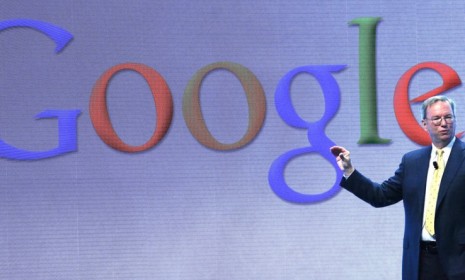

Why Google's stock is at an all-time high: 4 theories

With Facebook and Apple stumbling, Google's share price is on a tear, obliterating concerns that the search giant's best days are behind it

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Google's share price closed on Monday at an all-time high of $749.38, breaking the previous record that the king of search set in 2007. Google's recent surge in the stock market (which continued early Tuesday) capped a years-long comeback from the dark days of 2009, when its share price fell below $300. Google has regained its former glory without an iPhone 5-like publicity extravaganza, and despite its well-publicized stumbles in social media. (Google+ anyone?) And the company could reach still loftier heights. "We're now back at the peak," said Citigroup analyst Mark Mahaney. "And we believe Google shares can rise materially higher over the next 12 months." So why is Google looking so good to investors? Here, four theories:

1. Google is making a pile of money

"Google has been raking in cash from mobile and web advertisements," says Eric Abent at SlashGear. Advertisers see Google's search engine as the ideal platform for hooking up users with the products they want. Google's Android smartphone operating system is also a lucrative revenue stream and it's only getting more popular. Indeed, Android "gained a whopping 68 percent share of the global smartphone market during the second quarter," says Hibay Yousuf at CNN.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. And Google has fingers in the right pies

"Google is extremely well situated against most of the major trends" in the internet economy, such as mobile, video, and cloud computing, says Mahaney. "The one big miss is social, but even there Google has a play with Google+." In addition, CEO Larry Page "has moved aggressively to pare the company's sprawling portfolio of products, eliminating projects involving green energy and health" that were unprofitable, say Alexei Oreskovic and Gerry Shih at Reuters.

3. Facebook isn't the threat it once was

Facebook and other younger social media companies "came to the public markets amid sky-high expectations during the past year, but have fallen out of favor on concerns about their future business prospects," say Oreskovic and Shih. Facebook's inability to satisfy investors with a sustainable revenue model only makes Google's proven businesses seem more attractive. And while Facebook CEO Mark Zuckerberg has floated the idea of focusing on search, it's unclear whether a Facebook-centric search can compete with Google's vast reach.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Apple just made a rare stumble

Since the launch of the iPhone 5, Apple has come under a hail of criticism for its decision to drop Google Maps from its iOS 6 operating platform and replace it with the inferior Apple Maps. It turns out that making a trustworthy maps app is no easy task, and "it doesn't take a rocket scientist to know that once your company and products start getting discussed a lot, people are going to take notice," says Drew Olanoff at TechCrunch. Google's stock also likely got an additional boost from rumors that Google Maps will soon go on sale at the iPhone App Store.

Sources: CNN, Investors Business Daily, Reuters, TechCrunch, The Wall Street Journal

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword