The daily business briefing: December 16, 2021

The Fed says it will end bond purchases faster to fight inflation, Moderna says booster restores protection against Omicron, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Fed to taper bond purchases faster to fight inflation

The Federal Reserve announced Wednesday that it will taper the bond purchases it has used to boost the economy during the coronavirus pandemic faster than previously planned, to fight rising inflation. The Fed has said it wants to end the asset purchases before raising historically low interest rates, so the change also will pave the way for the central bank to lift rates sooner than previously planned. The Fed signaled that it expects to raise rates three times next year. The policy shift came at the end of a two-day meeting following news that inflation jumped to 6.8 percent in November compared to a year earlier, the biggest increase in nearly four decades.

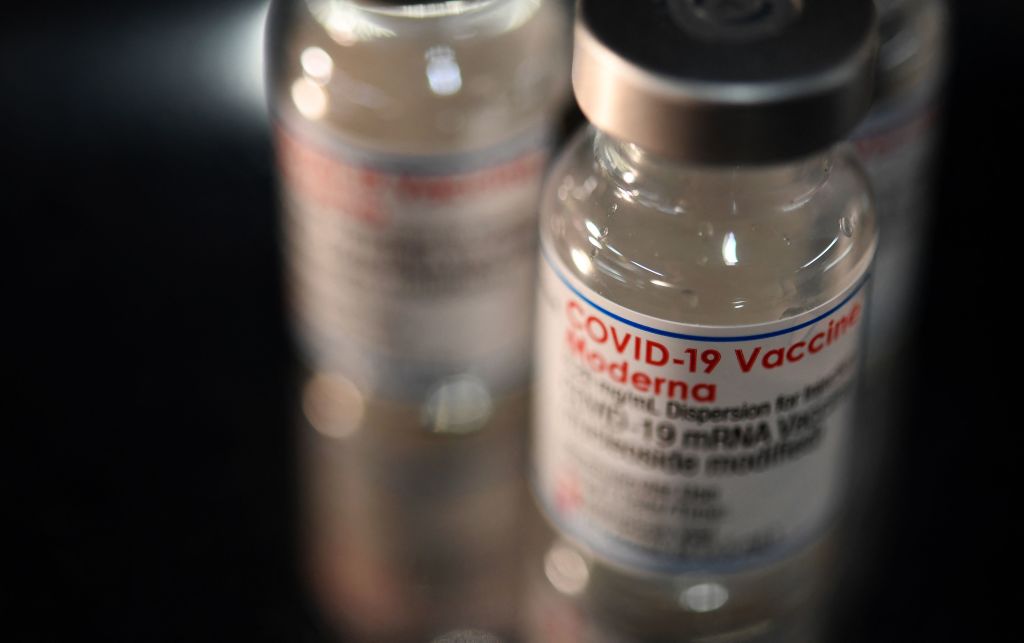

2. Moderna says Omicron evades vaccine but booster restores protection

Moderna said Wednesday that a preliminary laboratory study found that its coronavirus vaccine was less effective against the Omicron variant, but that a booster shot restored strong protection. Researchers looked at blood samples taken from 30 people who were fully vaccinated with the two-shot Moderna vaccine, and found that the antibodies in their blood were 50 times less effective than they were against the original strain. But samples from 17 more people in the study who had received the Moderna booster shot had about as much protection against Omicron as they did against the Delta variant. Pfizer also has said its vaccine was less effective against Omicron but a booster restored significant protection.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Retail sale gains slowed in November

Retail sale gains slowed in November as the holiday season began and shoppers showed caution in the face of rising inflation and supply shortages, the Commerce Department reported Wednesday. Sales at online and brick-and-mortar retailers and restaurants increased by a seasonally adjusted 0.3 percent in November over the previous month, down from the 1.8 percent monthly increase reported in October. One reason for the slowdown was that many Americans snapped up deals early to make sure they got what they needed before supplies ran out. Consumer demand remained stronger than at the same time last year. Retail sales were up by 18.2 percent compared to November 2020, thanks partly to rising wages and falling unemployment.

4. IRS makes last child tax credit payments under Biden coronavirus relief law

The Treasury Department and IRS on Wednesday made what will be their final monthly child tax credit payments unless Congress approves legislation to extend them. The more than $16 billion in payments went out to households with about 61 million children, bringing to nearly $93 billion the total distributed under the program, which was included in President Biden's coronavirus relief law. Families got up to $300 for each child under age 6 and $250 for each child ages 6 to 17. The November payments kept families with 3.8 million children above the poverty line. Democrats want to extend the monthly payments for some families under their proposed $1.9 trillion spending bill, which is stalled in negotiations over costs with moderate Sen. Joe Manchin (D-W.Va.).

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures rise after Fed announcement

U.S. stock futures rose early Thursday after the Federal Reserve announced plans to speed up the tapering of its economy-boosting asset purchases to contain inflation. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up by 0.7 percent and 0.8 percent, respectively, at 6:30 a.m. ET. Futures for the tech-heavy Nasdaq were up by about 0.9 percent. The Fed's shift came as policymakers at the central bank stopped calling inflation fueled by the coronavirus pandemic "transitory." The three main U.S. indexes jumped on Wednesday after the Fed announcement. The Dow and the S&P 500 closed up by 1.1 percent and 1.6 percent, respectively. The Nasdaq gained nearly 2.2 percent.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more