Housing: The rise of the rental economy

Because of the tightening credit market, former homeowners who can’t afford a mortgage are being forced to rent, while homeowners who can't sell their houses are being forced to become landlords.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It’s a brave new world for housing, said Brad Reagan in SmartMoney. Because of the tightening credit market, many former homeowners who can’t afford a mortgage are being forced to rent. At the same time, homeowners who need to relocate but can’t sell their houses—or who have vacation properties they can’t sell—have grudgingly become landlords. Neighborhoods and municipalities aren’t sure how to deal with such sudden changes. “Many towns and subdivisions are barring their doors, arguing that tenants usher in neglect, misbehavior, and even violent crime.” Nationwide, as many as 40 percent of communities governed by homeowners associations limit rentals or ban them altogether. Some neighborhoods are easing restrictions in order to keep homeowners out of foreclosure. But others have rolled out “even tighter” rental rules, in an attempt to keep home values high.

The increase in rental properties on the market is driving down monthly payments for renters, said Barbara Kiviat in Time. During the last three months of 2008, average rents fell nearly a half a percentage point nationwide, marking the first quarterly drop since early 2003. While the glut of unoccupied condos and houses has a little to do with falling rents, the bigger factor is jobs—or rather a lack of them. “When people—especially young adults, who are prone to rent—don’t have jobs, they’re more likely to stay with family or find a roommate instead of renting a place of their own.” Landlords may not welcome the news, but this year renters will have the leverage to bargain.

For that and other reasons, renting out your home may not be ideal for everyone, said Melissa Kossler Dutton in the Associated Press. For many desperate homeowners, “the role of landlord is something they’d never considered.” For some, though, it may be the only option. But before putting out the “For Rent” sign, get in touch with a property management company to find out how much you can realistically charge. “Homeowners are often disappointed to learn that their home would rent for less than their mortgage payment” in the current market. Eventually, you’ll also need help in navigating local rental laws, marketing your property, and screening applicants. Finally, don’t be hasty. After all, you’re handing over the keys to what is probably one of your biggest single investments.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

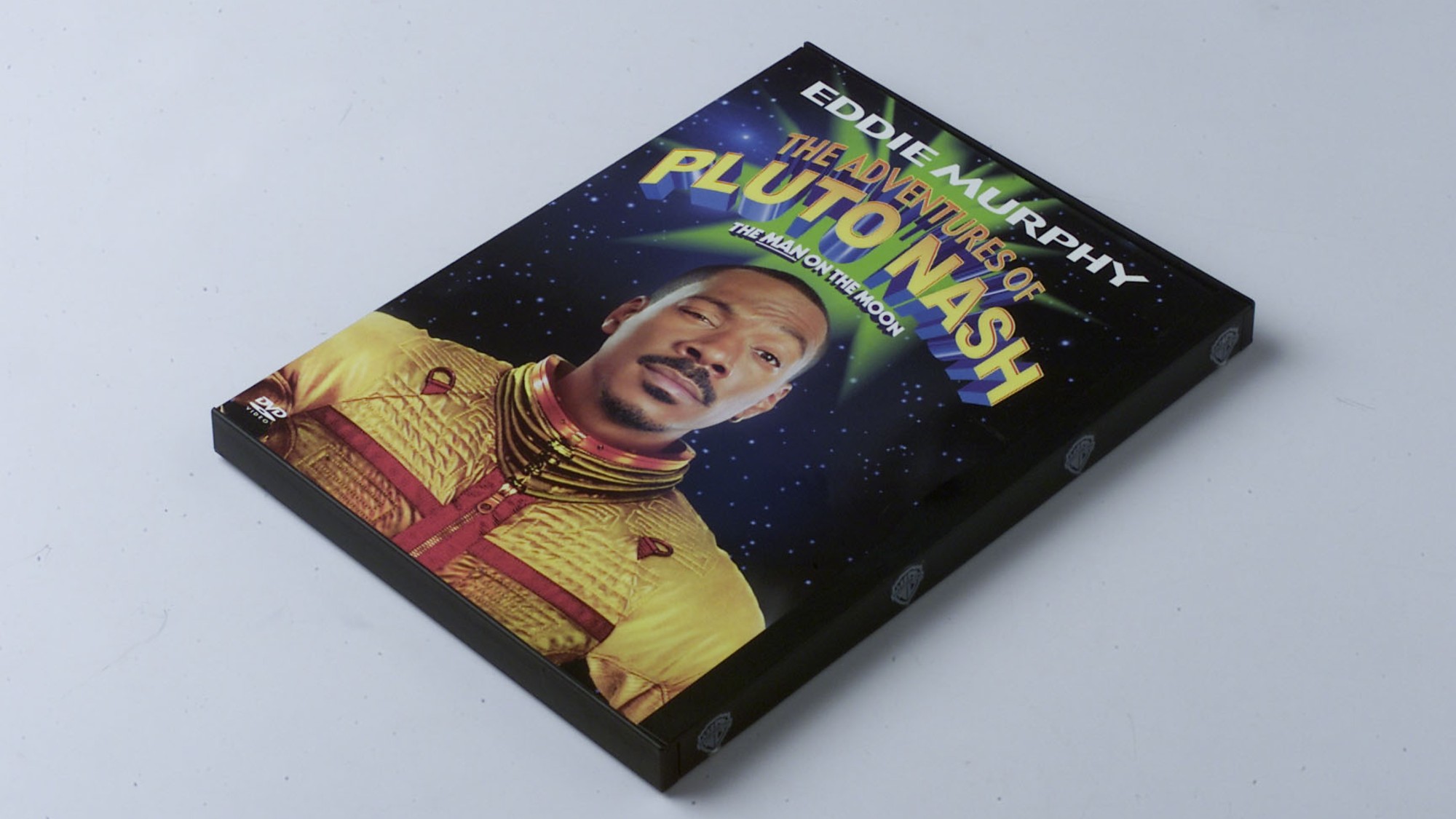

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers