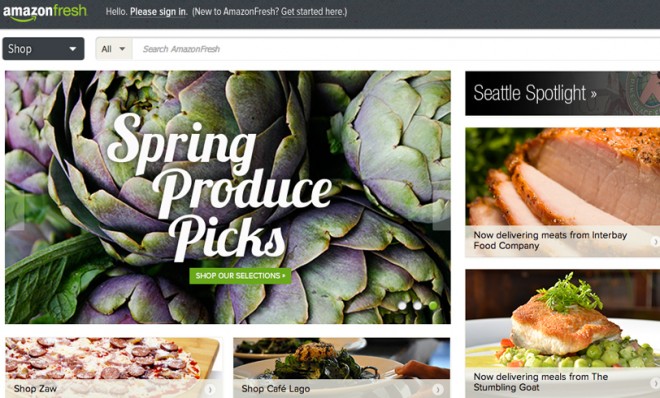

Could Amazon dominate the grocery business, too?

AmazonFresh may be coming to a city near you

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Amazon has already killed or crippled a number of big-name businesses: Brick-and-mortar booksellers like Barnes & Noble and Borders; electronics megastores like Circuit City, with Best Buy not too far behind. And now, the Seattle-based monolith could be aiming its cross-hairs at a new target: Your local grocery store.

Reuters reports that AmazonFresh, which has been running in Seattle for five years, could expand into new markets in the coming months, beginning with San Francisco and then Los Angeles. If these test markets go well, "the company may launch AmazonFresh in 20 other urban areas in 2014, including some outside the United States," according to two anonymous sources.

AmazonFresh has pretty much anything you can get at your local grocery store, and delivers the goods to your doorstep the day after you order. Users simply pick what they want online or through an app on their Windows Phone. In Seattle, AmazonFresh users can even order local and organic goods from specialty retailers, like Pike Place Fish Market or Blue Streak Chocolate.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The service isn't unlike FreshDirect in New York, or Instacart in the Bay Area. "Both firms have been working single markets, breaking ground and demonstrating a fact," says Alex Wilhelm at The Next Web: "Grocery shopping simply isn't a popular activity."

But food delivery is a low-margin business that grapples with a unique set of logistical challenges. If Amazon is indeed looking to expand its grocery-delivery service into new markets, perhaps its best move would be to acquire a would-be competitor like FreshDirect. Because expansion isn't easy, says Larry Dignan at ZDNet:

You need distribution, which Amazon has, logistics to keep food cold, tight delivery windows that the vendor needs to control and relationships with local providers and even local farmers if you want to play the better margin organic game. [ZDNet]

Such a move, argues Dignan, would be akin to Amazon's purchase of Zappos: "Amazon would get distribution, brainpower, and leave the brand largely alone."

Amazon doesn't typically play the short game, and has shown that it's willing to take big risks for long-term growth. Despite the challenges an AmazonFresh expansion presents, could a home delivery service actually succeed nationwide? If it does, you can see the upside for Amazon.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"Grocery is a frequency business," Manfred Bluemel, former head of market research at Amazon in 2010, tells Reuters. "If Amazon can deliver to consumers' homes two or three times a week, they can up-sell other items."

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict