Will consumers switch from plastic to PayPal?

The online payment company is expanding its services to physical retailers, in hopes that consumers will opt to use PayPal at the register

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

PayPal announced that it is taking its online payment system to 15 physical retailers, following the successful launch of a pilot program at 2,000 Home Depot stores in January. The move marks a significant expansion for PayPal in the physical realm, after the company emerged in the 2000s as a reliable and easy-to-use payment system for eBay and hundreds of other e-commerce sites. Here, a guide to PayPal's new plans:

How does the payment system work?

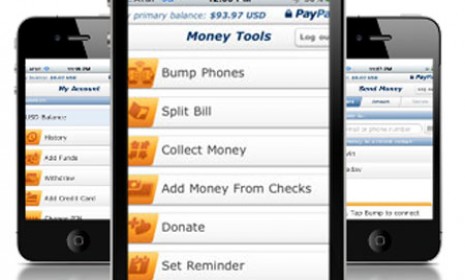

Instead of swiping a credit card at the cash register, customers can enter their mobile phone number and a pin to access their PayPal account. In some stores, customers can use a PayPal app on their smartphone to "check in" to the store and seamlessly charge their account, which analysts say is the model that PayPal will likely build on in the future.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What's in it for retailers?

Participating retailers — which include Abercrombie & Fitch, Barnes & Noble, Foot Locker, JC Penney, and Toys R Us — are pretty hot on the idea because PayPal will share data with them about their customers. "More data can be collected and used to better target shoppers, which, in turn, will encourage them to use PayPal more," says Helen Leggatt at BizReport. Company officials say PayPal plans to expand its physical business rapidly in the next year or two.

Does PayPal have competitors?

Yes. Last year, Google launched a similar online payment system for brick-and-mortar retailers called Google Wallet. Google has access to more retailers, but with 110 million users, PayPal has a far larger base of existing customers. Furthermore, "all of the incumbents, including American Express, MasterCard, and Visa, have announced digital wallet strategies," says Tricia Duryee at All Things D.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Will customers really make the switch?

They might. Google Wallet has "yet to gain traction thanks to device and network compatibility issues," says Duane Barnhart at Daily Disruption. PayPal will have to figure out how to smoothly transform its online users into smartphone-app users, and make sure retailers carry the technology that can make PayPal compatible in their stores.

Sources: All Things D, BizReport, Daily Disruption, Reuters, ZDNet