Chipping away at the mortgage crisis

President Bush's plan to freeze interest rates on some subprime mortgages will help many people avoid losing their homes, said USA Today, but it may be too little too late. It's not a cure-all, said The Boston Globe, but it's "at least a start"

What happened

President Bush on Thursday announced a plan to freeze interest rates on subprime mortgages set to rise in coming months. With foreclosures rising and millions of Americans at risk of losing their homes, Bush said the deal with lenders was a “sensible response to a serious challenge.” (Kansas City Star)

What the commentators said

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

This plan makes sense, said USA Today in an editorial. It will help more than 1 million people with iffy credit avoid losing their homes, because their monthly payments won’t rise to levels they can’t afford. But it’s “unfair” because it only helps a select few, and it’s probably too little, too late, anyway.

It’s not a cure-all, said The Boston Globe in an editorial (free registration), but it’s “at least a start.” It won’t “make the broader financial crisis go away,” but freezing rates will help some of those with “risky” adjustable-rate mortgages avoid getting caught up in the record wave of foreclosures without placing an “unreasonable burden” on investors.

Bush’s mortgage plan doesn’ have to erase the debt crisis to boost the stock market, said Susan Harrigan in Newsday. “People who manage investors' money said that although Washington's actions are a drop in the bucket compared to the magnitude of the problems in the credit markets, they may help bring about solutions.”

“Industry and government can still do more,” said the Los Angeles Times in an editorial (free registration). Lenders should extend a hand to borrowers whose rates have already jumped—especially those who were lured into unwise deals with “aggressive (and sometimes fraudulent) sales techniques.” And regulators should strengthen the rules so these “abuses” become “less common in the future.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

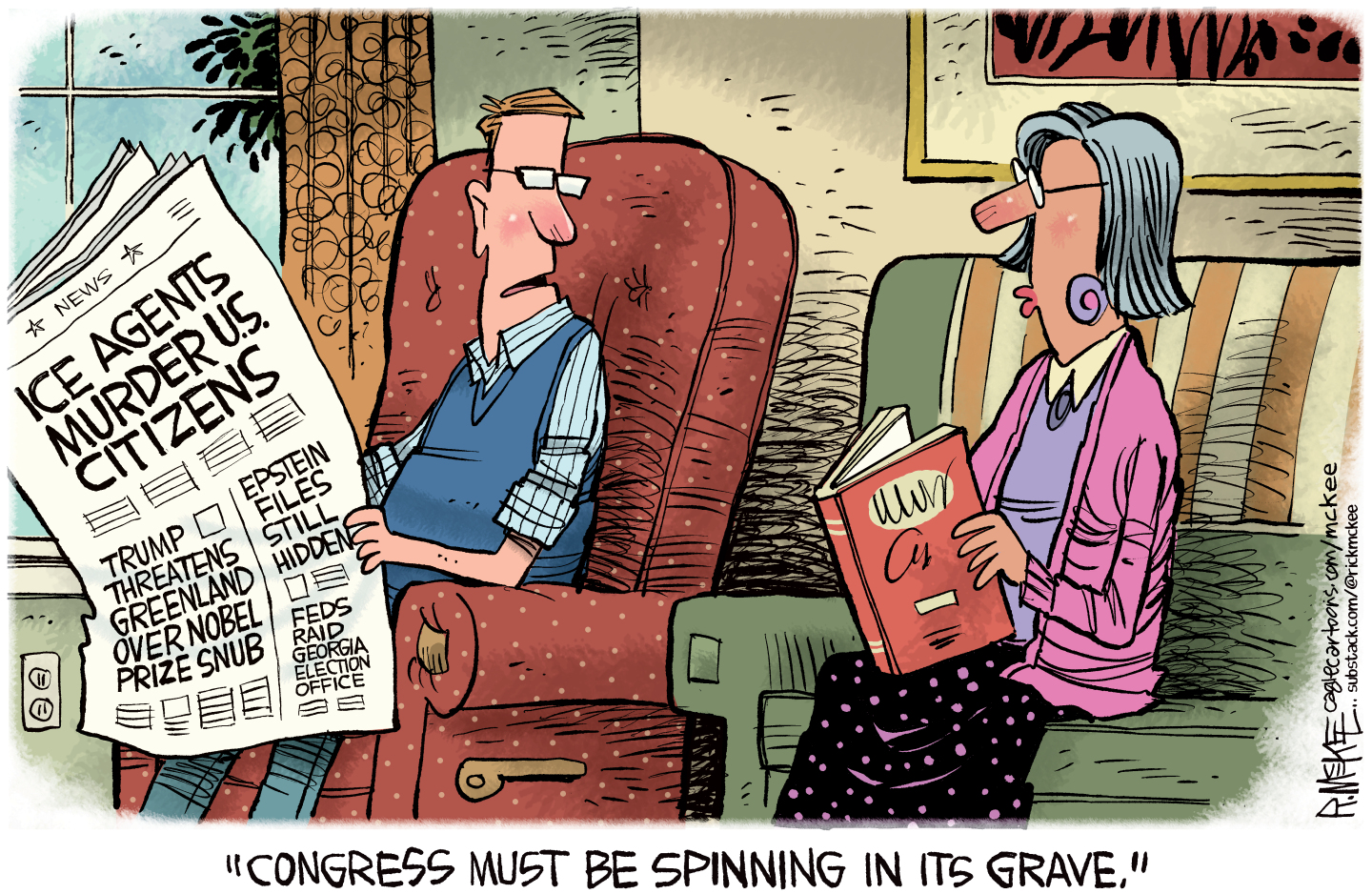

31 political cartoons for January 2026

31 political cartoons for January 2026Cartoons Editorial cartoonists take on Donald Trump, ICE, the World Economic Forum in Davos, Greenland and more

-

Political cartoons for January 31

Political cartoons for January 31Cartoons Saturday's political cartoons include congressional spin, Obamacare subsidies, and more

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities