Trouble in the eurozone

The 17-nation European currency union is fracturing, as the haves battle the have-nots

How does the eurozone work?

When it was introduced in 2002, Europe’s common currency, the euro, represented a bold step toward uniting member nations in a transnational economy that now rivals the U.S. in output. In return for membership, each country in the eurozone — there are now 17: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain — agrees to contribute to the European Central Bank, keep government debt within defined limits, and check inflation. At the same time, however, each member retains control over its budget and tax policies, and there is no formal mechanism for disciplining members that violate the currency union’s fiscal guidelines.

Is that the source of the conflict?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Yes. A financial crisis in Greece last spring pitted the European Union’s largest and wealthiest members, France and Germany, against the debt-plagued nations on Europe’s southern and western periphery. Portugal, Ireland, Italy, Greece, and Spain — their initials form the derisive acronym PIIGS—are all struggling now to balance shaky budgets with outsize deficits, and they’re seeking help from their more solvent neighbors. So far, the EU and the International Monetary Fund have provided more than $225 billion in aid to Greece and Ireland. But with Portugal and Spain also in financial trouble, few analysts think the bailouts are over.

How do France and Germany feel about that?

Furious. Both countries want to “avoid becoming the deep pocket to the rest of Europe,” said financier George Soros. As the largest economies in the union, and the largest contributors to the central bank, Germany and France exert greater power over policymaking, but they also shoulder a greater burden in bailouts. A poll last spring revealed that 80 percent of Germans opposed bailing out Greece. Their discontent increased pressure on German Chancellor Angela Merkel to demand more onerous bailout terms, which, in turn, fueled violent protests in Greece. “The entire country has no sense of responsibility,” Berliner Karen Schumann complained of Greece, “and now we’re supposed to fix it.”

How have markets reacted?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Currency and bond traders have been punishing Europe for its disarray. The value of the euro, a barometer of market confidence in the union’s financial and political soundness, hit a four-year low in May during the worst of the Greek crisis. Meanwhile, bond traders have expressed their skepticism of the PIIGS by selling off their government bonds, which forces the bonds’ prices down and their yields up. That only exacerbates the PIIGS’ financial problems, further undermining confidence.

How much does that cost?

Over time, billions. Consider Portugal’s December auction of $663 million in three-month Treasury bills. Because of rising doubts about Portugal’s solvency, its government had to pay an average interest rate of 3.4 percent on the December bonds — nearly twice what it paid in November. If bond markets continue demanding higher interest rates from the eurozone’s weaklings, “the sheer burden of dealing with the interest starts to overwhelm the economy,” said Julian Callow, chief European economist at Barclays Capital.

What would calm the markets?

A signal that eurozone nations are politically in sync—capable of jointly defending their currency and strengthening member finances. In December, members voted to create a bailout fund to be tapped in the event of future financial troubles. But the agreement doesn’t specify the size of the fund or the conditions under which a nation can tap it, leading many to doubt its soundness. Meanwhile, Spain’s $1.4 trillion economy — double the combined economies of Portugal, Ireland, and Greece — is teetering. To forestall another round of crises, many investors and politicians favor allowing the European Central Bank to issue bonds on behalf of the entire eurozone. That would lower the borrowing costs of poorer nations, but increase them for France and Germany, leading Germany’s Merkel to steadfastly oppose the idea. With hard feelings all around, Luxembourg’s foreign minister, Jean Asselborn, reacted by accusing Germany of “haughtiness and arrogance.”

Is the European Union itself at risk?

Incredibly, it might be. “The failure of the euro — and thus of the EU and its Common Market—would be the biggest pan-European disaster since 1945,’’ said former German foreign minister Joschka Fischer. “This outcome is possible — despite protestations to the contrary by all involved.’’ Tensions between nations are rising, with Germany recently proposing that bailed-out nations share the pain of future bailouts. That announcement caused an immediate sell-off of Irish government debt, as investors dumped bonds that, under the German plan, might never be repaid in full. The Irish public erupted in fury over the harsh austerity measures imposed as terms of the bailout (see below). Some see these events as signs that the union is unraveling. “My current best guess,” said Financial Times columnist Gideon Rachman, is that “the single currency will indeed eventually break up — and that the euro’s executioner will be Germany.”

Dark suspicions in Dublin

In late November, more than 100,000 Irish citizens marched in Dublin to protest the hefty tax hikes and public-service cuts that the European Union and the International Monetary Fund exacted in exchange for an $89 billion bailout. But in addition to denouncing the bailout deal and the Irish government that had accepted it, protesters swapped conspiracy theories about the nefarious role played by Germany in the affair. One popular theory holds that Germany deliberately sparked a run on Irish bonds, thereby forcing a reluctant Irish government to impose austerity measures. “This is not a rescue plan,” said writer and political commentator Fintan O’Toole. “It’s the longest ransom note in history.” True or not, O’Toole’s statement is typical of the resentment Europe’s have-nots feel toward the continent’s wealthier nations, especially Germany.

