The forgotten recession that irrevocably damaged the American economy

What Paul Volcker wrought

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Let's talk about Paul Volcker. These days he's best known for the "Volcker Rule," a part of the Dodd-Frank financial reform bill. But for a long time he was known for something else too: the Volcker recession.

In 1979, Volcker was promoted to chair of the Federal Reserve by President Jimmy Carter, with one primary mission: get inflation under control. The consumer price index (CPI) — the measure of inflation most cited in the popular discourse — had hit a growth rate of 6 percent in 1970, then 12 percent in 1974, and finally climbed to almost 15 percent in early 1980. This was accompanied by recessions in both 1970 and 1974.

You can see the run-up in the graph below. (The blue line is CPI. The red line is core PCE, the Fed's preferred inflation measure.)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

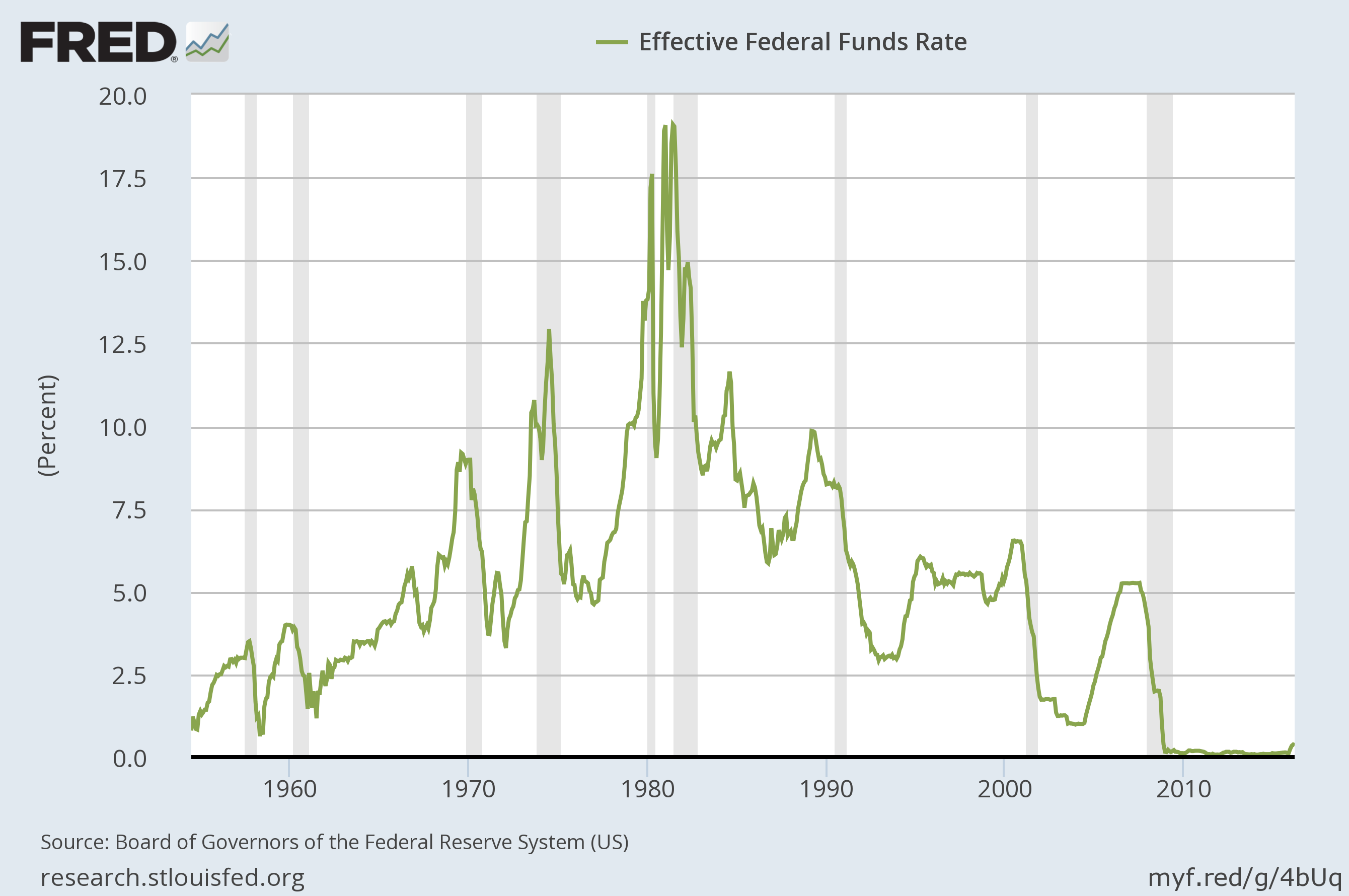

The story of how Volcker fulfilled his mission is complicated. But it boiled down to a massive hike in interest rates: The Fed's primary target for those rates reached an astronomical 19 percent in 1981.

