General Growth’s mall failure

The bankruptcy of mall giant General Growth, and whom it hurts

What happened

No. 2 U.S. mall owner General Growth Properties filed for Chapter 11 bankruptcy, along with 158 of its 200-plus malls, in the largest U.S. real estate failure on record. General Growth owns New York’s South Street Seaport, Boston's Faneuil Hall, and Chicago’s Water Tower, among other prominent shopping centers. (Reuters)

What the commentators said

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

I know what you’re thinking, but “don’t fret,” said Parija Kavilanz in CNNMoney.com. Your local mall isn’t likely to “disappear” due to General Growth’s bankruptcy. According to experts, “it’s very rare for a mall to be shut down.” And unlike in the case of Circuit City, General Growth’s troubles are “finance-related rather than consumer-driven.”

Shoppers might be fine, said Russ Britt in MarketWatch, but this is the “potential first thud” in a commercial real estate market “free fall.” General Growth “dug itself in deep” by borrowing heavily to expand, so its "demise" is no surprise. But General Growth wasn't alone—commercial real estate could be near “its own subprime-like debacle.”

A “domino effect” in commercial real estate is a real fear, said Douglas McIntyre in 24/7 Wall Street, and that's bad news for banks. General Growth owes $27 billion, much of it to Goldman Sachs, Citigroup, and Deutsche Bank. That’s just one mall owner, and “malls are only the tip of the commercial real estate iceberg”—let’s hope banks don’t assume the role of the Titanic.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

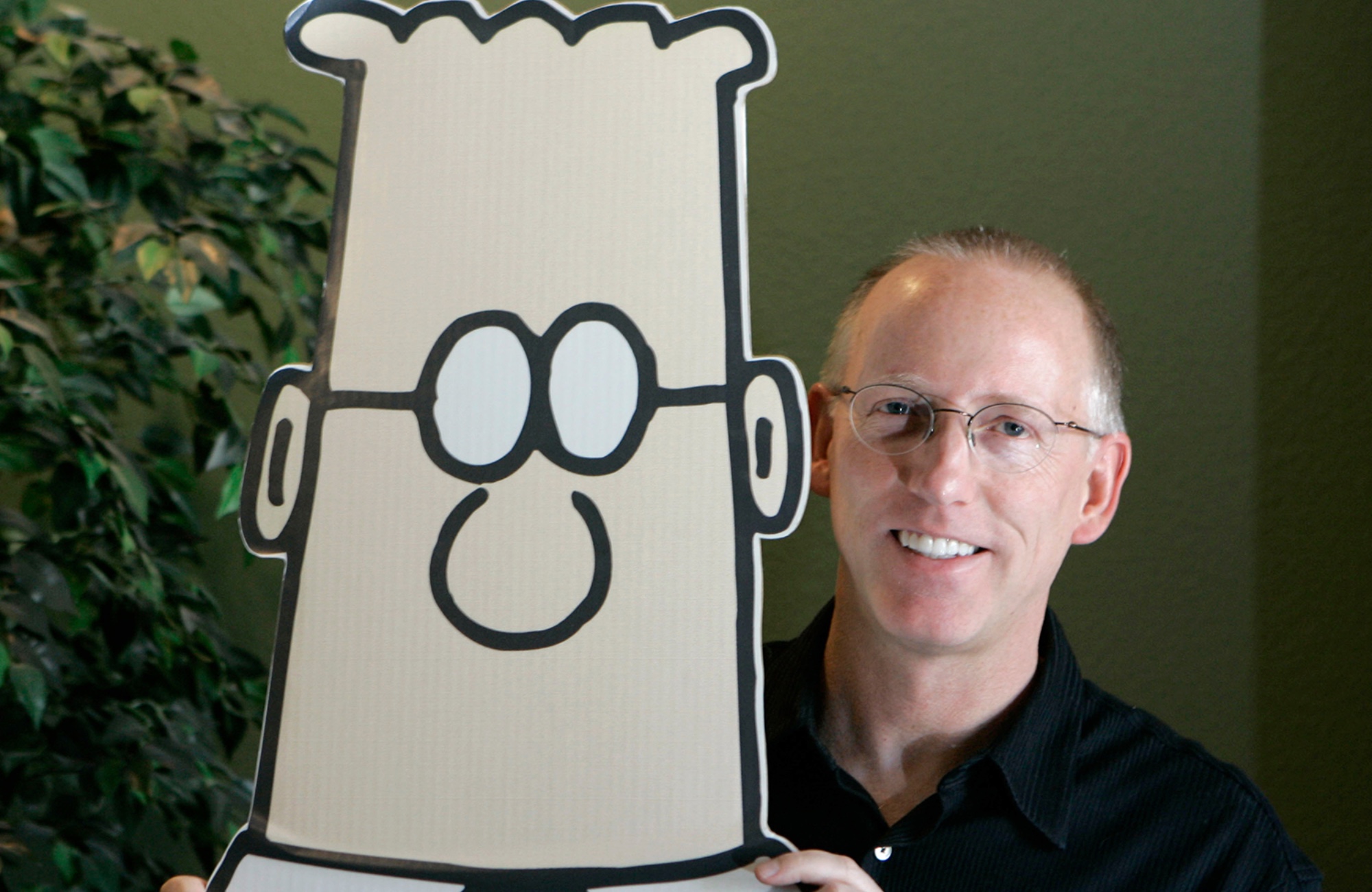

Scott Adams: The cartoonist who mocked corporate life

Scott Adams: The cartoonist who mocked corporate lifeFeature His popular comic strip ‘Dilbert’ was dropped following anti-Black remarks

-

The 8 best animated family movies of all time

The 8 best animated family movies of all timethe week recomends The best kids’ movies can make anything from the apocalypse to alien invasions seem like good, wholesome fun

-

ICE: Now a lawless agency?

ICE: Now a lawless agency?Feature Polls show Americans do not approve of ICE tactics