Why does Wall Street hate Obama?

The titans of Big Finance are raking it in like never before

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Hey, Wall Street, where's the love for Barack Obama? His presidency has been good for you. Very good. Let me count the ways:

* Since bottoming out in March 2009, the stock market, as measured by the S&P 500, has gained 125 percent. Investors have more than doubled their money in less than four years. It's the biggest gain under any president since World War II.

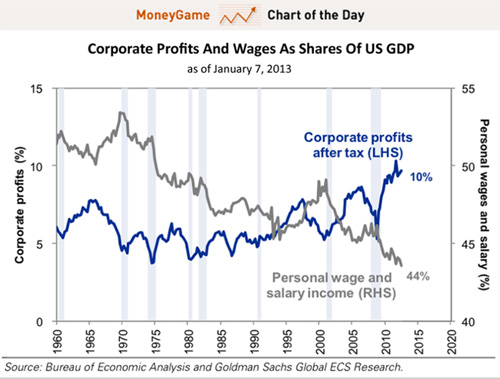

* Since 2009, corporate profits — even when taxes are factored in — have surged 171 percent, to their highest levels since World War II.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

* Companies are now more profitable, relative to the size of the economy, than at any time since such data has been gathered (going back to 1947).

One reason profits are so high: Companies aren't paying workers much these days (relative to the size of the economy), as this chart, produced with the help of Goldman Sachs, shows.

But wait, there's more. In the wake of the economic meltdown, the Obama administration didn't prosecute a single Wall Street executive — not one — for the widespread fraud that nearly destroyed the economy and wiped out nearly $8 trillion in the citizenry's wealth from the real estate meltdown alone — and trillions more from the stock market's 57 percent drop. If you missed the recent Frontline documentary on PBS about this (fittingly titled The Untouchables), it's worth an hour of your time. The execs, as Frontline puts it, were simply "too big to jail." The president even stopped Congress from going after their pay.

In sum: After wrecking the economy — and leaving the White House to pick up the pieces — the titans of Big Finance have been laughing all the way to the bank. And they hate Obama!

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But really, they should bow before him, lauding him for his timidity and failing to take them on over the last four years while they, whining all the while, stuffed their pinstriped pockets with oodles of cash. Let's be honest: For Wall Street, these are the good old days.

Of course, that's not how the business community sees it. They see the boom as a reflection of their own brilliance (conspicuously absent prior to 2009); cheap credit, thanks to the Federal Reserve's near zero-interest rate policies; and falling labor costs.

"I don't think he deserves any credit," John Engler, president of the Business Roundtable, a Washington-based association of chief executive officers, recently told Bloomberg.

But Engler, the former Republican governor of Michigan, seems to be in a distinct minority. A survey of economists a year ago showed overwhelming approval for Obama's policies, with 80 percent saying the often-maligned 2009 stimulus (one-third of which was tax cuts, by the way) kept things from getting worse. Mark Zandi of Moody's Analytics and Alan Blinder, the former Vice-Chairman of the Federal Reserve, said administration policies "probably averted what could have been called Great Depression 2.0." At a bare minimum, it stabilized the economy after the 2006-08 catastrophe, setting the stage for Wall Street to rake it in.

What's really behind the banking industry's anger — which has given way to a sense of resignation since the election — is that the president has gone out of his way to demonize it. After taking office, he came to New York and told top executives to their faces: "I want everybody here to hear my words: We will not go back to the days of reckless behavior and unchecked excess that was at the heart of this crisis, where too many were motivated only by the appetite for quick kills and bloated bonuses."

And if that wasn't clear enough, he later invited 13 top executives to the Oval Office and told them bluntly: "My administration is all that stands between you and the pitchforks." This was all a bucket of cold water for the bankers who backed Obama in 2008 — with their votes and their cash. In the early stages of his campaign, they had no reason to think then-Sen. Obama was sour on the industry. And he wasn't sour on it, not until the economy melted down that fall, changing both the dynamic of the campaign and, ultimately, the focus of the president's entire first term in office.

It was said in 2008 that Barack Obama would be a transformational president. But it was the president himself who was transformed by events. Without the meltdown, he wouldn't have pushed for the things that have sparked such animosity in the financial community and kept armies of Washington lobbyists busy. No Dodd-Frank financial reform bill, which spawned a big expansion of government bureaucracy, with new agencies like the Consumer Financial Protection Bureau springing to life. No Volcker Rule (named for former Fed Chairman Paul Volcker) meant to ban banks from using bank deposits to make speculative investments (though this has been severely watered down by lobbyists).

What's likely to happen in Obama's second term? Wall Street bet big on Mitt Romney during the campaign and lost, a fact that hardly went unnoticed in the West Wing. Obama may be planning to return the favor. His pick to head the Securities and Exchange Commission, Mary Jo White, is seen as a sign that he may finally be serious about, as he put it when introducing her, "going after irresponsible behavior in the financial industry so taxpayers do not pay the price."

An award-winning member of the White House press corps, Paul Brandus founded WestWingReports.com (@WestWingReport) and provides reports for media outlets around the United States and overseas. His career spans network television, Wall Street, and several years as a foreign correspondent based in Moscow, where he covered the collapse of the Soviet Union for NBC Radio and the award-winning business and economics program Marketplace. He has traveled to 53 countries on five continents and has reported from, among other places, Iraq, Chechnya, China, and Guantanamo Bay, Cuba.