It seemed to work, as CPI fell below 4 percent in 1983. And the standard tellings of this incident tend to emphasize the courage of Volcker and the policymakers and elected officials who stuck by him — their willingness to do what was necessary in spite of its massive political unpopularity.

But there's a different version of the story you could tell. Volcker's policies were unpopular for a very good reason. They sparked two recessions: A brief one in early 1980 (arguably costing Carter re-election) and then a massive one from late 1981 to late 1982.

The basic problem, as economist Dean Baker explained to The Week, is there's no way to tame inflation that doesn't involve inflicting damage on the economy. But using interest rate hikes to spark recessions is a methodology that loads the bulk of the pain onto everyday workers, and people who are marginalized in our society. The national unemployment rate (the blue line below) briefly reached 10.8 percent — higher than it got even in the Great Recession — and it didn't get back to 5 percent until 1989. Which was bad enough. But the unemployment rate for lower class workers is always much higher than for upper class ones. Ditto racial minorities: The unemployment rate for African-Americans (the red line below) topped 20 percent by 1983.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"People lost their jobs and never got them back," Baker said. "People lost their houses, lost their families."

The Volcker recession also roughly coincides with a remarkable inflection point in the American economy. Before the mid-1970s, labor markets were often tight and full employment was common. After the Volcker recession, full employment — when there are more jobs available than workers, so employers have to bargain up wages and work conditions — basically disappeared. Union membership had already fallen 5 percentage points from roughly 1960 to 1980. But after the Volcker recession, its decline accelerated, falling another 10 percentage points from 1980 to roughly 1995.

