Making money: Saving for college with a 529, and more

3 top pieces of financial advice — from where to buy a home to avoiding the urge to flee the market

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Saving for college with a 529

If you're going to be sending a kid to college someday, consider a 529 plan, said Jeff Reeves in USA Today. This government-approved, tax-free investment account is "one of the best tools out there" to help pay for a child's tuition. Anyone can contribute to a 529, so you can nudge your extended family and friends to pitch in to your offspring's collegiate future, too. Accounts are also transferable, so if one child doesn't go to college, the cash can be transferred to another 529 account without any penalties, and there's no time limit on when the funds need to be used. But you should still research your plan — there are dozens to pick from, and some impose fees, have minimum contributions, and cap how much you can save. Depending on your state, they may also offer income tax incentives.

Don't flee the market

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Worried about the recent market sell-off? asked Melanie Hicken at CNN.com. Ignore the knee-jerk reaction to panic and sell, even if Wall Street's recent tumult delivered "a hit to your retirement savings." Financial planners say the wisest plan of action is to stay the course. As they always remind us in moments like this, investing in the stock market "is inherently volatile, but it's also the best way for retirement savers to build up nest eggs large enough to last decades." Over time, daily market fluctuations will eventually be eclipsed by longer-term gains. And since many retirement accounts are composed of different assets based on your age and career stage, "the effects on your portfolio may look different from the headlines."

Where to buy a home

We all know that when it comes to real estate, location is key, said Ilyce Glink at CBSNews.com. But a good address can actually be a drawback for buyers as "homes in the most desirable locations in any city are snapped up within days of going on the market — and at increasingly high prices." Homebuyers who are looking to save money as they search for their dream home should "avoid areas with a lot of name recognition." A location's reputation alone can swell the price of a house. Identify your favorite places, but don't shop there — look for comparable areas that have "a similar feel, but with a lower median list price." You may not even have to go far. Quite often "there can be a huge price difference between two cities located right next to each other."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

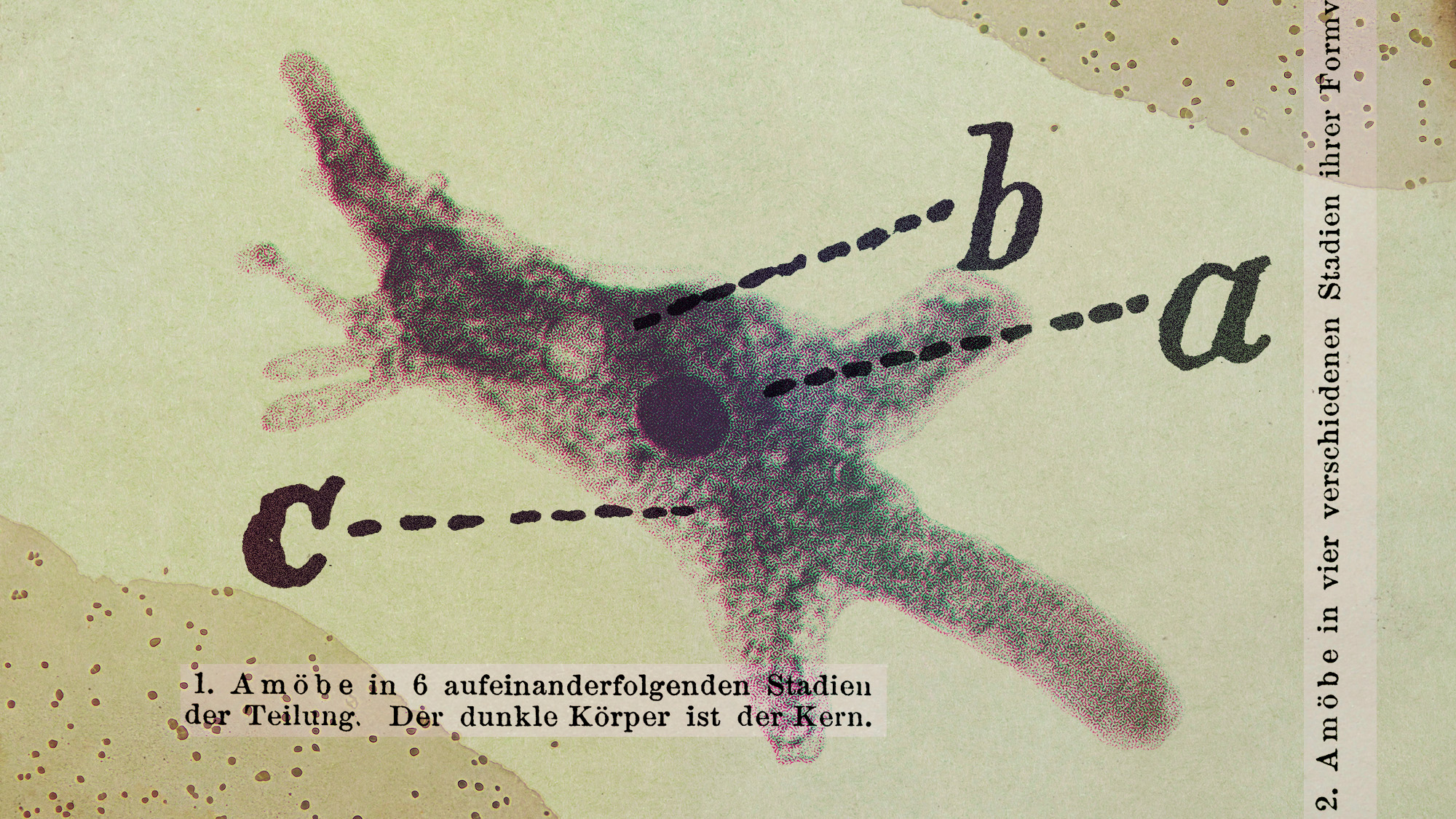

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’