Bush offers some mortgage relief

With record numbers of Americans falling behind on their mortgages, the Bush administration last week unveiled a plan to provide relief to some of the nation

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

With record numbers of Americans falling behind on their mortgages, the Bush administration last week unveiled a plan to provide relief to some of the nation’s hardest-pressed homeowners. Under a deal brokered by Treasury Secretary Henry Paulson, a coalition of mortgage lenders and investors agreed to a voluntary framework to streamline the mortgage-workout process for 1.2 million subprime borrowers whose adjustable-rate loans are due to reset higher in 2008. The agreement, said President Bush, “will offer more relief to more homeowners, more quickly.”

Under the plan, the rate on adjustable loans would be frozen for five years for homeowners who have borrowed more than their homes are worth and can’t afford the higher, reset rate. Those who borrowed less than their home’s value could refinance with federally insured fixed-rate mortgages. But reaction to the plan was tepid across the political spectrum. “What they are proposing doesn’t help a single soul who is currently delinquent on their mortgage or facing foreclosure,” said Michael Shea of the homeowner advocacy group Acorn. A group of 61 free-market economists complained of unwarranted “federal intervention” in the housing market.

Any plan that’s attacked from both the left and the right can’t be all bad, said the San Jose Mercury News in an editorial. While it’s no panacea, “the plan rightly prods mortgage lenders and investors to allow some at-risk homeowners to renegotiate.” True, the “Bush plan won’t begin to make up for the reckless lending—and reckless borrowing—that took place during the boom.” But why should taxpayers get stuck with that bill anyway?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The problem with the plan, said Paul Krugman in The New York Times, is that it helps the wrong people. The administration’s approach is focused on “reducing investor losses” by making foreclosures less likely. It virtually ignores the “human suffering” of those who were victimized by predatory lenders. One suspects the plan was designed to give “the appearance of action,” in hopes of scuttling a more aggressive response. One Democratic bill, for instance, would empower bankruptcy judges to rewrite the terms of mortgage loans to help people keep their homes. That’s the sort of plan that “would actually help working families.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

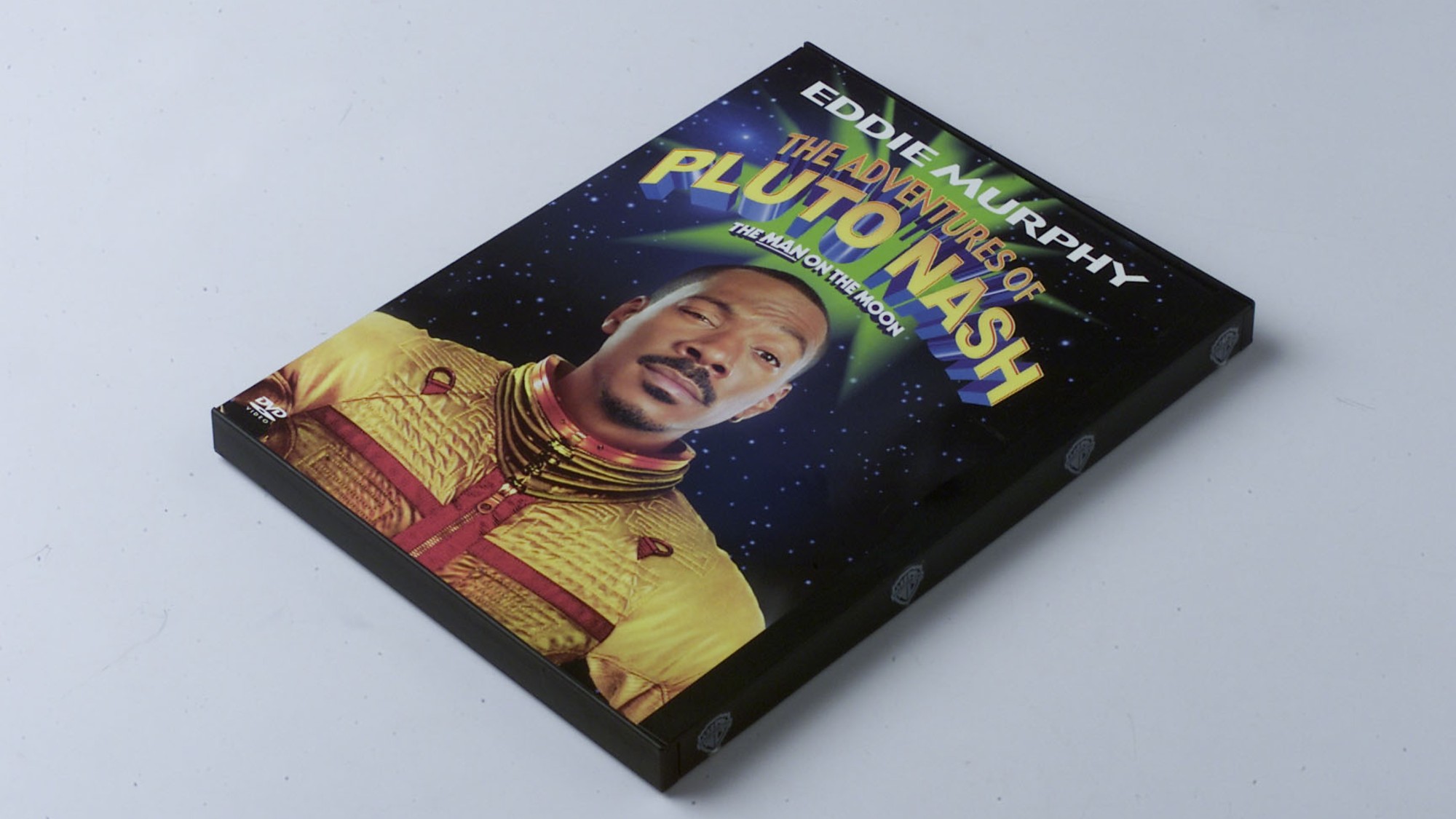

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

The final fate of Flight 370

feature Malaysian officials announced that radar data had proven that the missing Flight 370 “ended in the southern Indian Ocean.”

-

The airplane that vanished

feature The mystery deepened surrounding the Malaysia Airlines flight that disappeared one hour after taking off from Kuala Lumpur.

-

A drug kingpin’s capture

feature The world’s most wanted drug lord, Joaquín “El Chapo” Guzmán, was captured by Mexican marines in the resort town of Mazatlán.

-

A mixed verdict in Florida

feature The trial of Michael Dunn, a white Floridian who fatally shot an unarmed black teen, came to a contentious end.

-

New Christie allegation

feature Did a top aide to the New Jersey governor tie Hurricane Sandy relief funds to the approval of a development proposal in the city of Hoboken?

-

A deal is struck with Iran

feature The U.S. and five world powers finalized a temporary agreement to halt Iran’s nuclear program.

-

End-of-year quiz

feature Here are 40 questions to test your knowledge of the year’s events.

-

Note to readers

feature Welcome to a special year-end issue of The Week.