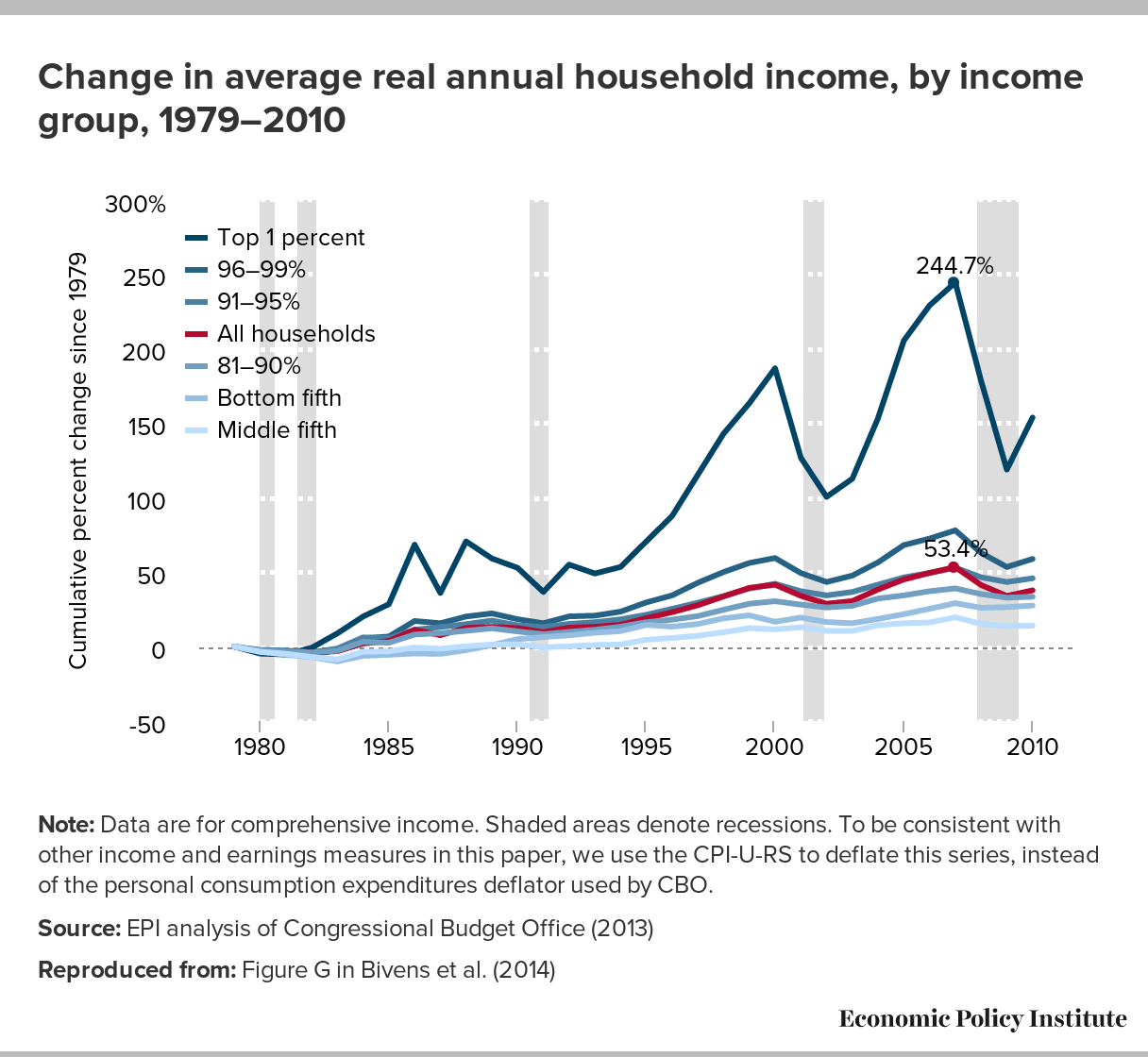

Most strikingly, the Volcker recession falls almost right atop the moment when inequality took off:

