Why Puerto Rico needs its own currency

Unless Puerto Rico is made a U.S. state, this is the only longterm solution to its debt problem

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Puerto Rico is in a tight spot. It is staring down $72 billion in debt — and the reason is almost stupifyingly simple.

But first, some important background: Puerto Rico has already defaulted on $221 million in debt payments, and is facing multiple lawsuits from wealthy hedge funds that own many of its bonds — and who expect their payout. Much of the rest of its debt obligations are due sometime in the next few months, and with punishingly high unemployment and an economy that's been in recession for years, the money just isn't there.

Furthermore, as an American commonwealth rather than a full-fledged U.S. state, Puerto Rico exists in an odd legal netherworld where it's unclear what forms of bankruptcy — if any — it can access. So last week, Puerto Rico made the case that it's been wrongly locked out of bankruptcy before the U.S. Supreme Court. Meanwhile, members of Congress are struggling to hash out some sort of fix for the situation; draft legislation from the House Natural Resources Committee will hopefully arrive sometime this week.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That's the situation. So what's the one, simple reason? Puerto Rico can't issue its own currency.

The U.S. federal government has the sole power to create U.S. dollars. It says so right in the Constitution. In order to get money, it doesn't have to go out and do anything; it can just print it.

States and commonwealths, by contrast, are cash-constrained. To get money, these smaller governments can't just print it; they have to tax or borrow. Which means they can run out of money. Maybe the economy tanks and brings tax revenue down with it. Or maybe, like Puerto Rico, the government gets itself into a debt situation where it can't pull enough money out of the economy to pay off all its bonds and obligations.

But it's important to distinguish between the flows of money represented by taxes and debt payments, and the actual economic activity these governments engage in. They provide courts and law enforcement, the safety net, roads and infrastructure, regulatory bodies, health care, education, and more — all things which need to continue for society and the economy to function properly. Insisting indebted governments just suck an economy dry to pay off its creditors is incredibly destructive.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Greece is a good example of what can happen. The country uses the euro as currency, which it has no control over: The supply of the currency is managed by the European Central Bank. The Greek government admittedly didn't do a great job of managing its debt in the 2000s, but when the Great Recession hit, its economy and tax revenues tanked. International financial authorities have insisted Greece massively cut basic public services and raise taxes in order to pay off its debt overhang, which has only driven the Greek economy further into the ditch.

Here in America, our own system also doesn't have a good answer for what to do when cash-constrained pseudo-governments fail.

Practically speaking, this isn't as big a problem for the states, because their economies are enmeshed in the far larger churn of money and services and redistribution created by the federal government. It's just really hard for one individual state economy to get so out of whack with the rest of the country. And even if one did, states have legal access to parts of the bankruptcy code.

But for Puerto Rico, its cash-constraint is a huge problem. Its economy is far more removed from the various federal programs that support the states' economies. And it has no equivalent legal access to bankruptcy.

So the ultimate solution lies in deciding just what Puerto Rico is. If it's part of the American economy, then we should treat it accordingly: give it access to the bankruptcy code, and the same economic support that states get. We could even just make it a full-fledged state itself.

Alternatively, if Puerto Rico isn't part of the American economy, then we need to state explicitly what that means: Puerto Rico is its own economy with its own government. And it should have the ability to create its own currency.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

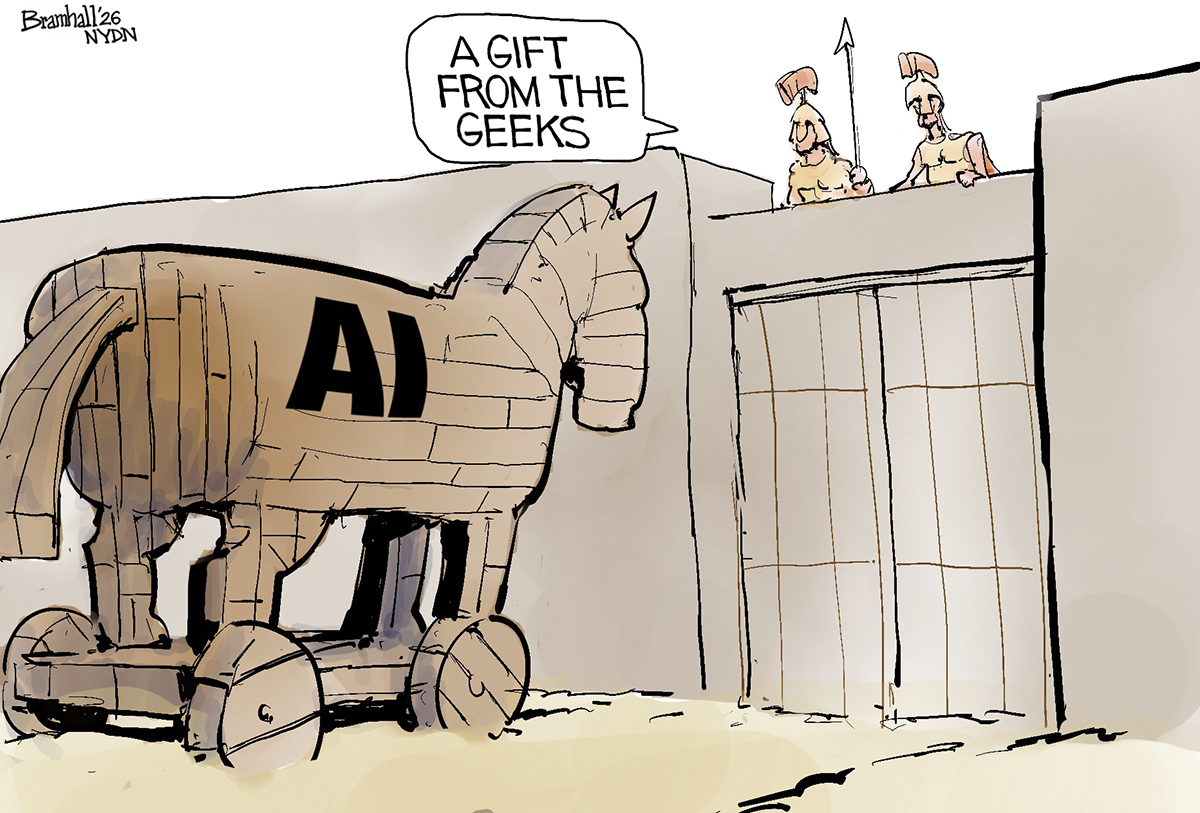

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’