Savings: Leaving your spendthrift ways behind

Just remember that budgets—like diets?—are all about moderation; overdoing it can lead to a relapse.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

One silver lining of the bad economy has been that many of us spendthrifts finally scrutinized our spending habits, said Alina Tugend in The New York Times. The question is: Will we stick to our budgets when the economy makes a turn for the better? If ?history is any indication, unfortunately, most of us will eventually revert. “It takes both a long time and a complex combination of factors—often including some personal trauma, social stigma, and government policy—to promote any real transformation.” With the exception of the Great Depression, most recessions have been over too soon to make a lasting impression on most people.

It seems to be part of human nature that we “grow overly optimistic” during economic boom periods, said Carolyn Bigda in Money. The key to maintaining perspective, in good times and in bad, is to “trick yourself into staying on track.” Let’s say you’re saving a bit more now because you expect more bad news. Should things start to get better, “undermine your optimism bias” by setting up automatic savings plans that are earmarked for different? purposes. Give each account a descriptive name—the “If I Lose My Job Fund” or the “Alaskan Cruise Fund.” Setting aside money for specific purposes will help you “visualize” why you need that money, reducing the temptation to blow the balance on something else.?

Let’s face it: The only way to really save more is by figuring out how to spend less, said Laura Cohn in Kiplinger’s Personal Finance. To get a grip, track where every single penny goes for at least a month. Then chart out what a year’s worth of spending might look like—after, of course, you’ve accounted for all the vacations, doctor’s bills, Christmas shopping sprees, and other budget-busters that tend to come up unexpectedly. “The good news is that most people overspend ?in just two or three areas.” Once you identify your weaknesses, set reasonable goals for cutting back. Just remember that budgets—like diets?—are all about moderation. “If you restrict yourself too much, you may get so frustrated that you splurge on a big impulse buy—the dieter’s equivalent is cheating with a banana split.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Colbert, CBS spar over FCC and Talarico interview

Colbert, CBS spar over FCC and Talarico interviewSpeed Read The late night host said CBS pulled his interview with Democratic Texas state representative James Talarico over new FCC rules about political interviews

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

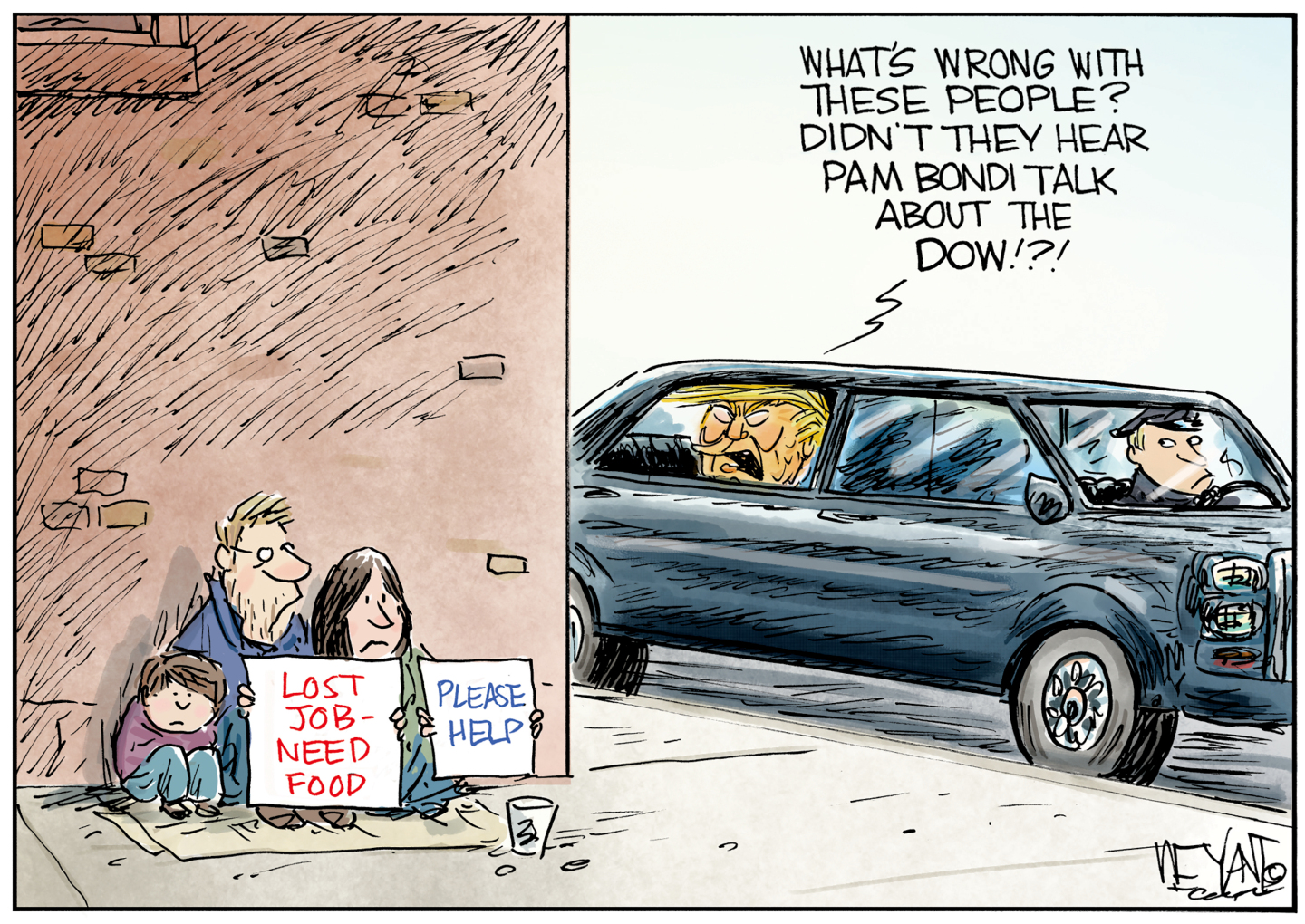

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more