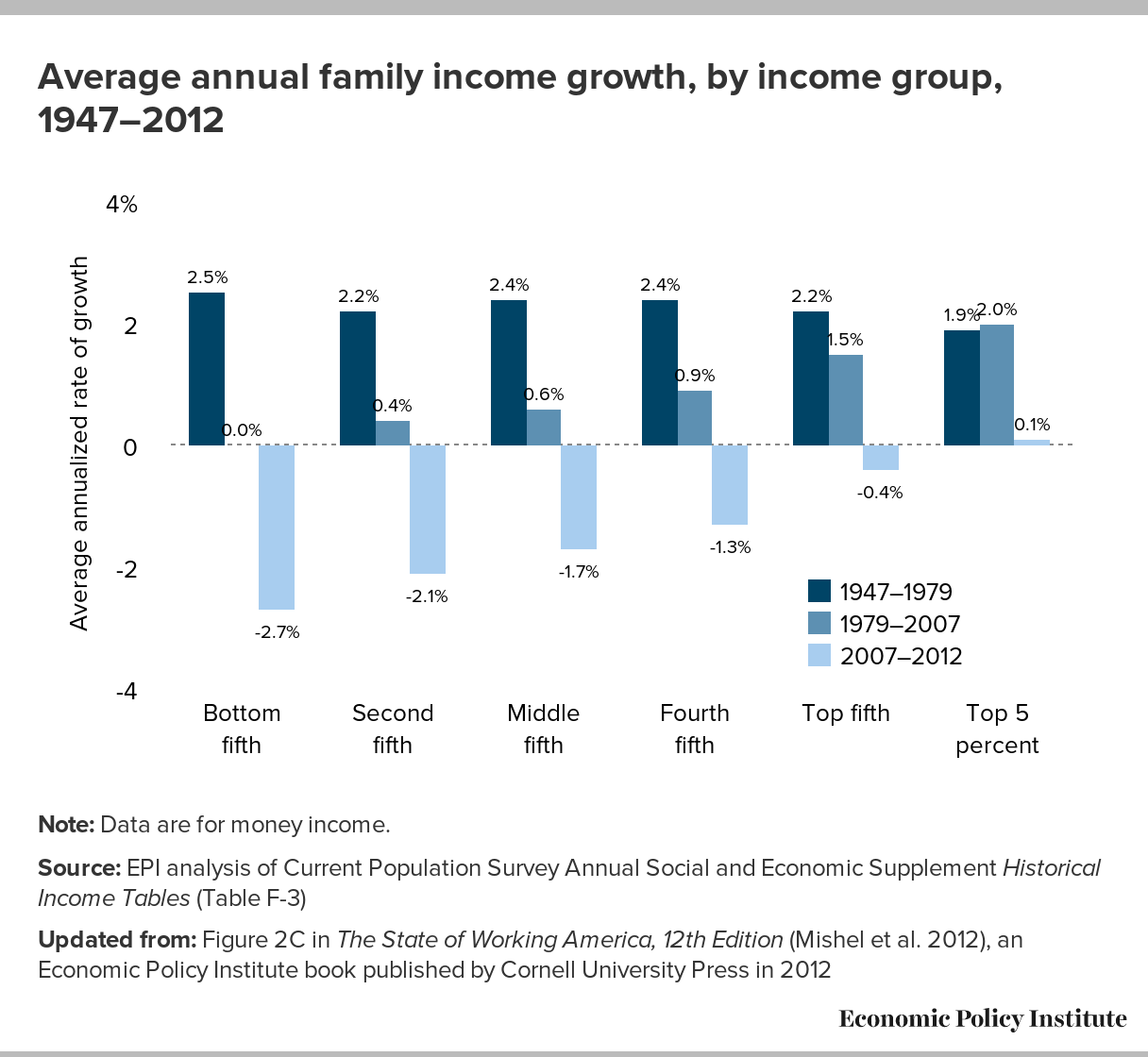

It was when the top 1 percent (and those within the top 1 percent) started gobbling up a much larger share of national income, it was roughly when hourly compensation stagnated and disengaged from productivity growth, and it was when family income growth in the bottom 80 percent of the economy slowed way down:

"That was when you see this big upward shift in wage income from non-college educated workers to college-educated workers — 1982 to 1983," Baker explained. "In some ways we're still seeing the costs to this day, in the sense that real wages haven't made up the lost ground."

All of that raises the obvious question: Could we have done things differently?

The 1970s were actually a relatively straightforward version of standard Keynesian macroeconomic theory, in which an overheating economy drives up the inflation rate. The real economic growth rate was actually quite strong that decade, bouncing around near 5 percent. The growth rate for nominal wages was also quite strong, ranging between 6 and 8 percent. And the country was running a modest budget deficit.

Keynesianism says that hiking taxes and balancing the budget, or even driving it into surplus, will put a drag on economic growth and slow down inflation. So we could've raised taxes and returned to the mid-century model of lots of brackets and really high rates at the top. That would've inflicted most of the damage on richer Americans who can afford to absorb it, rather than the workers and the poor who can't.

Unfortunately, Reagan's tax cuts at the start of his administration did the opposite.

On top of that, inflation was exacerbated by several historical flukes. The most obvious was the rise in oil prices over the 1970s, driven by OPEC's oil embargo against the U.S., and then by the shutdown in Iranian oil exports brought on by the Iranian revolution.

There was also a flaw in how the CPI was calculated at this time. That was a problem because many union contracts at the time indexed wage increases to the CPI, and many other legal contracts — like those for renters — relied on the measure as well. "The error in the measure of inflation was about 2 percentage points by 1978 and 1979," Baker said. "That meant the erroneously measured inflation got translated into higher wages, higher rents, and other prices that were indexed."

In other words, the government mis-measured the inflation rate as even higher than it actually was. That set off a chain reaction that drove up prices throughout the economy, creating a negative feedback loop that drove actual inflation higher still.

All these problems would've likely worked themselves out regardless of what Volcker did. The error in the CPI was corrected in 1982. The run-up in oil prices from the Middle East drove a massive surge in oil production in other parts of the world, and a big uptick in energy efficiency, all of which would've naturally pushed inflation back down. And as mentioned, unions were losing their clout, with membership already on a downslide.

"We could've expected inflation to fall in any case," Baker continued. "Probably not as quickly and not as much."

"But suppose it took us 6 years to get down to 4 percent inflation? What would've been the problem with that?"

None of this means Volcker didn't need to raise interest rates at all. But he probably didn't need to raise them nearly as much as he did. And had we considered other options, like tax hikes, he would've needed to raise them less still.

"In retrospect, I find it hard to say that the best thing we could've done is push the unemployment rate up to 11 percent and have that really whack inflation," Baker concluded. "It did do that. But it was at a really horrible cost."

The American economy would never be the same.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal