China’s long shadow

China is in the midst of an astonishing economic boom. How will China’s rapid transformation affect the rest of the world?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What is going on in China?

The world’s most populous nation is undergoing what some are calling an “economic miracle.” China’s economy is growing by an astonishing 8 percent a year, as its largely agrarian economy is rapidly being transformed into a modern capitalist state. The sheer scale of the development is breathtaking: Paddy fields are being concreted over and villages torn down to make way for eight-lane highways, luxury housing estates, golf courses, skyscrapers, and sprawling industrial parks. With discretionary income in their pockets, hundreds of millions of Chinese are voraciously buying consumer goods. China is now the world’s largest market for television sets, and the Chinese bought 1.8 million new cars last year. Demand, however, is still in its infancy. Foreign companies—from Volkswagen to Coca-Cola—have invested billions in Chinese operations to gain a share of the vast potential market.

How is this affecting the rest of the world?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Chinese economy is growing so fast that it is responsible for a third of global economic growth—as much as the U.S. and far more than the European Union. Thanks to its huge pool of cheap labor—Chinese workers on average earn just 60 cents an hour—China has been able to flood world markets with cheap exports, thereby driving down global prices for manufactured goods. Once known as a supplier of cheap plastic toys, China is now the largest exporter to the U.S. of refrigerators, televisions, and bicycles, and is moving into semiconductor technology. Economists believe that the cheap cost of Chinese goods is the primary factor in keeping inflation so low in the West.

How has the boom affected the U.S.?

Americans have become avid customers of China’s inexpensive goods, importing a record $163 billion worth last year. But the trade boom has been mostly a one-way street. U.S. companies find it difficult to sell anything to the Chinese, largely because of their higher labor costs. As a result, the U.S. trade deficit with China last year hit $124 billion—the largest ever with one country. U.S. labor groups complain that the lopsided relationship has cost the U.S. 700,000 manufacturing jobs in the last decade. The Bush administration has pressured Beijing to make its markets more friendly to U.S. exports, with little luck. Over time, some economists warn, China’s rapid growth could actually fuel inflation.

How could that be?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

China’s voracious appetite for “hard” commodities is driving up their prices worldwide. Last year, China consumed 40 percent of the world’s cement and 27 percent of its steel. It is buying up so much aluminum that the Western bicycling industry is facing a shortage. It imports, annually, about 1.8 million cubic yards of timber from Burma alone. Thanks to Chinese demand, prices for commodities such as metals and ores have risen by 60 percent over the past two years. Then, of course, there is the impact on oil prices.

How is China affecting oil prices?

China’s economy has grown to such an extent that in the past decade, it has gone from being a net exporter of oil to being the world’s second-largest importer after the U.S. This additional demand on world supplies is one of the reasons oil prices have doubled since December 2001. If prices keep rising, the global effects could be damaging, not only to transportation costs but to manufacturing in general, since oil is used to make everything from plastics to food preservatives.

Will the demand continue to grow?

China’s oil consumption is likely to grow from 4.78 million barrels a day in 2000 to 10.5 million barrels a day by 2020, experts say. But China doesn’t only need oil; it is also the world’s biggest producer and consumer of coal. Even so, it is still not generating nearly enough electricity to meet demand, which is projected to grow by 4.3 percent a year until 2025. As a result, it is building dozens of hydroelectric dams, and is also expected to start importing vast quantities of coal, with potentially devastating consequences for the environment. In the meantime, in big cities such as Shanghai, the authorities now must ration electricity.

Can the Chinese sustain this growth?

Some experts fear that the Chinese economy is dangerously overheated. Many of the country’s huge construction projects are being financed by government-owned banks, which charge little interest and do minimal credit checks. Several major defaults could rapidly deflate the bubble. A crash of the Chinese economy would wreak havoc throughout the world, and could trigger serious inflation in the U.S. The Chinese have been using some of their billions to buy Treasury bonds floated to finance the U.S.’s growing debt. If China stopped buying those bonds, interest rates here would shoot up. But most experts think that even if China stumbles in the next year or two, its economic miracle has just begun. Millions of Chinese are pouring into the workforce every year. Over the next 25 years, some 350 million people are expected to migrate from the countryside to take jobs producing shoes, bicycles, cars, and televisions in what economists now call “the workshop of the world.”

