The daily business briefing: October 5, 2021

Facebook apps return after hours-long outage, OPEC+ decision on slow output hike pushes up oil prices, and more

- 1. Facebook apps return after hours-long outage

- 2. OPEC+ decision to increase output slowly pushes up oil prices

- 3. Biden calls Republicans 'hypocritical' in battle over debt ceiling

- 4. Stock futures rise after Monday's plunge

- 5. Jury awards former Tesla worker $136.9 million over racial abuse

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

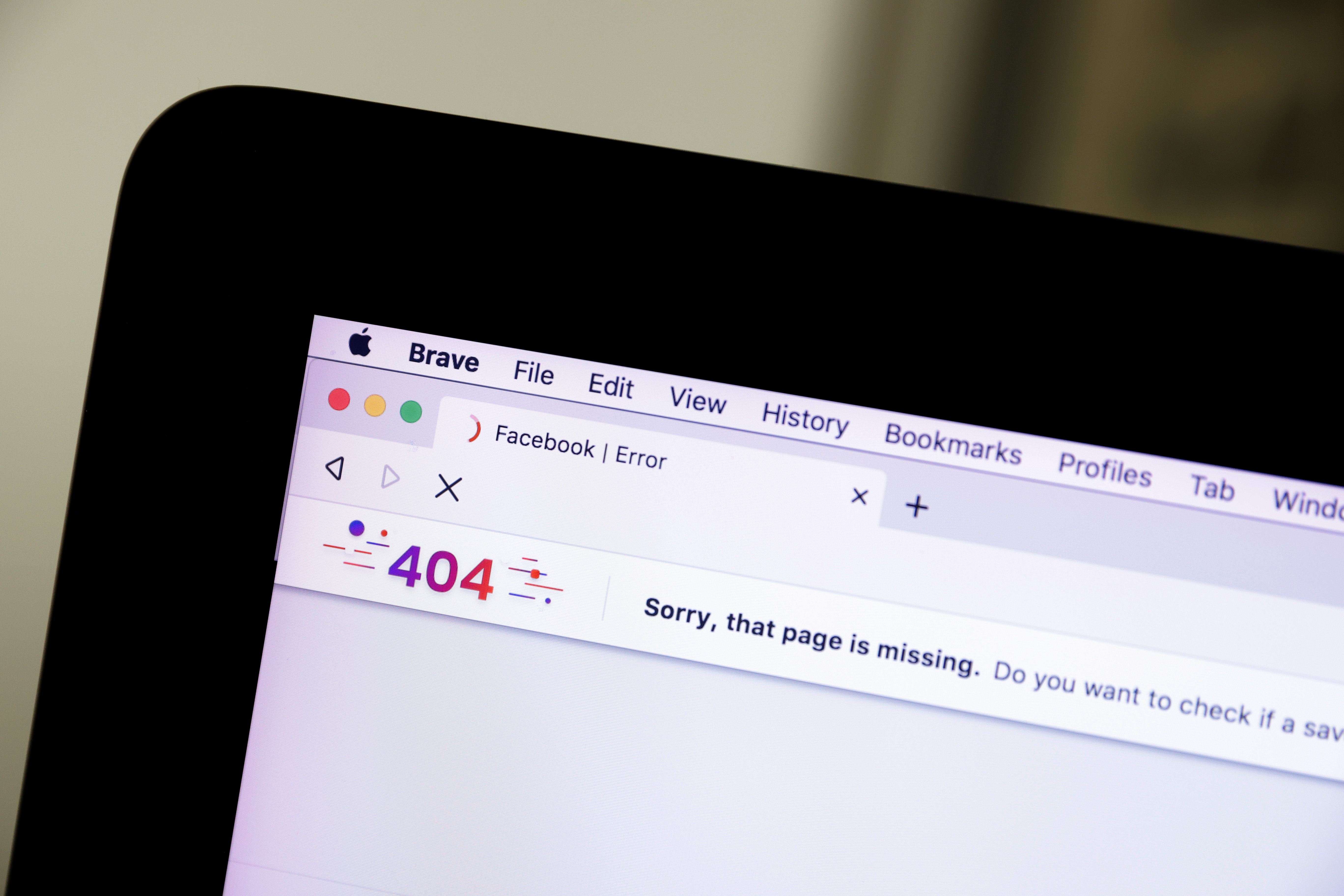

1. Facebook apps return after hours-long outage

Facebook and its apps, including WhatsApp and Instagram, went down worldwide on Monday, as did the internal systems used by the social media giant's employees. "This is epic," said Doug Madory, director of internet analysis for network-monitoring company Kentik Inc. The services were out for hours, far longer than the last major internet outage, which occurred in June and kept the world's top internet sites offline for less than an hour. The company said its engineers found that changes to the internet infrastructure of its servers disrupted network traffic between its data centers, "bringing our services to a halt." Facebook eventually restored service by resetting server computers at a data center in Santa Clara, California. "We're sorry," the company said. "Thank you for bearing with us."

The Associated Press The New York Times

2. OPEC+ decision to increase output slowly pushes up oil prices

OPEC and other oil producers led by Russia have agreed to continue increasing production slowly, delegates from the countries said Monday. The decision against boosting output more quickly helped send West Texas Intermediate, the U.S. benchmark crude oil, rising by 2.3 percent to $77.62 per barrel, its highest level since 2014. Brent, the international benchmark, rose by 2.5 percent to close at $81.26, its highest level in three years. Because of recent price increases, analysts and economists had expected the producers to lift production more sharply. Instead, the Organization of the Petroleum Exporting Countries and Russia said the group, which calls itself OPEC+, would hike output by 400,000 barrels a day in monthly installments under a push to return to pre-coronavirus pandemic levels.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Biden calls Republicans 'hypocritical' in battle over debt ceiling