-

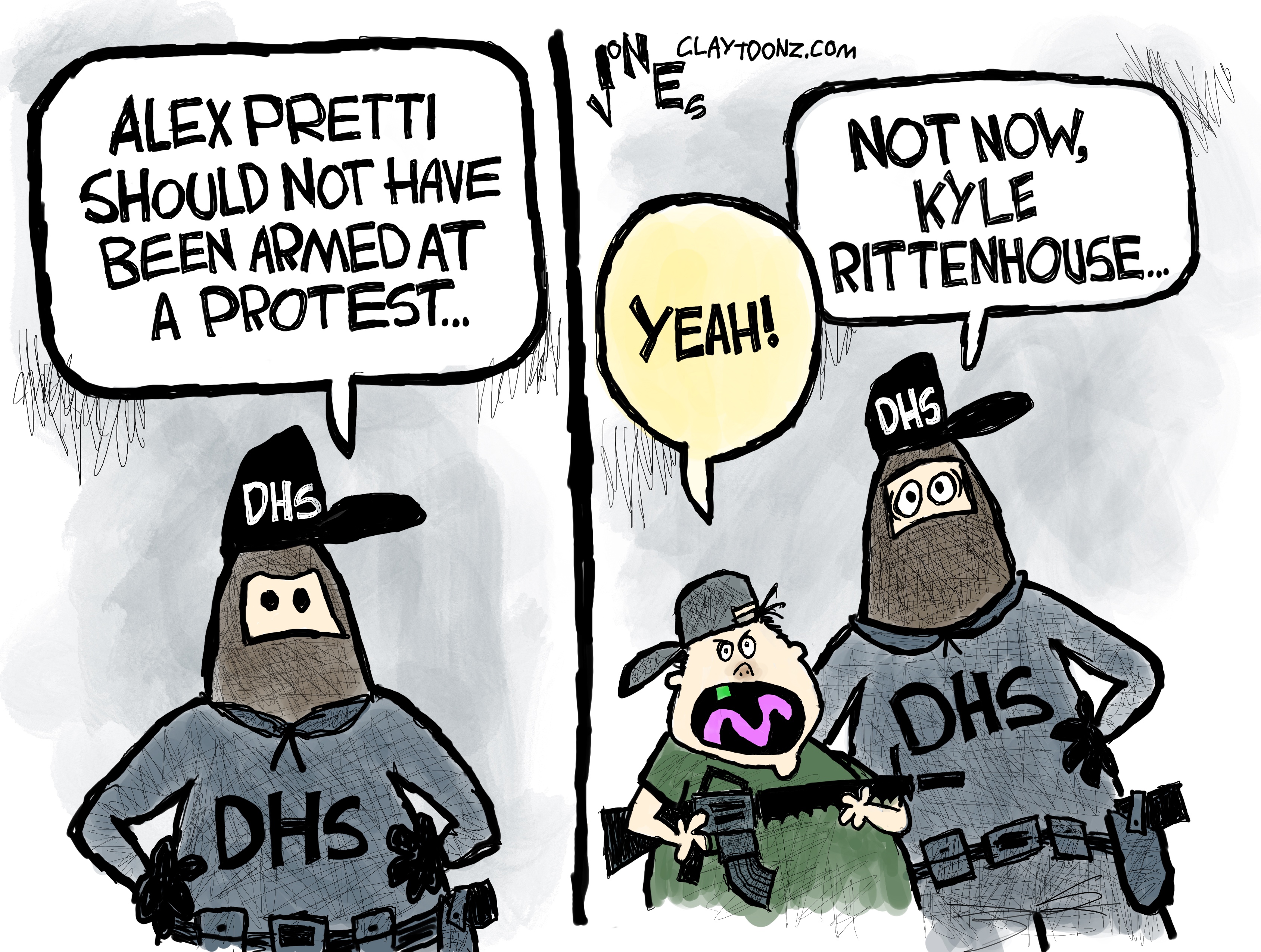

5 highly hypocritical cartoons about the Second Amendment

5 highly hypocritical cartoons about the Second AmendmentCartoons Artists take on Kyle Rittenhouse, the blame game, and more

-

‘Ghost students’ are stealing millions in student aid

‘Ghost students’ are stealing millions in student aidIn the Spotlight AI has enabled the scam to spread into community colleges around the country

-

A running list of everything Donald Trump’s administration, including the president, has said about his health

A running list of everything Donald Trump’s administration, including the president, has said about his healthIn Depth Some in the White House have claimed Trump has near-superhuman abilities