What's behind the Dow's record high? 4 theories

The benchmark index's exceptional run stands in stark contrast to the average American's mediocre economic reality

The Dow Jones Industrial Average on Tuesday stormed past its previous all-time high, capping an extraordinary, years-long bull run that began in the depths of the Great Recession. The Dow closed at 14,254, pulling ahead of its previous closing day high of 14,164.53 in October 2007, as well as an intraday high of 14,198.10 achieved at roughly the same time. The surge in market activity stands in stark contrast to the slow grind of the American economy, which is suffering an unemployment rate of 7.9 percent and grew at a near-standstill pace in the fourth quarter of 2012. Here, four theories for why the Dow is screaming hot:

1. The Fed's easy-money policies

Since the financial crisis, the Federal Reserve has been buying up bonds and assets by the trillions, which has kept borrowing costs low for companies. According to Peter Eavis at The New York Times:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Federal Reserve has added more than $3 trillion of monetary stimulus to the economy and more than $1 trillion of bailout loans to financial firms since the 2008 financial crisis. This was done to prevent a widespread banking crash and help the wider economy.

Perhaps as important is the psychological shot in the arm: When investors believe the Fed is providing a systemic backstop, they will be more likely to get back into the market, and stay there. [The New York Times]

2. The U.S. economy is improving

While many Americans may not feel it, there are indications that the economic recovery is gaining momentum — or at the very least, is here to stay. "Equity investors have been welcoming signs of improvement in the U.S. economy," writes Ryan Vlastelica at Reuters, "the latest sign was data showing that growth in the vast U.S. services sector accelerated to its fastest pace in a year in February." The services sector, as measured by the Institute for Supply Management, covers nearly 90 percent of the economy, from housing to manufacturing to exports.

3. Companies are making profits — overseas

The Dow is composed of an elite group of multinational, blue-chip companies that have been making money hand over fist in China and elsewhere, one reason why there is such a disparity between the fortunes of corporate America and Main Street. "Big American-based corporations have been expanding and hiring around the globe where markets are growing fastest — even while the U.S. market is lackluster," writes former Labor Secretary Robert Reich at his blog. "Tax policies and trade policies have encouraged them."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Markets are ignoring Washington

The Dow's all-time high comes just days after Congress failed to avert the sequester, $85 billion in across-the-board spending cuts that the White House and independent analysts have claimed will take a toll on the economy. But coming on the heels of the fiscal cliff and a showdown over the debt ceiling, it appears the market has learned to shrug off the never-ending budget crisis that has engulfed the capital. As Ben White at Politico writes:

Perhaps, [Wells Capital Management analyst James] Paulsen suggested, investors have decided to just stop paying attention to every single Washington-engineered budget meltdown.

"I think it's poetic justice that the market is going to all-time highs just as we go over the sequester edge," he said. "What this bull market has been all about has been overcoming one Armageddon story after another. And here we are and investors are finally saying, 'Screw it, I've had enough of Washington.'" [Politico]

How long will the good times last? Many analysts say rising share prices are in line with corporate earnings — meaning we're not seeing another bubble emerge. And the market in many ways has simply regained what it lost during the crisis and the recession.

However, the fact that the market appears to be on stable ground may be encouraging a bubble-like trend, following years in which cautious individual investors largely withdrew from riskier investments. Skeptics note that trading volume — the sheer amount of shares traded on a day-to-day basis — remains at historically low levels, which indicates that the bull run has mostly been driven by large, institutional investors. "Signs are picking up that the little guy is coming back to stocks," says Steven Russolillo at The Wall Street Journal. "With the Dow at new highs, the question is whether mom and pop have arrived too late to the party."

Ryu Spaeth is deputy editor at TheWeek.com. Follow him on Twitter.

