Will ethanol survive without government subsidies?

After more than three decades, a once-sacrosanct tax credit dies a quiet death, putting the future of a controversial alternative fuel in doubt

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A federal tax credit for ethanol quietly died as 2012 began, ending a controversial program that began more than 30 years ago. The 45-cent-per-gallon tax credit for corn-based ethanol and an accompanying 54-cent-per-gallon tariff on imported ethanol were intended to encourage the domestic production of greener fuel. The tax credit, which was worth $6 billion a year, once seemed untouchable, particularly because it was so popular with corn growers in Iowa. But in recent years, it lost supporters as Congress focused on reducing deficits. How badly will the loss of subsidies hurt the ethanol industry?

Ethanol can't compete on its own: Now domestic ethanol, foreign ethanol, and oil can compete on a more level playing field, says Phil Miller at Market Power. And that can't be good for ethanol producers in the heartland. "A product that needs this much government support probably isn't all it's cracked up to be in the first place." Ethanol is bound to suffer when it has to face the marketplace without Big Government to protect it.

"Thoughts on the end of the ethanol tax credit"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But ethanol is still getting plenty of government help: "While the tax credit may be dead," says Doug Mataconis at Outside the Beltway, "ethanol subsidies are still very much with us." In fact, the industry is now propped up by the most powerful subsidy of all — "mandated demand." Thanks to several energy bills passed in recent years, refiners are required to blend ethanol into every gallon of gasoline sold in the U.S., which is why the people who make this "environmentally dubious product" don't seem all that worried.

"Ethanol tax credit expires after three decades"

Still, maybe this will force the industry to improve: Ethanol will survive, says Brad Plumer at The Washington Post. But "the key question is whether better ethanol will come along." Studies show that the kind of ethanol we use now, made from corn or soybeans, "can often be worse for the environment than regular gasoline by driving up food prices and creating incentives for deforestation." Maybe losing the tax credit "will prod producers to seek out newer, cleaner alternatives," such as ethanol made from cellulosic crop waste or algae.

"Can ethanol survive a hostile political climate?"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

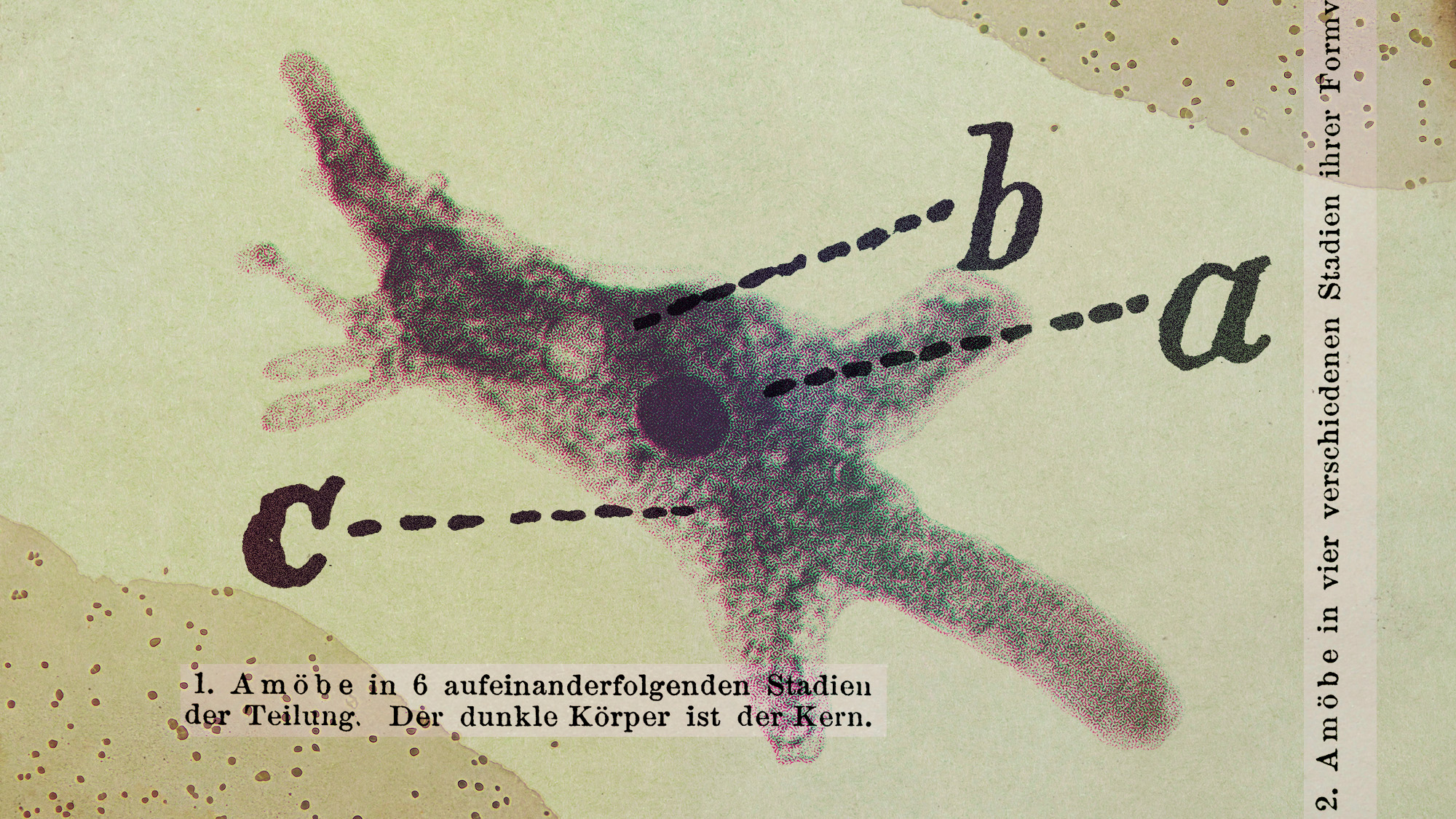

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’