How Apple dodges billions in taxes: A concise guide

The visionary tech giant is rolling in extra cash — and maybe a bit too much of it. Is Apple's accounting team brilliant or just plain devious?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Apple is on track to bank $45.6 billion in profits this fiscal year, the biggest haul of any U.S. business, ever. That's a testament to its hot-selling iPhones, iPads, and other trendsetting objects of desire, but also to the innovation and creativity in its accounting department, according to yet another long, critical look at Apple's business operations by The New York Times. Apple uses legal loopholes and operates in various tax-free and low-tax locations worldwide to avoid paying billions in taxes each year, The Times reports. Here's a look at how Apple does it:

How much does Apple sidestep in taxes?

Corporations don't publicly release tax returns, but The Times estimates that Apple avoided paying $2.4 billion in federal taxes last year, citing the work of former Treasury Department economist Martin A. Sullivan. Apple did report paying $3.3 billion in taxes globally on $34.2 billion in profits, giving it a 9.8 percent tax rate. Walmart, in comparison, paid a 24 percent global tax rate, which is about the average for non-tech companies. Apple told The Times that it "pays an enormous amount of taxes," with its U.S. operations having "generated almost $5 billion in federal and state income taxes" in the first half of this fiscal year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How does it manage this accounting feat?

Essentially, Apple routes a sizable portion of its profits through countries and states that allow it to pay low tax rates. For example, the Cupertino, Calif.-based company has a tiny subsidiary in Reno called Braeburn Capital that manages and invests much of Apple's enormous cash reserve — California has an 8.84 percent corporate tax rate; Nevada's is zero, and the state has no capital gains tax.

That's all it takes to save $2.4 billion?

Not quite. Apple is also a pioneer of a tasty-sounding accounting move called the "Double Irish With a Dutch Sandwich," which involves routing profits through subsidiaries in Ireland and in the Netherlands, before sending it on to the British Virgin Islands or another Caribbean tax haven. In all, about 70 percent of Apple's profits are housed overseas.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

And this is all legal?

Yes. Apple and other tech giants "have taken advantage of tax codes written for an industrial age and ill suited to today's digital economy," say Charles Duhigg and David Kocieniewski in The New York Times. Much of their revenue comes from sources like patents and digital downloads, intangible things you can easily "sell" from anywhere in the world, particularly places that offer good tax arrangements. When people in Africa, Europe, and the Middle East buy songs and movies from iTunes, for example, the sale is recorded in a nondescript office in Luxembourg, a notorious tax haven.

Is Apple the only tech company that does this?

Not at all. "They've just brought it to a level of high art," says Brent Rose at Gizmodo. In 2010, Bloomberg explained how Google uses many of the same creatively named tax strategies to save itself billions in taxes, and on average, the 71 tech companies in the S&P 500 stock index pay a third less on global taxes than the other 429 companies, The Times reports. Dozens of companies say they have "directly imitated Apple's methods," though, report Duhigg and Kocieniewski.

Is this ethical?

Not surprisingly, Apple seems to think so, saying it has "conducted all of its business with the highest of ethical standards, complying with applicable laws and accounting rules." But tax experts aren't convinced that the letter of the law is enough. The U.S. tax system is premised on collecting from companies that create value here, no matter where they sell their products, and Apple's entire creative team is in California. Its home state and nation "could really use those extra tax revenues right now," says Gizmodo's Rose. But publicly traded Apple also "has an obligation to its shareholders to be as profitable as possible." It's not just the IRS that suffers, though, says Sullivan, the former Treasury economist. "When America's most profitable companies pay less, the general public has to pay more."

