evidence that the recovery is continuing apace.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The jobs growth, combined with relatively positive numbers in auto sales, housing, and manufacturing activity, could convince the Federal Reserve to start trimming its massive stimulus plan in just a few months.

The Fed is now purchasing $85 billion in Treasurys and mortgage-backed securities each month to keep interest rates down and encourage economic growth. In June, Fed Chairman Ben Bernanke said that if the economy continues to grow steadily, the central bank could start "tapering," or cutting down on the monthly purchases, as soon as later this year.

Bernanke's report has left the bond market, which has come to rely on the Fed's easy money, on pins and needles the last few weeks, and investors have started dumping bonds in anticipation of tapering. This morning, the bond market seemed to read the jobs report as more scary news: The 10-year Treasury note yield surged to 2.70 percent this morning, from around 2.55 percent before the report.

But while job growth is on track to trigger tapering, Bernanke also said the unemployment rate will need to shrink to around 7 percent to end quantitative easing. The sticky 7.6 percent unemployment rate is a sign the labor force is swelling at about the same rate of job growth. Business Insider's Joe Weisenthal called the report "the mother of all goldilocks."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"Because unemployment remained at 7.6% — contrary to expectations of 7.5% — and because there was a rise of part time and undermployed workers, the Fed keeps ample breathing room, even though the pace of job creation is picking up," he wrote.

Others seemed to find the number disheartening.

Other measures of unemployment were also worrisome. The U-6, a broader measure of unemployment that includes part-time workers looking for full-time work and those who have abandoned their job search, actually rose a half a percentage point to 14.3 percent, from 13.8 percent.

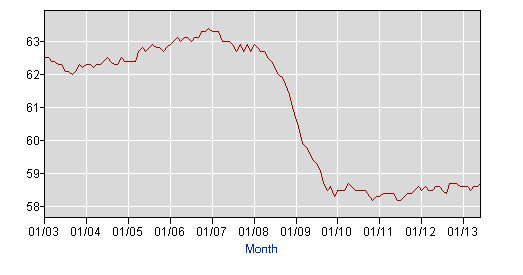

And the employment to population ratio is still at a depressed 58.7 percent.

The bright news: The private sector is adding enough jobs to offset any drag caused by the sequester, across-the-board spending cuts that were enacted in the spring. Though the government at all levels lost 7,000 jobs in June, the leisure and hospitality industries added 75,000. Professional and business services added 53,000 new jobs.

Carmel Lobello is the business editor at TheWeek.com. Previously, she was an editor at DeathandTaxesMag.com.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day