The Chinese stock market debacle is a wake-up call about the exalted 'China model'

Will pro-China pundits like Tom Friedman eat crow?

A pundit is someone who thinks they know better than everybody else. So is a CEO.

So, on some level, it shouldn't be surprising that many in our pundit class — most famously, Tom Friedman — and many in our CEO class, like GE's Jeff Immelt, find so much to admire in China's state-driven capitalism.

They look at sclerotic democracies that can never get reforms past interest groups and long for an authoritarian pro-business regime that can just get things done. For example, we are told that America's red tape and political obstruction stymies the construction of needed infrastructure even as the Chinese are winning the future by building up a 21st century infrastructure.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If anything, the debacle with the Chinese stock market, which has fallen for weeks despite government intervention, should get us to stop admiring the so-called China model.

If there's anything we should all agree on, certainly post 2008, it's that asset bubbles are bad. And yet, the Chinese government is so terrified of bad economic news that it's willing to bully banks and asset managers into buying stocks rather than letting its stock market crash. With its bailouts, America has had problems with letting the chips fall where they may, but it's never been this bad.

Authoritarian governments seem stronger than democratic governments, because they are constrained by fewer rules, but in reality they are weaker. Because their rule is based on force, not law or common consent, they must exist in constant fear of overthrow. Western pundits look at the Chinese Communist Party and see strong, far-sighted technocrats. But the men inside are actually terrified of anything that might cause unrest, and know very well that they are more like rodeo riders hanging on for dear life than sovereigns.

What's more, because authoritarian governments do not have the rule of law, and do not have accountability through a transparent, agreed-upon process, they are inevitably corrupt. What some see as an ambitious plan to build 21st century infrastructure is in reality mostly an orgy of useless boondoggles, such as empty cities. China's government targets a GDP growth number every year, and rewards local officials based on attaining it; building useless white elephants boosts yearly GDP growth, but it is actually destructive to the long-term health of the economy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When China unveiled an amazing new bullet train, everybody in the West drooled while sounding dire warnings about what would happen if we didn't become more like China. When, a few weeks later, the same bullet train crashed because parts of the track had been built with subpar materials by companies that got the contract through bribes, we heard nothing.

Meanwhile, the U.S. has one of the most precious pieces of economic infrastructure ever designed by man: the rule of law. Building ambitious infrastructure projects is hard in the U.S., because the U.S. has a strong culture of property rights. This sort of infrastructure may be invisible, but it is the kind most conducive to long-term economic growth. People whose assets might be taken overnight by a neighbor or by the government don't invest much. Just ask most people in sub-Saharan Africa.

China's economic miracle has been a tremendous boon to, well, first, hundreds of millions of poor Chinese and, second, to the world at large. In many ways it is an enormously impressive feat, and China's leaders have much to be proud of. But as we coo and aww at China's impressive yearly GDP growth figures (even though they are massaged), we should also remember that they are growth figures. At an absolute level, China remains a very poor country.

But more importantly, we should keep in mind the main reason for such high growth figures: China was run for many decades by an insane murderous clique that did their very best, with the Great Leap Forward and the Cultural Revolution, to destroy absolutely everything that was conducive to prosperity, including the rule of law, infrastructure, and, most of all, tens of millions of people.

Once you have turned your country into a wasteland with disastrous policy, implementing less-disastrous policies will lead to less disaster, and — presto! — you will have something called "GDP growth." And if your previous policy was truly disastrous and you are starting off of a really low level, those GDP growth figures will be very high. Again — while in many ways truly impressive — we should not kid ourselves that these figures contain any profound lessons about which regime is most condusive to prosperity, let alone human flourishing.

The Chinese government is embarrassing itself, and it knows it. It is because it is weak, and it knows it. We should do well to remind ourselves.

Pascal-Emmanuel Gobry is a writer and fellow at the Ethics and Public Policy Center. His writing has appeared at Forbes, The Atlantic, First Things, Commentary Magazine, The Daily Beast, The Federalist, Quartz, and other places. He lives in Paris with his beloved wife and daughter.

-

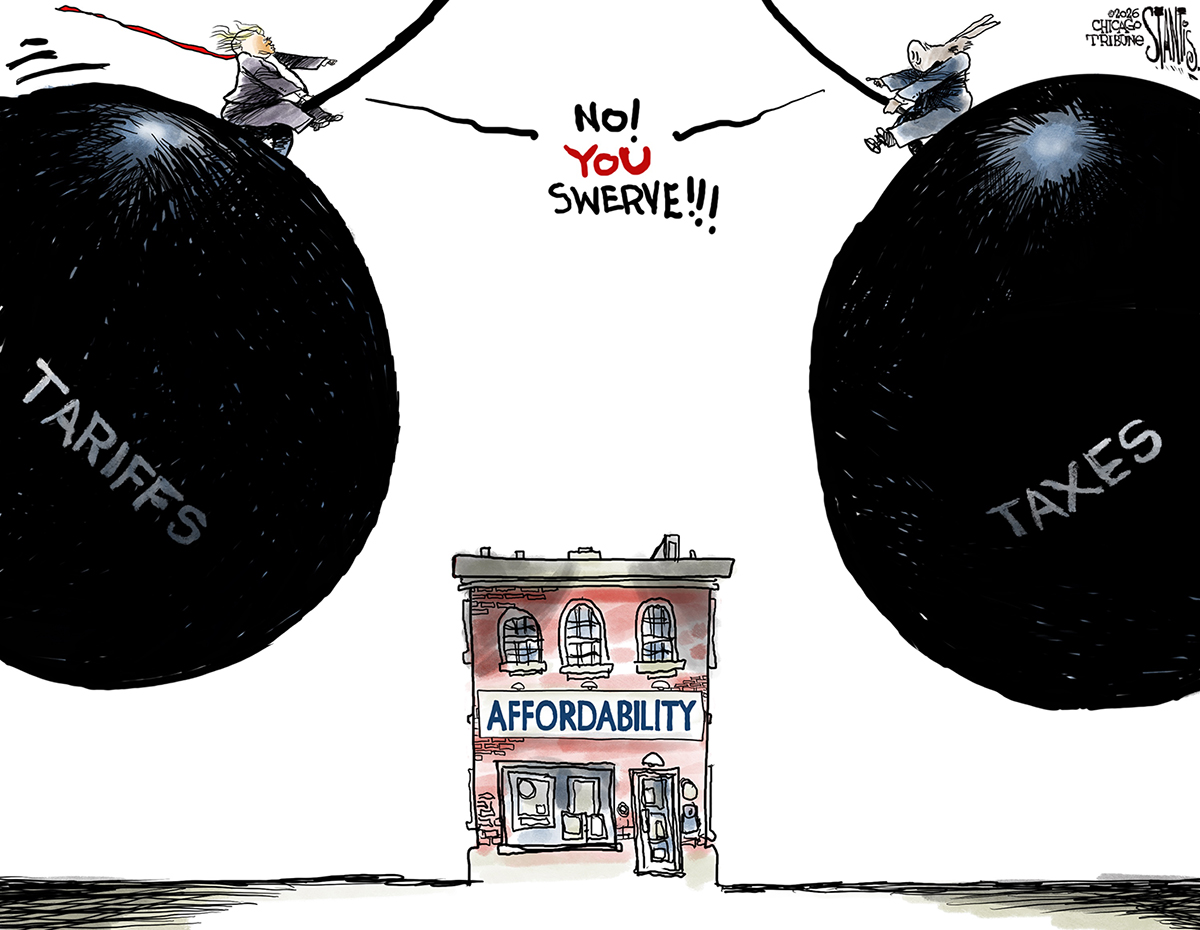

Political cartoons for January 18

Political cartoons for January 18Cartoons Sunday’s political cartoons include cost of living, endless supply of greed, and more

-

Exploring ancient forests on three continents

Exploring ancient forests on three continentsThe Week Recommends Reconnecting with historic nature across the world

-

How oil tankers have been weaponised

How oil tankers have been weaponisedThe Explainer The seizure of a Russian tanker in the Atlantic last week has drawn attention to the country’s clandestine shipping network