Sources: AFP, AP, CNET News, Gizmodo, Mashable The New York Times (2, 3)

-

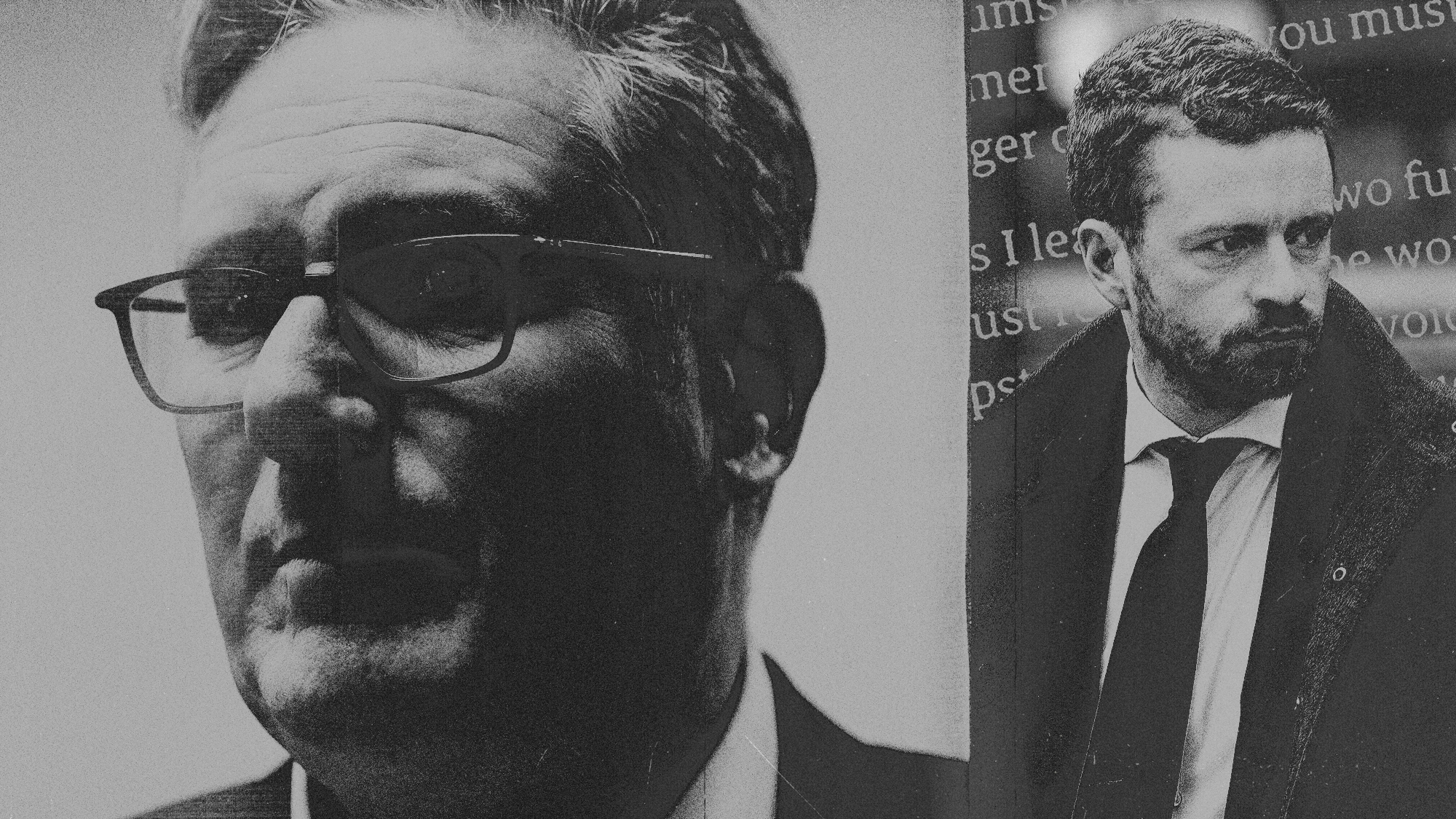

Who is Starmer without McSweeney?

Who is Starmer without McSweeney?Today’s Big Question Now he has lost his ‘punch bag’ for Labour’s recent failings, the prime minister is in ‘full-blown survival mode’

-

Hotel Sacher Wien: Vienna’s grandest hotel is fit for royalty

Hotel Sacher Wien: Vienna’s grandest hotel is fit for royaltyThe Week Recommends The five-star birthplace of the famous Sachertorte chocolate cake is celebrating its 150th anniversary

-

Where to begin with Portuguese wines

Where to begin with Portuguese winesThe Week Recommends Indulge in some delicious blends to celebrate the end of Dry January