America's retirement crisis: A concise guide

One in four American workers has saved less than $1,000 for retirement. Are "The Golden Years" a fading dream?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One in four Americans has less than $1,000 in his retirement savings account, according to the 20th Retirement Confidence Survey, a new study conducted by The Employee Benefit Research Institute that's sending shock waves through the media. Here's a rundown of how we got into this hole, and what you can do to avoid a bleak retirement:

What's the most important conclusion?

Americans aren't saving enough for retirement, and they don't have a realistic sense of how much they'll need. "People just don't want to think about this," says report co-author Jack VanDerhei. "Everybody thinks they're too young to think about it, until suddenly they're too old to do anything about it."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How bad is the situation?

A frightening 27 percent of workers have saved less than $1,000 for their retirement, and 43 percent have less than $10,000. Only 46 percent of American workers have even figured out how much they need for their Golden Years.

But everyone has something put away, right?

No. According to the study, a significant percentage of workers have saved nothing at all, and only 16 percent are "very confident" they'll have enough money to fund their retirement.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What will happen to those without savings?

They'll need to keep working longer. A third of workers now plan to stay at their jobs past age 65 — triple the number back in 1991 — and 24 percent have already pushed back their retirement in the past year, mostly for financial reasons.

Can't I just sell my house?

Perhaps, but you might not make money out of it. As many as 11 million Americans now own houses worth less than their mortgage. Thanks to that "tremendous sea change" in our personal finances, says Douglas McIntyre at 24/7 Wall Street, the historically low savings rate "is likely to get worse, at least [in the] short term."

Are workers expecting a federal bailout?

Absolutely not. Public confidence in the government is now so low that only 11 percent of workers trust it to come to their aid. A paltry 8 percent of retirees have faith.

Is there any good news?

It's never too late to start saving, says Mitchell Slater at Morgan Stanley Smith Barney. Put aside some of your paycheck and you've made a start. That said, "be realistic," and lower your retirement goals to fit your situation.

How much should I be saving, ideally?

Between 6 percent to 10 percent of your paycheck, according to Fidelity's Beth McHugh. That means your post-retirement income would come to 80 percent of your working salary, in line with what financial experts recommend.

Sources: CBS News, LA Times, 24/7 Wall Street, WalletPop

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

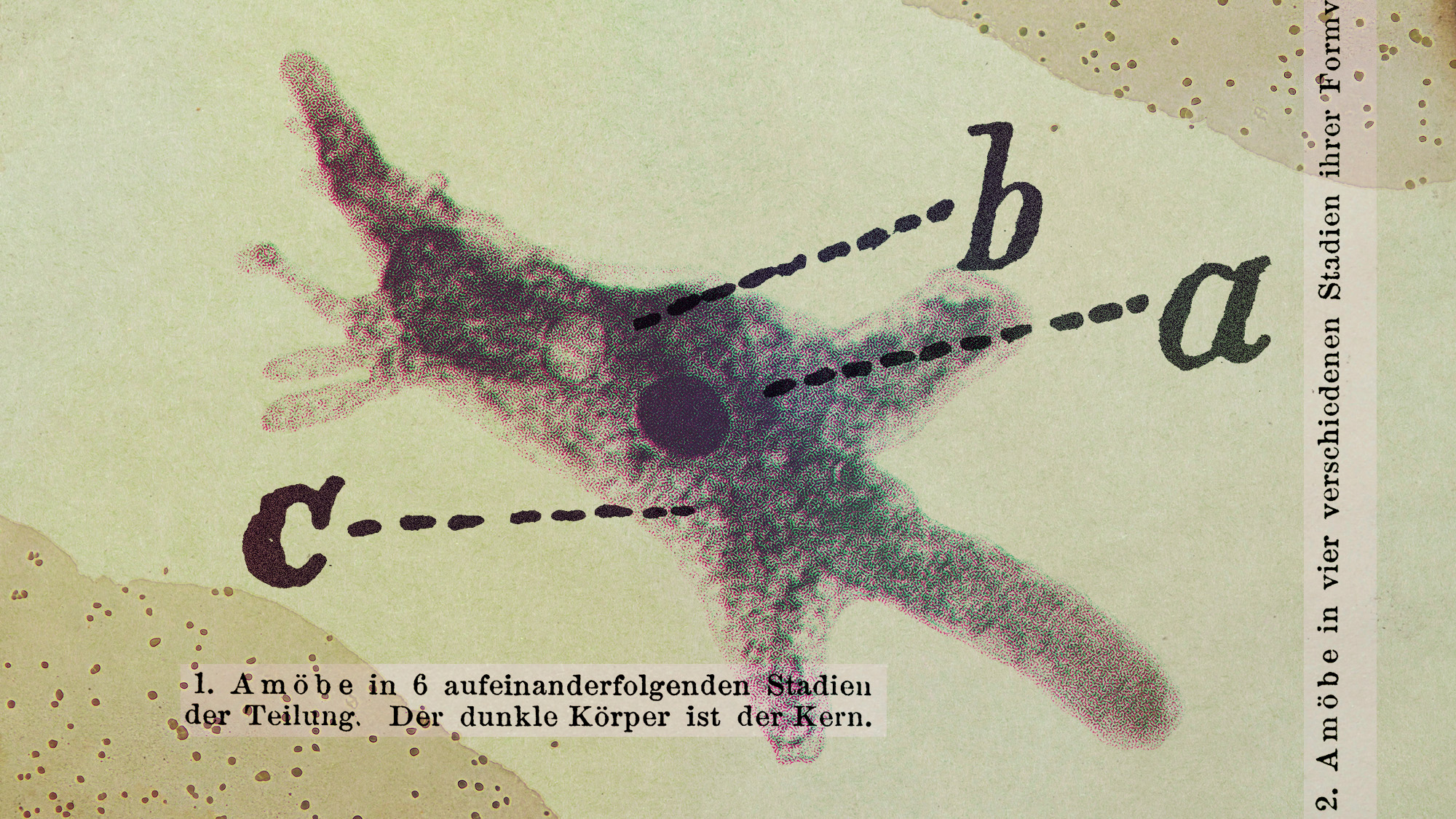

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’