Goldman Sachs execs: Going to jail, after all?

Sen. Carl Levin says the bank misled its clients and Congress and that Goldman executives could still face charges. How likely is that?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Goldman Sachs manipulated financial markets, profited from the housing crisis, and misled its clients and Congress, according to a 635-page report released Wednesday by a Senate subcommittee. Sen. Carl Levin (D-Mich.), the chairman of the Senate Permanent Subcommittee on Investigations, says some of the findings of the panel's two-year investigation will be referred to the Justice Department for possible criminal or civil action. He calls the investment bank a "financial snake pit rife with greed, conflicts of interest, and wrongdoing." Naturally, Goldman disagrees with many of the report's conclusions and insists its executives did not lie. But could Goldman executives really be prosecuted?

No, there isn't enough new here: "This isn't the first time we are seeing Wall Street's many warts up close," says Colin Barr in Fortune. Levin may see this as "one last chance for U.S. prosecutors to finally reel in the big fish that has eluded them." But as "nauseating" as the findings in the report may be, it's hard to spot specifics that "would rise to the level of a prosecutable offense." The "ambition" of the report is commendable, but don't hold your breath for the indictments to come down.

"Goldman report: Last chance for perp walks?"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

No, if history is any indication: The Justice Department has been more cautious about pursuing fraud cases after losing one against two Bear Stearns hedge fund managers, says David Wediner at MarketWatch. The government's "one big success" was getting Goldman to settle a mortage-related fraud case with the SEC for $550 million last year. Otherwise, regulators seem to prefer "letting investors fend for themselves" by filing their own lawsuits.

"Senate bust won't put bankers behind bars"

No, because Congress screwed up: Levin is accusing Goldman execs like CEO Lloyd Blankfein of lying before Congress, but the senators asked the bankers such "tactless and fuzzy" questions that it would be hard to prosecute, says Halah Touryalai at Forbes. And the answers from the Goldman bankers were so confusing that it would be hard to pin them down as being "intentionally evasive."

"Barry Bonds faces jail time while Wall Street execs sit pretty"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Prosecutions matter less than reforms: Prosecuting bankers and punishing those who caused the financial meltdown may satisfy our cravings for justice, but it won't bring about the reform we need, says Douglas A. McIntyre at 24/7 Wall St. Yes, President Obama signed the Dodd–Frank Wall Street Reform and Consumer Protection Act last year. But territorial fights and possible budget cuts mean it's unclear whether the new law will actually work—or be fully enforced. That's the more important issue here.

-

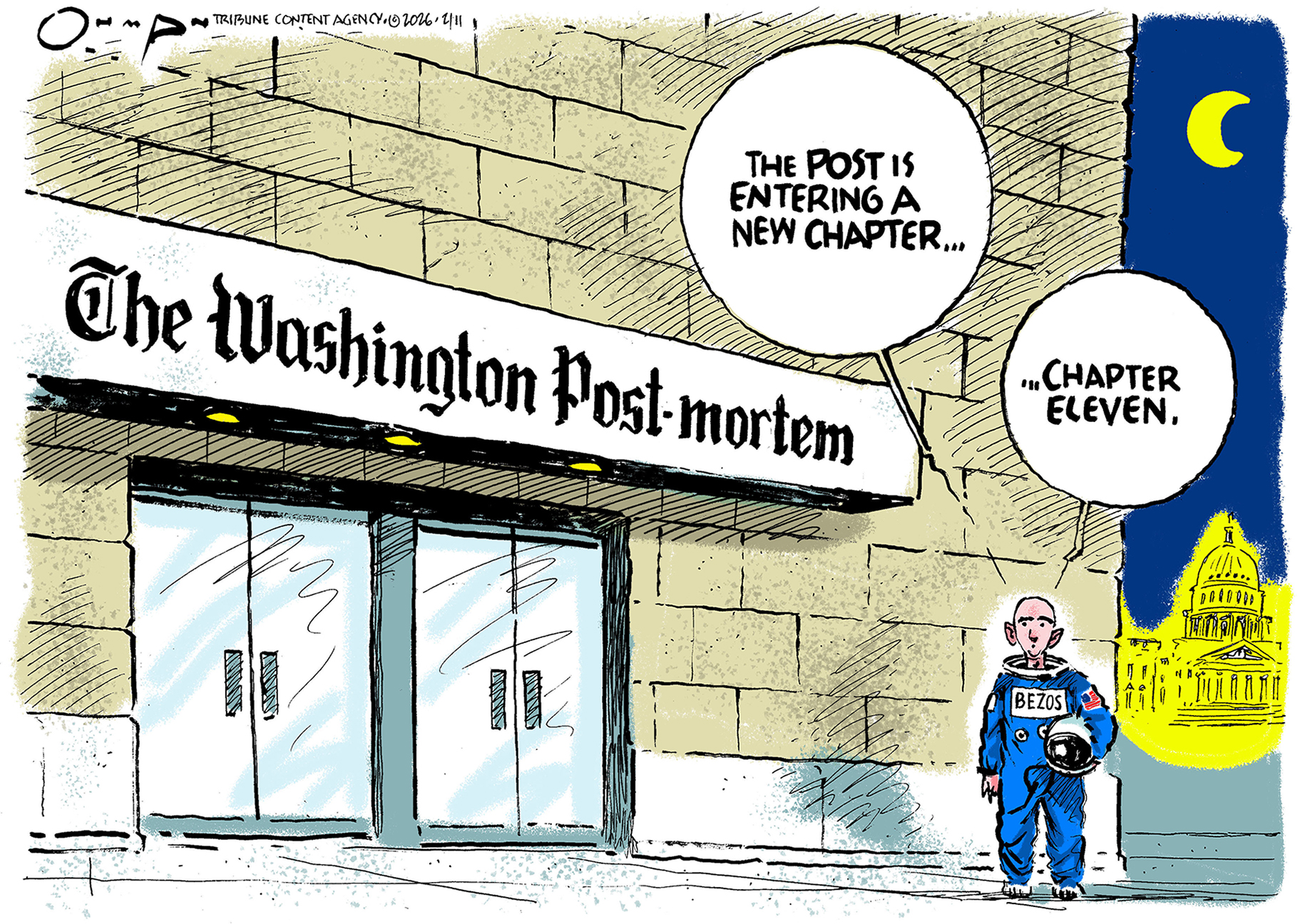

5 calamitous cartoons about the Washington Post layoffs

5 calamitous cartoons about the Washington Post layoffsCartoons Artists take on a new chapter in journalism, democracy in darkness, and more

-

Political cartoons for February 14

Political cartoons for February 14Cartoons Saturday's political cartoons include a Valentine's grift, Hillary on the hook, and more

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic