Consumer debt is not to blame

Given the circumstances, in fact, consumer spending is pretty consistent and pretty healthy, said James Surowiecki at The New Yorker.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

James Surowiecki

The New Yorker

Many pundits have called Americans’ staggering household debt the “silent assassin” of the recovery, said James Surowiecki. Their theory is that consumers are so focused on paying off their debts that they can’t spend the economy out of its doldrums. But this idea is a myth. U.S. consumer spending has actually increased for the past nine quarters, and Americans aren’t saving any more than they usually do. Given the circumstances, in fact, consumer spending is pretty consistent and pretty healthy. It’s only when compared with the extravagant, unsustainable spending of the bubble years that today’s spending looks anemic.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The recovery is sluggish not because people are paying off debt, but because the steep drop in housing prices has left them “much less rich than they were—or thought they were.” If your house is worth half what it was, you are going to spend less, whether you’re carrying debt or not. That means that solving the debt problem “is not the panacea for the economy that many have made it out to be.” Even if we could somehow wipe away all the underwater mortgages, people still wouldn’t feel wealthy enough to spend us into higher growth.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

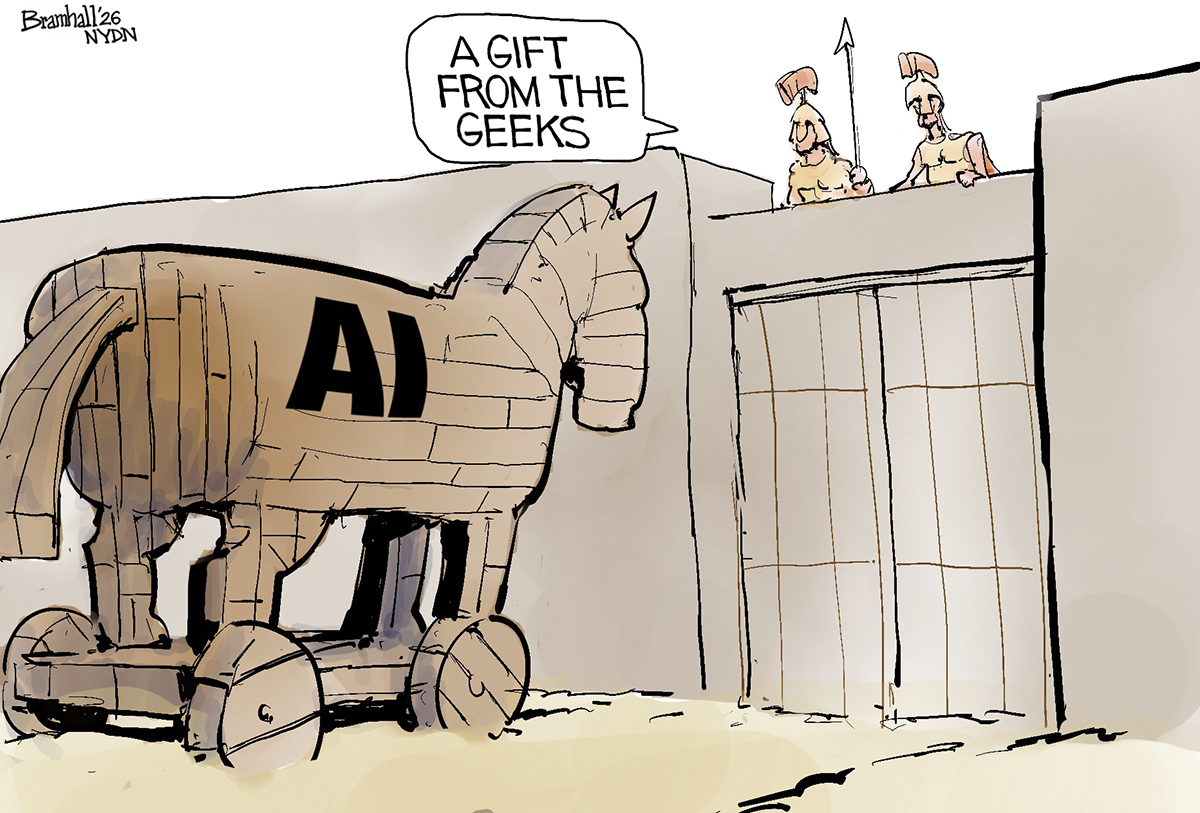

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Getting more by working less

feature A shorter workweek would produce happier, healthier workers and put many of the unemployed back to work, said Richard Schiffman at The Washington Post.

-

Mall rats don’t foster prosperity

feature Our promotion of consumption “as the key to health and wealth” has whittled the savings rate from an average of 9.6 percent in the 1970s to 3.3 percent in the 2000s, said Caroline Baum at Bloomberg.com.