The environmental cost

-

Magazine printables - February 20, 2026

Magazine printables - February 20, 2026Puzzle and Quizzes Magazine printables - February 20, 2026

-

Growing a brain in the lab

Growing a brain in the labFeature It's a tiny version of a developing human cerebral cortex

-

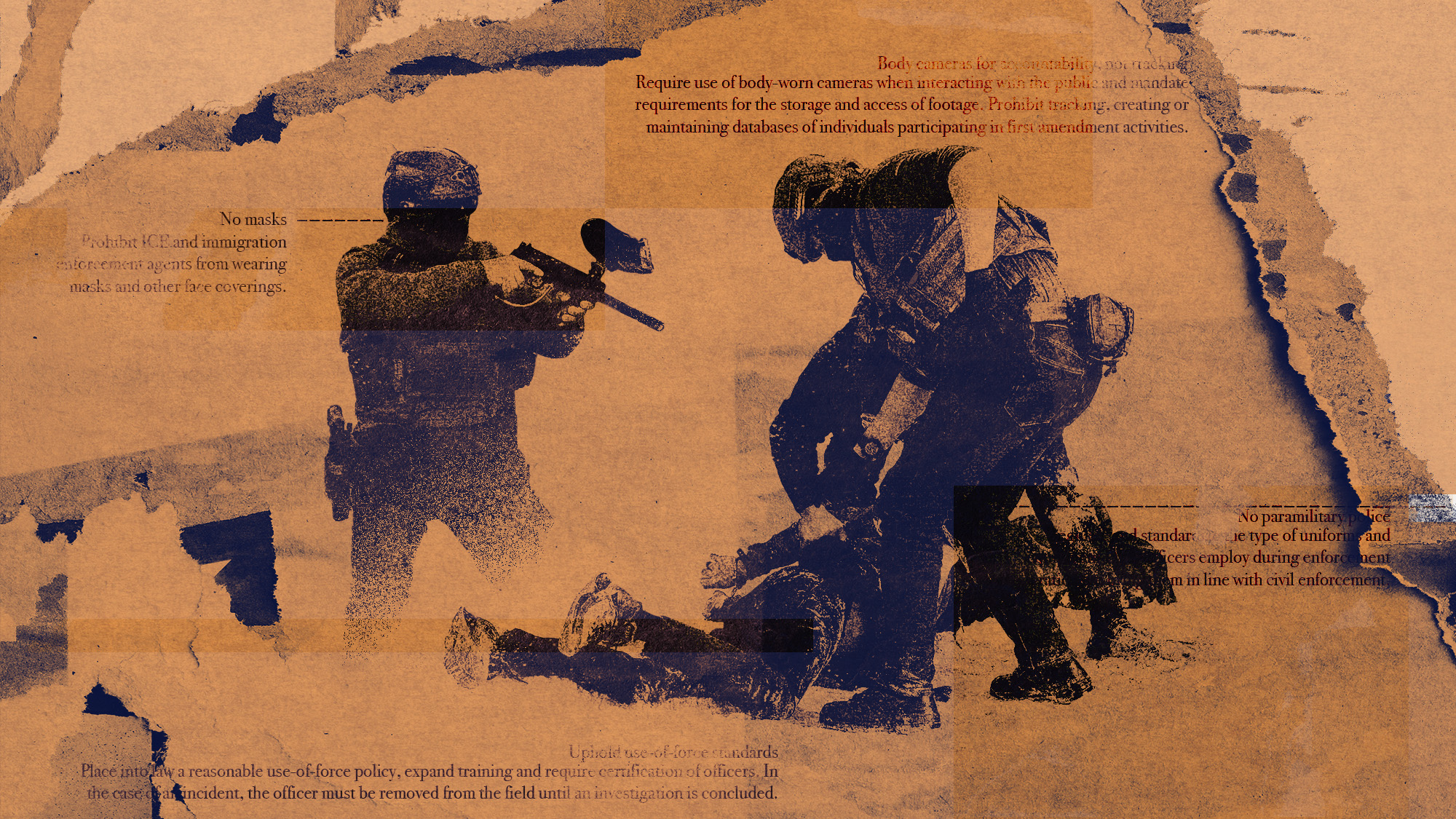

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency