The next phase of America's coronavirus problem is a massive housing crisis

Millions will be out on the street in a few months without swift action

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Thursday brought yet more grim economic numbers, with 2.98 million Americans filing for unemployment over the last week. That makes for 36.5 million claims since the beginning of the coronavirus crisis (though millions no doubt have not managed to make it onto the program rolls, or are not receiving benefits even if they have). A recent Federal Reserve study found that nearly 40 percent of households making $40,000 per year or less lost a job in March.

Millions of people are already unable to afford their rent or mortgage payments, and tens of millions more will be unable to in a few months if nothing changes. America is facing a major housing crisis if it doesn't get its act together. Either the economic rescue programs need to be strengthened and extended, or we need some kind of cancellation of rent and mortgage payments until things return to normal, or both.

There have been several programs and rules passed already intended to help homeowners and renters. But, as usual in American policymaking, these policies are haphazard, over-complicated, and incomplete. For renters, evictions have been temporarily banned in many cities and states, and some places like Philadelphia have begun to extend rental payment assistance for lower-income people. But rent payments have only been paused in most places, not canceled, and there hasn't been any nationwide policy. Landlords are already champing at the bit to evict people.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For homeowners, mortgage holders or servicers have been banned from foreclosing on people for 60 days starting March 18. Homeowners whose loans are backed by the government (which is most of them) can apply for forbearance, which puts their payments on hold for up to a year. However, the stipulations are complicated and unclear. Mortgage servicers (businesses that collect the loan payments and administer paperwork for the true loan owner) are reportedly misleading homeowners by telling them all missed payments will be due at the end of the forbearance period, when in fact there are several repayment options, including paying them at the end of the loan term.

These are the same servicers who were major villains in the foreclosure crisis a decade ago. The Obama administration deliberately enabled this between 2009-11 by running its homeowner "assistance" program through servicers, who have a financial incentive to foreclose and routinely tricked people into it, often with forged documents. The effect was to push the losses from the housing bubble from banks to individuals. (As an aside, it is preposterous for the government to use servicers for the loans it owns. It could easily do the job itself for cheaper.)

So far the number of people failing to pay rents or mortgages has not increased that much, probably because of the one-off rescue payment of $1,200 and the temporary increase in unemployment benefits. But that won't last forever. Many have already spent their payment, and super-unemployment expires at the end of July. Analysts are predicting a big surge in rent and mortgage nonpayment if nothing changes.

A tidy solution here would be to simply pause all rent and mortgage payments for the duration of the crisis, and restart afterwards without any repayment. Homeowners and renters would be secure, and landlords would be mostly fine as well since mortgages are typically by far their largest expense — plus it would be much easier to administer without any complicated means test. Joe Biden actually suggested something along these lines recently.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The overall effect would probably be somewhat regressive on net. Many more people live in owner-occupied homes than rent them, and higher-income people tend to live in more expensive homes with bigger mortgage payments. But now is hardly the time to worry about that. The Federal Reserve is blasting rich investors with a money cannon, and even Democrats are trying to sneak through a tax cut in which 56 percent of the benefit would flow to the top one percent. (Loudly protesting about the rich being included in welfare systems while quietly shoveling money out the back door to plutocrats is a long bipartisan American tradition.)

Alternatively, we could simply flood the population with enough income that everyone can pay all their bills. If Congress keeps universal stimulus payments flowing monthly (which will be easier logistically now that the first one has been done), and preserves super-unemployment as long as the crisis lasts, then just about everyone should have enough money to cover their bills indefinitely.

Over the medium term, we should also consider homeowner relief along the lines of Franklin Roosevelt's Home Owners' Loan Corporation. Millions of homeowners will no doubt be underwater on their mortgages soon if they aren't already (that is, their mortgage debt is greater than the value of the home). This will be a big economic drag in the future — people with negative net worth tend to drastically cut their spending to repair their balance sheet, and many will likely opt to just walk away from their homes, which badly harms neighborhoods. We should allow underwater homeowners to write down their principal to the value of the property, and refinance to take advantage of the cheap credit the Federal Reserve is flooding into the economy.

That's a lesser priority, but America needs to do something to stave off a housing disaster. Children are already going hungry. Without swift action many will end up on the street.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Colbert, CBS spar over FCC and Talarico interview

Colbert, CBS spar over FCC and Talarico interviewSpeed Read The late night host said CBS pulled his interview with Democratic Texas state representative James Talarico over new FCC rules about political interviews

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

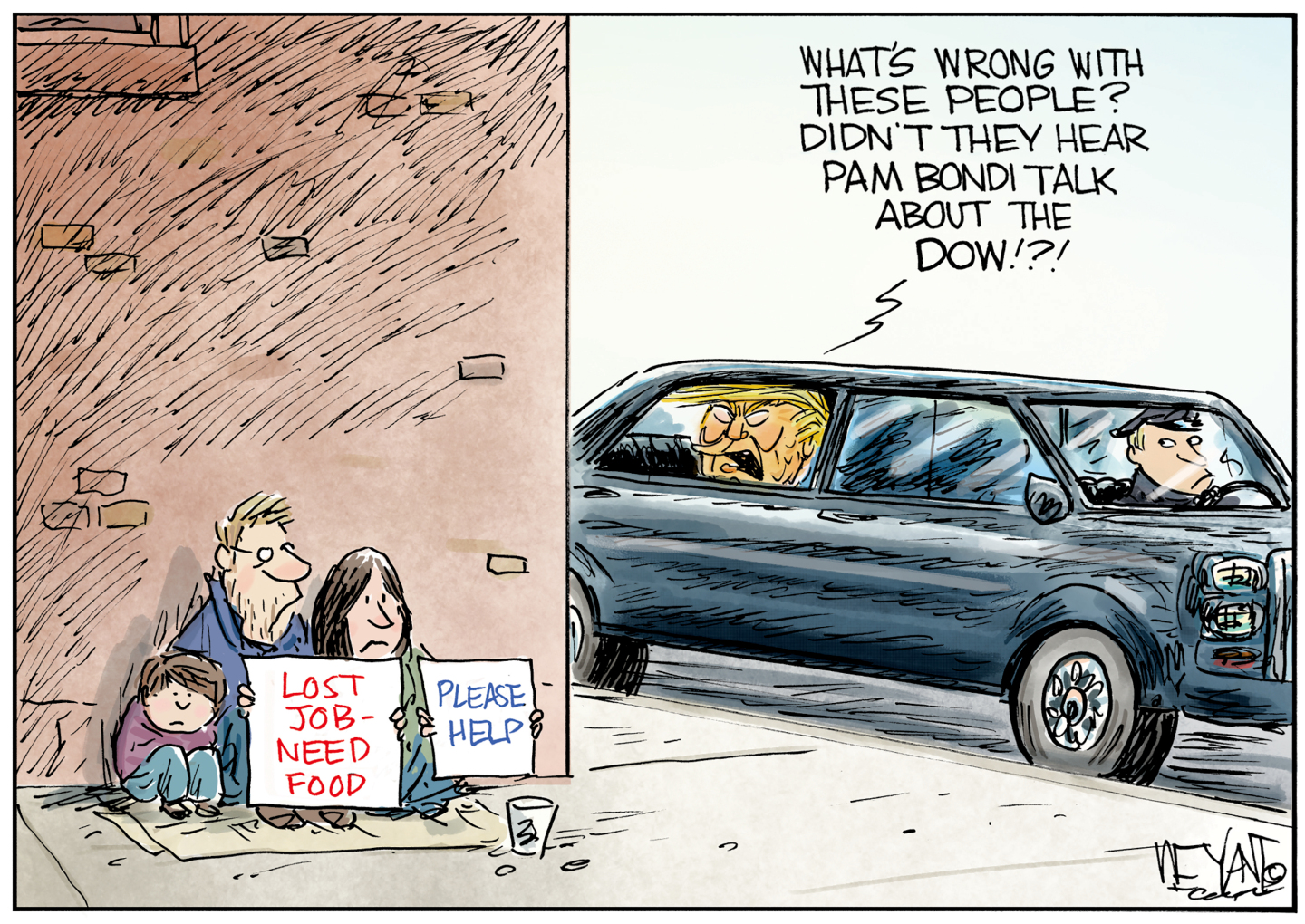

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more