The new world banking rules: An instant guide

The world's top financial regulators have drawn up a new set of financial regulations to avert another economic meltdown. Here's what you need to know

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Financial regulators from around the world met over the weekend to finalize a deal to prevent the likelihood of another financial collapse, agreeing to a series of measures that are intended to make taxpayer bailouts a thing of the past. (Watch a Bloomberg discussion about the new rules.) Here's an instant guide:

What are the new rules?

At the most basic level, banks will have to maintain a larger cushion against losses. That is, they will be required to hold onto more capital in reserve — in some cases, more than three times as much. Regulators believe this will make the international banking system safer and less suscepible to shocks and panics.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Specifically, how much bigger will the banks' cushions have to be?

Before, banks only had to hold 2 percent of their safest form of capital — called common equity — in store. When the new regulations go into effect, that figure will rise to 4.5 percent, and banks will also have to keep another 2.5 percent of their capital aside in special emergency funds.

Will banks have trouble meeting these new requirements?

The new rules don't go into effect until 2013, and then will be slowly phased in over a five-year period. The international regulators believe this offers banks ample opportunity to adjust.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Who are these international regulators?

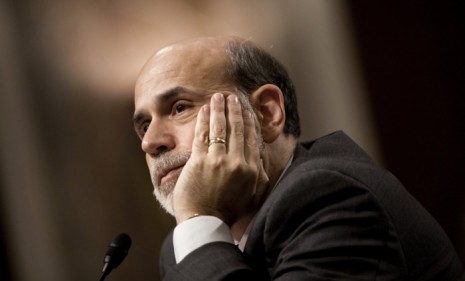

The group is known as the Basel Committee on Banking Supervision, and it is made up of financial officials from 27 countries. The group includes Ben S. Bernanke, chairman of the Federal Reserve, and is chaired by Jean-Claude Trichet, president of the European Central Bank.

How much will they affect U.S. banks?

Probably not very much. In fact, they don't go as far as the U.S. regulators might have liked. The Fed is likely to require U.S. banks to meet even more stringent capital requirements, says Paul Miller, an analyst at FBR Capital Markets quoted at Bloomberg. "We don't really see at this point that this is a big deal for us," says Howard Atkins, chief financial officer of Wells Fargo, quoted at ABC. European banks are far more likely to be affected by the new rules.

What is there to worry about, then?

Some economists worry that the long delay before the rules are set in stone puts the public at increased risk of another crash. Nobel laureate economist Joe Stiglitz warned that waiting until 2013 to bring in the rules was "unconscionable," and exposed taxpayers to enormous risk. I'm not "particularly worried about the timetable," counters Felix Salmon at Reuters. There's little evidence that large banks will take advantage of the phase-in period, and most of them are already subject to "too-big-to-fail capital requirements" from their own countries.

What would be a smart thing to say if I sit next to a banker at a dinner party?

You could do worse than quoting Paul Miller, who points out that U.S. banks have plenty of capital already: "Most of the banks in the U.S. already meet the criteria. It’s very easy, nobody’s going to be raising capital because of this -- maybe some small institutions, but none of the big boys." Or you could quote Stephen Lewis, an analyst at Monument Securities quoted by the Financial Times, who found the new regulations somewhat short-sighted: "Like generals fighting the last war, who fail to recognise current dangers, the regulators appear intent only on ensuring that their recent embarrassing history does not repeat itself."

Sources: Bloomberg, New York Times, BBC, The Economist, Reuters, Financial Times, ABC News