Will Congress actually break up 'too big to fail' banks?

Washington can't agree on much these days. Which makes this new bipartisan push all the more surprising...

Cutting the big Wall Street banks down to size has been a liberal fantasy since at least 2008, when the financial system teetered on the brink of its own recklessness and hubris, dragging the rest of the economy down with it. Democrats managed to pass a big financial reform package, Dodd-Frank (or Wall Street Reform and Consumer Protection Act), in 2010. But even if Republicans hadn't taken over the House in elections later that year, the general consensus has been that there's no more will to take on Wall Street (and its deep pockets).

In February, Federal Reserve Chairman Ben Bernanke appeared to say that Dodd-Frank has solved the problem of giant banks being so big they threaten the global economy — in a disagreement with Sen. Elizabeth Warren (D-Mass.), who argued that "too big to fail" is too big a problem to ignore. On Wednesday, Bernanke officially switched sides. "I agree with Elizabeth Warren 100 percent that it's a real problem," he said at a press conference. "Too Big To Fail is not solved and gone.... Too Big To Fail was a major source of the crisis, and we will not have successfully responded to the crisis if we do not address that successfully."

Bernanke was a registered Republican when George W. Bush tapped him to be Fed chairman, says Jason Sattler at The National Memo, and he isn't the only prominent Republican to agree with Warren about the danger of giant banks.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In fact, it's surprising "just how bipartisan the support for breaking up the big banks has become," says David Dayen at The American Prospect. "Over the last few years, conservative intellectuals — from economists and central bankers to think-tankers and high-profile pundits — have come to the conclusion that the largest institutions remain Too Big to Fail," and together with populist conservative anger from grassroots Tea Partiers, "these forces have penetrated the Beltway."

The new surge of interest in ending Too Big to Fail on the right has converged with an existing effort on the left, and it's translating into legislative action. Sherrod Brown, the populist progressive senator who just won re-election in Ohio, has been discussing solutions to the mega-bank problem with up to ten Republican senators. Against all expectations, his main partner is David Vitter, a Republican and fellow member of the Senate Banking Committee....

At the end of February, Brown and Vitter announced they would work on legislation to incorporate much of the thinking about how to deal with runaway banks. Brown tried this once with an amendment to Dodd-Frank with Senator Ted Kaufman that would have capped mega-bank assets to a percentage of GDP. It received 33 votes in 2010, with only 3 Republicans supporting. Brown's discussions with colleagues leave him thinking Brown-Kaufman could get at least 50 votes today, and the bipartisan nature of the Brown-Vitter effort could mean that whatever results will have an even better chance at broad support. [American Prospect]

Here's the problem, says Matthew Yglesias at Slate. Even if everybody agrees on the need to cap the size of big banks, there's no agreement about what that's supposed to accomplish. Would smaller banks have less political clout? Probably not. Was the size of banks really the problem? It's not clear. And "I get really suspicious" about conservatives' motives: Does breaking up the banks just give "Republicans something to talk about while in practice they work to subvert the regulatory framework"?

Is there really a bipartisan movement here? I'm not so sure. I'm not saying there isn't. But I have my doubts. To me a key question is do people want to reduce bank size as part of a regulatory strategy or as an alternative to a regulatory strategy. Those are two very different policies. My view is that the right direction of causation is that better-regulated banks would be smaller and much less likely to fail, but that's not the same as saying there's a class of "Too Big To Fail" banks that can be shrunk down and forgotten. [Slate]

"I favor breaking up big banks, but despite this supposedly newfound fervor on the right, I doubt that it has any chance of happening," says Kevin Drum at Mother Jones. "It's just too big a task," and it would be much easier — and almost as effective — to just require banks to keep larger capital reserves.

Either way, though, this is good news. I've always figured that Dodd-Frank and Basel III were basically our only shots at fixing the financial system, and once they were done, they were done. There was just no appetite to revisit them. That's still the smart way to bet, but there may be a slightly brighter ray of hope on this front than I thought. [Mother Jones]

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

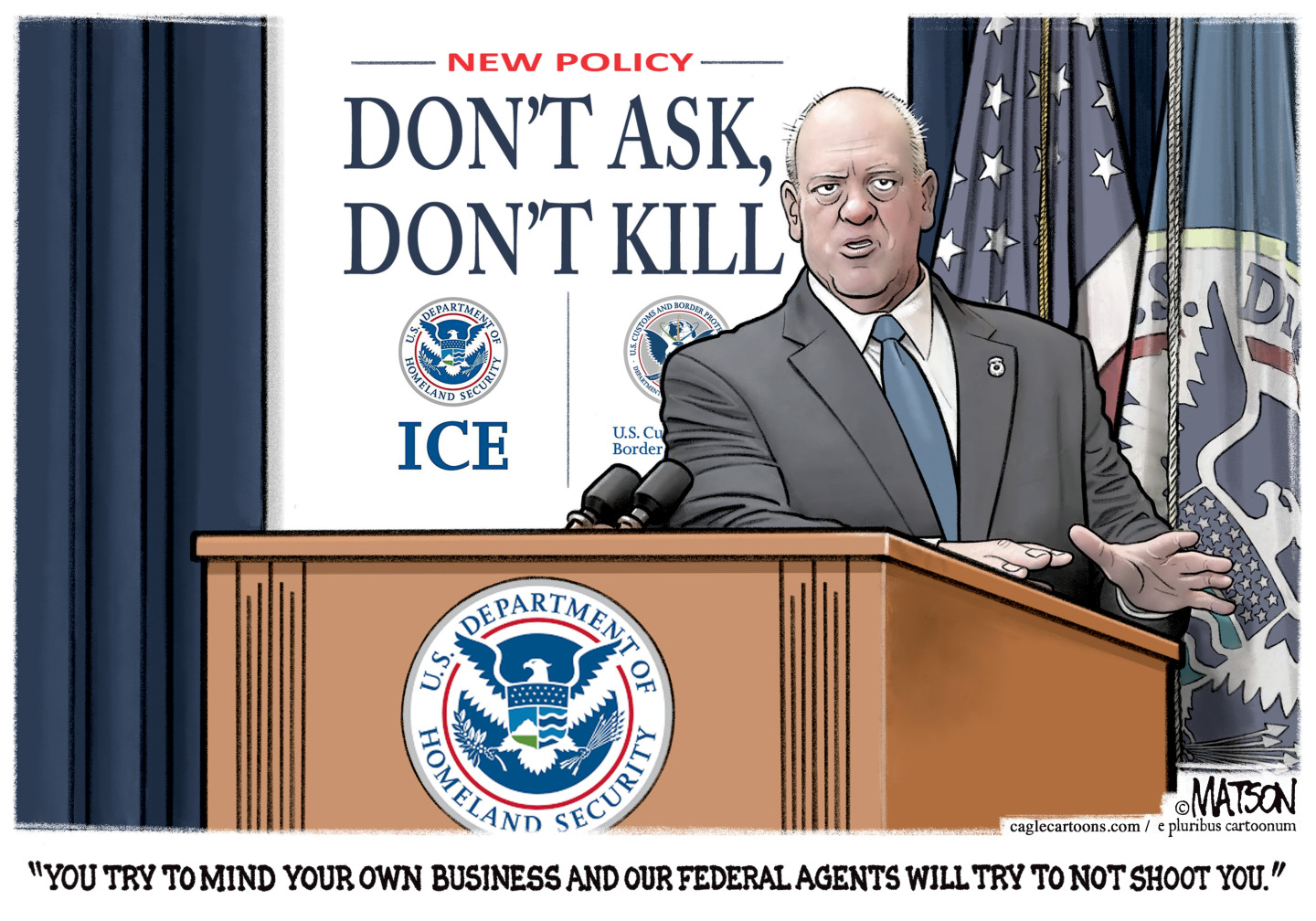

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’