President Biden on Monday increased pressure on Republicans to agree to raise the debt ceiling to pay for spending already approved by Congress, accusing them of being "hypocritical, dangerous, and disgraceful" by risking a devastating, historic federal debt default. "Not only are Republicans refusing to do their job, but they're threatening to use their power to prevent us from doing our job — saving the economy from a catastrophic event," Biden said. Treasury Secretary Janet Yellen has said the government will run out of ways to keep paying its bills by Oct. 18. Republicans, led by Senate Minority Leader Mitch McConnell, have said Democrats should handle raising the debt ceiling themselves by using the budget reconciliation process, which would allow them to do it without Republican votes.

4. Stock futures rise after Monday's plunge

U.S. stock index futures rose early Tuesday after Wall Street's sharp Monday losses, which came as rising bond yields continued to drive investors away from tech stocks. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up by just over 0.3 percent several hours before the opening bell. Futures for the tech-heavy Nasdaq gained 0.5 percent. The Dow and the S&P 500 fell by 0.9 percent and 1.3 percent, respectively, on Monday. The Nasdaq plunged by 2.1 percent as shares of Apple, Amazon, Microsoft, and other tech giants fell. Facebook dropped by 4.9 percent as it suffered a worldwide outage and a whistleblower accused it of a "betrayal of democracy," saying it used algorithms that push misinformation onto users.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Jury awards former Tesla worker $136.9 million over racial abuse

A federal jury on Monday awarded $136.9 million to a Black former Tesla worker who said the electric-car maker failed to do anything to stop racial abuse he was subjected to while working at the company's Fremont, California, factory. The former employee, Owen Diaz, said he was called racist names and shown racist cartoons while he worked as an elevator operator at the plant in 2015 and 2016. The eight-member jury in San Francisco found that Tesla violated Diaz's right to be free of a racially hostile work environment. The jurors awarded Diaz, 53, $6.9 million for emotional distress and $130 million in punitive damages. "They're putting Elon Musk on notice to clean up his factory," he said, referring to Tesla's CEO. Tesla lawyers did not immediately comment.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

Anthropic: AI triggers the ‘SaaSpocalypse’

Anthropic: AI triggers the ‘SaaSpocalypse’Feature A grim reaper for software services?

-

NIH director Bhattacharya tapped as acting CDC head

NIH director Bhattacharya tapped as acting CDC headSpeed Read Jay Bhattacharya, a critic of the CDC’s Covid-19 response, will now lead the Centers for Disease Control and Prevention

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more