-

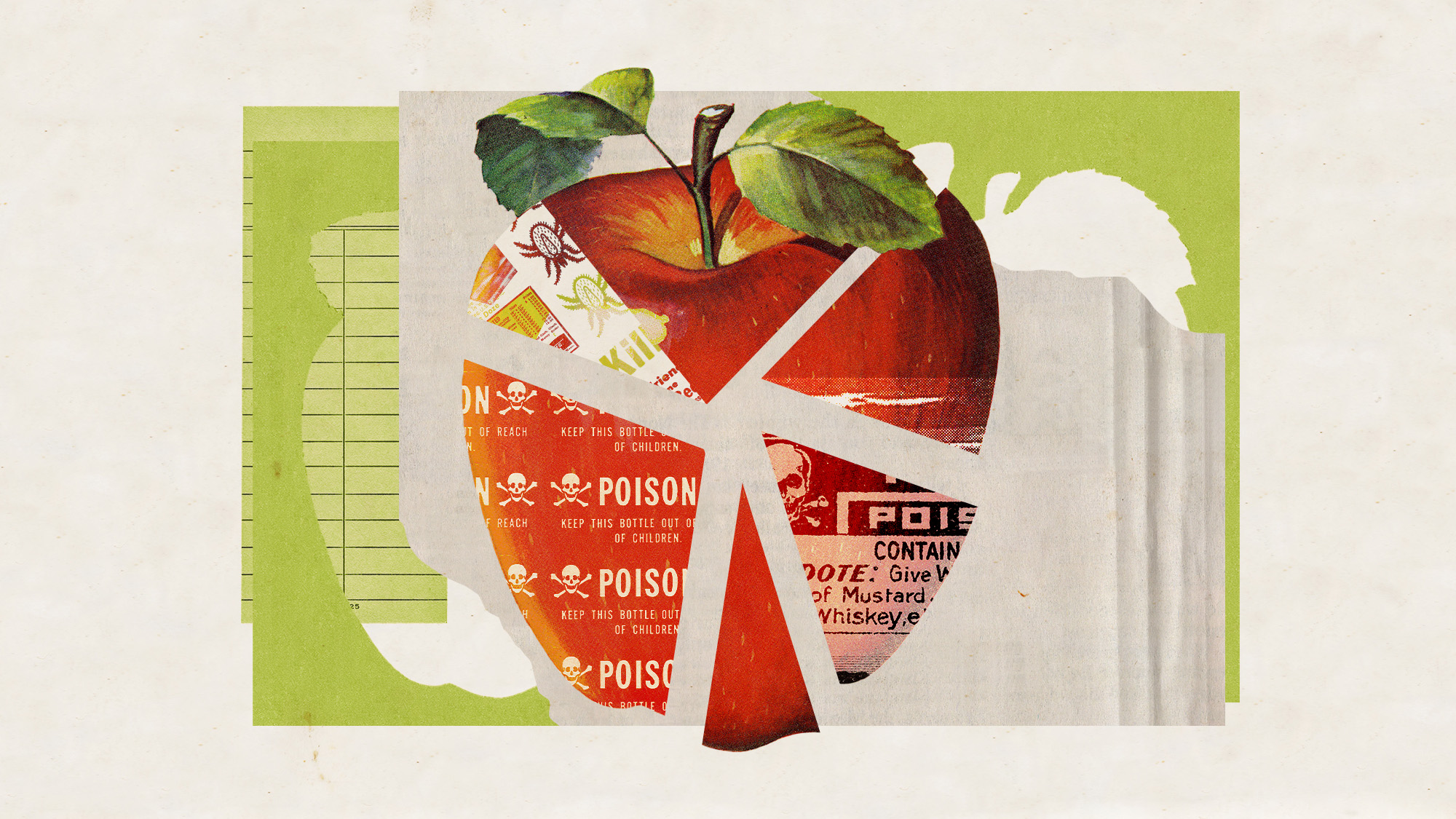

Europe’s apples are peppered with toxic pesticides

Europe’s apples are peppered with toxic pesticidesUnder the Radar Campaign groups say existing EU regulations don’t account for risk of ‘cocktail effect’

