The daily business briefing: August 4, 2021

The CDC announces a new eviction ban, Blizzard president resigns as game-maker faces sexual harassment backlash, and more

- 1. CDC announces new, targeted eviction moratorium

- 2. Blizzard president resigns as company faces sexual harassment backlash

- 3. PepsiCo selling Tropicana, other juice brands in $4.5 billion deal

- 4. Stocks flat after S&P 500's latest record

- 5. Honda, Toyota profits jump in sign of pandemic-era resilience

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

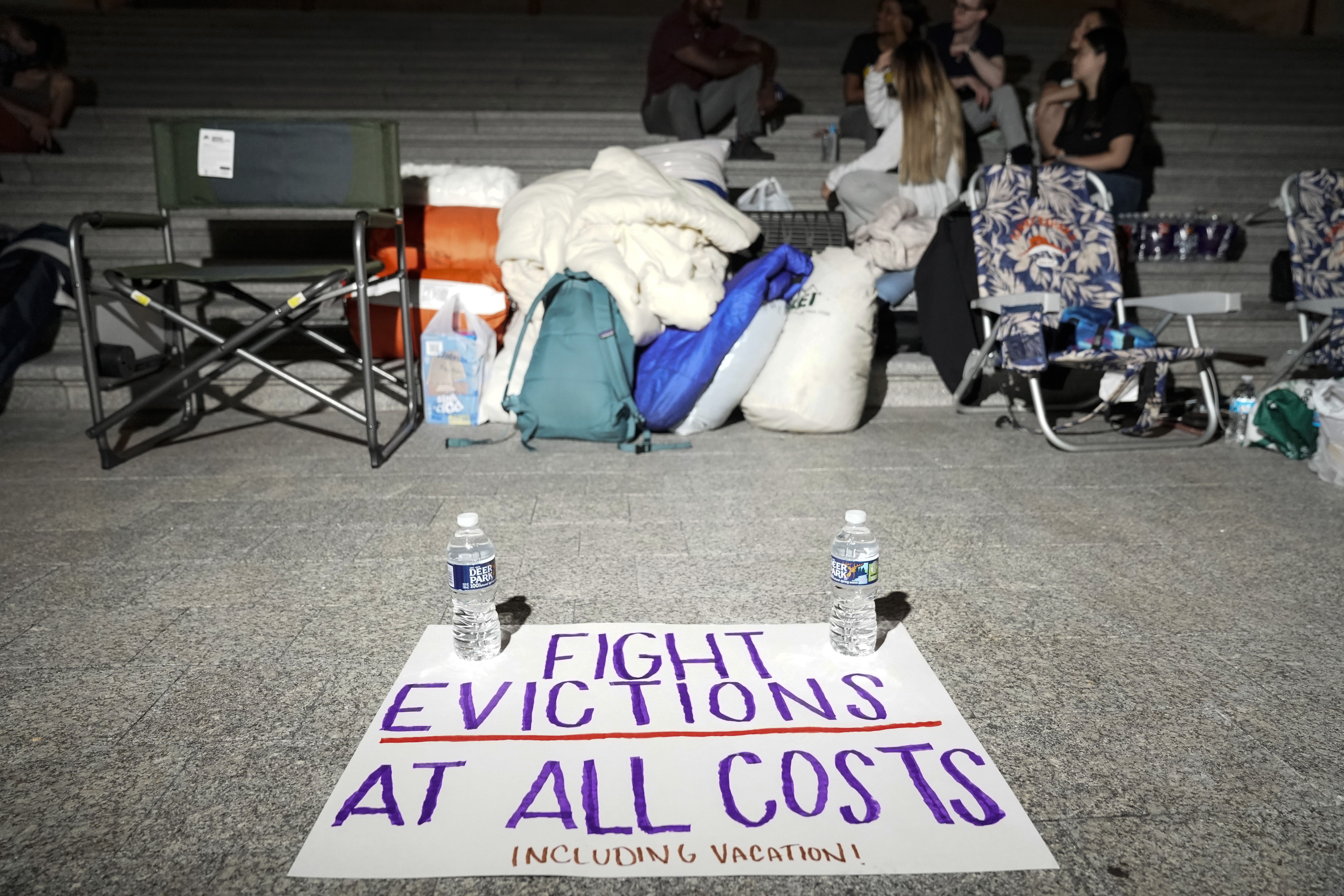

1. CDC announces new, targeted eviction moratorium

The Centers for Disease Control and Prevention on Tuesday announced a new eviction moratorium covering areas with high coronavirus transmission rates. The policy will last 60 days. Many progressive Democrats in Congress harshly criticized President Biden for letting the original moratorium expire on Saturday, although Biden said a June Supreme Court decision required action from Congress to extend the ban. The new eviction freeze affects counties where the CDC has recommended that even vaccinated people wear masks indoors. The areas covered are home to 90 percent of the U.S. population. Biden acknowledged that even a limited freeze could face court challenges, but the legal process would provide time to get emergency assistance to millions of people in danger of losing their homes.

2. Blizzard president resigns as company faces sexual harassment backlash

Video-game giant Activision Blizzard announced Tuesday that its president, J. Allen Brack, is stepping down as the company faces a discrimination and sexual harassment lawsuit in California, and an employee revolt. The state last month sued Activision Blizzard, maker of World of Warcraft, Call of Duty, and other popular games, accusing it of fostering a "frat boy" culture that is "a breeding ground for harassment and discrimination against women." More than 1,500 workers walked out from their jobs this week, and thousands signed a letter criticizing the company after executives dismissed the lawsuit as "meritless" and "inaccurate." Activision CEO Bobby Kotick on Tuesday apologized for the "tone deaf" response, and said there was "no place anywhere at our company for discrimination, harassment, or unequal treatment of any kind."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Associated Press The New York Times

3. PepsiCo selling Tropicana, other juice brands in $4.5 billion deal

PepsiCo is selling its Tropicana, Naked, and other juice brands to private-equity firm PAI Partners, the snacks-and-beverage company confirmed Tuesday after The Wall Street Journal first reported the news. PepsiCo will get $3.3 billion and retain a 39 percent stake in a deal worth about $4.5 billion. PepsiCo said last year that orange juice sales rose last year as more people ate breakfast at home due to the coronavirus pandemic, but overall fruit-juice sales continued a decline as consumers cut sugar consumption. PepsiCo, rival Coca-Cola, and other beverage companies in recent years have tried to shift away from sugary drinks in favor of diet soda, flavored seltzer, and bottled water.

4. Stocks flat after S&P 500's latest record

U.S. stock futures were mixed early Wednesday following the latest record-setting session for the S&P 500. Futures tied to the S&P 500 and the Dow Jones Industrial Average were up by about 0.1 percent several hours before the opening bell. Nasdaq futures were down by less than 0.1 percent. The three main U.S. indexes struggled for footing on Tuesday before surging late in the day. The S&P 500 rose by 0.8 percent to close in the latest in a string of all-time highs. The Dow and the tech-heavy Nasdaq gained 0.8 percent and 0.6 percent, respectively. After the bell, Lyft and Caesars Entertainment became the latest companies to report better-than-expected quarterly results in a strong earnings season. Both stocks gained more than 3.5 percent in after-hours trading.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Honda, Toyota profits jump in sign of pandemic-era resilience

Honda reported Wednesday that it made a $2 billion profit in the second quarter, returning to profitability as improving sales and cost cuts helped it bounce back from the damage of the coronavirus pandemic. The Japanese automaker's sales reached $33 billion, an increase of 69 percent on the year, with a boost from recovering sales in North America and higher motorcycle sales in India and Indonesia. Honda also raised its sales forecast for the next year. Earlier Wednesday, Toyota reported a record $8.2 billion profit for its fiscal first quarter, a more than five-fold increase over last year. Toyota kept its forecast for the year ending March 2022 unchanged, citing the ongoing semiconductor shortage and other remaining concerns.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more