Best Columns: Eyeing inflation, Investing in optimism

The economy is heading

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Betting against hope

The economy is heading “in an ominous direction,” says Fred W. Frailey in Kiplinger.com. We’re looking at a “huge burst of inflation” on the horizon, as booming economies like China, India, and Brazil are scooping up “prodigious amounts of raw materials” to essentially “live as we do in the U.S.” And it isn’t a commodities “bubble,” as some argue. It is the reality of more people bidding for increasingly “scarce resources.” This “rumbling” of inflation could explode “like a vocano” and wipe out your retirement savings. What to do? Well, “if commodities are fueling inflation, invest in them.”

Betting on hope

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

True, “the economy is in trouble,” says Money’s Michael Sivy in CNNMoney.com, and the news from Wall Street is “unsettling in the extreme.” But there are reasons for optimism. Despite well-publicized prognostications from the “predictors of doom,” most forecasters are relatively upbeat about the future. If you agree with this “reasonable, though by no means surefire” optimism, you should invest before the market rebounds. Many investors like commodity stocks and “foreign blue-chip mutual funds,” but “following the crowd only leaves you poorer.” Better to “pick up bargains among the strongest U.S. stocks,” especially those that earn much of their money overseas.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

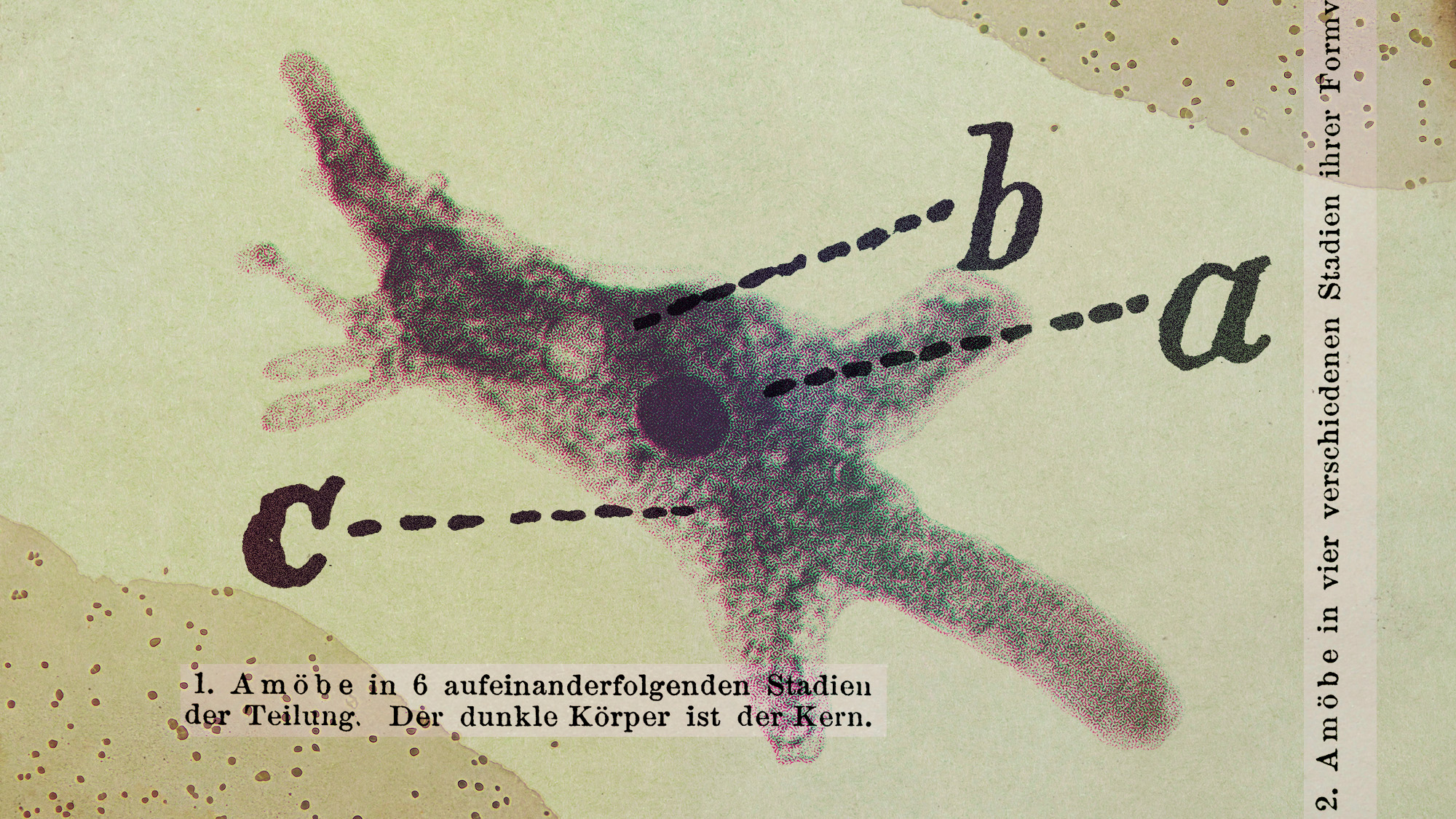

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’