-

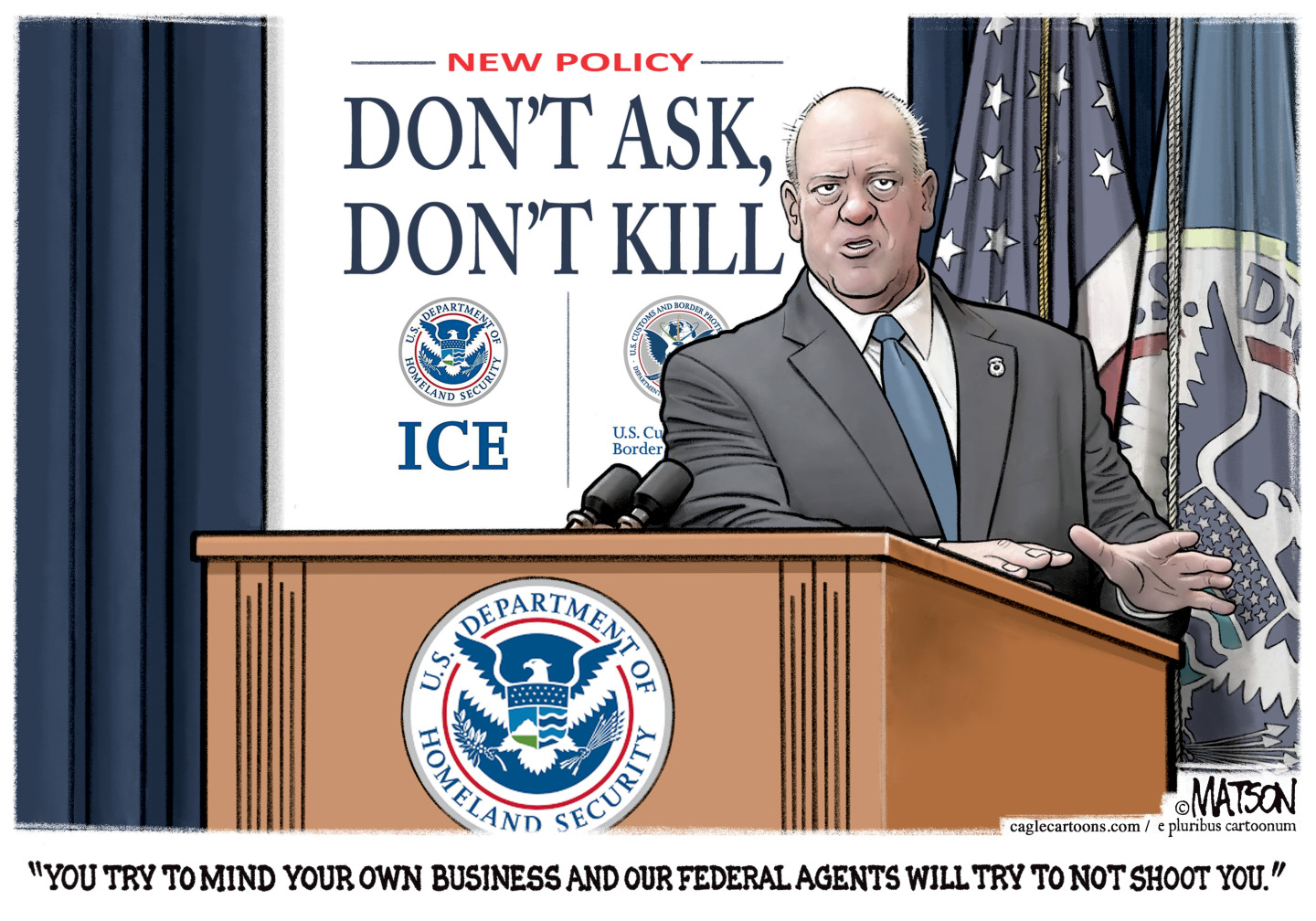

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history