Is the U.S. headed for deflation?

Falling prices are an economic disaster. With some economists saying we are on the brink, is it time to take this threat seriously?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

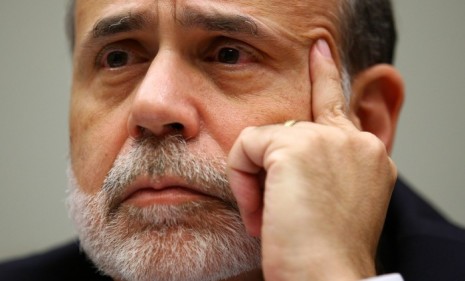

As Federal Reserve Chairman Ben Bernanke prepares for a big speech on the economy Friday, some economists, financial analysts, and even Fed officials are warning that the U.S. is at risk of a rare, worrisome bout of deflation. "At first glance, deflation sounds like a good deal," explains Russ Wigh in the Savannah Morning News, since "prices drop and our dollars go further" — but it creates a downward spiral of less demand and fewer jobs, and can leave a nation's economy mired for years or even decades. How worried should we be? (Watch a CBS discussion about managing your money during deflation)

Watch Bernanke: Consumer prices are still rising, albeit slowly, so "there aren't current indicators of deflation," says Greg Robb in MarketWatch. But "the economy is showing new signs of wilting," and even a "slow-growth period could be a breeding ground for deflation." We'll know if Bernanke is worried about deflation if he starts taking his "money-creating helicopter to a new altitude."

"Bernanke's helicopter could move to new altitude"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The markets are sending "an ugly warning": Given the weak economy, it looks like the Fed's "printing money has only stalled the West’s own post-bubble deflation, not reversed it," says Adrian Ash in Forbes. Certainly something has snapped in the markets, because we just switched to a rare period where stocks are offering a bigger dividend yield than bonds.

"Dividend-yield signal screams 'deflation' or 'back up the truck'"

The worries are overstated: The markets are probably a little spooked by conflicting comments from a few Fed officials, with some warning of deflation and others of inflation, says Neil Irwin in The Washington Post. But neither warning is "within the mainstream of opinion on the Fed policy committee, where the majority view holds continued expansion as likely, deflation unlikely," and a big money drop is necessary only if things deteriorate further.

"Fed policy foggy as the economic picture clouds"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

‘Those rights don’t exist to protect criminals’

‘Those rights don’t exist to protect criminals’Instant Opinion Opinion, comment and editorials of the day

-

Key Bangladesh election returns old guard to power

Key Bangladesh election returns old guard to powerSpeed Read The Bangladesh Nationalist Party claimed a decisive victory

-

Judge blocks Hegseth from punishing Kelly over video

Judge blocks Hegseth from punishing Kelly over videoSpeed Read Defense Secretary Pete Hegseth pushed for the senator to be demoted over a video in which he reminds military officials they should refuse illegal orders