The daily business briefing: January 27, 2022

Fed leaders signal an interest rate hike in March, Spotify removes Neil Young's music after his Joe Rogan objections, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Fed officials signal rate hike in March

The Federal Reserve said Wednesday that with inflation high and the job market strengthening it will "soon" be appropriate to start raising interest rates, which the central bank has kept near zero to boost the recovery during the coronavirus pandemic. Fed Chair Jerome Powell said Fed leaders were keeping rates unchanged for now, but inclined to "raise the federal funds rate at the March meeting," assuming current trends continue. "The economy no longer needs sustained high levels" of monetary policy support, he said. The Fed also is tapering the bond purchases it has used to further support the recovery, on track to end the program in March. The suggestion that the Fed could aggressively increase borrowing costs dragged down stocks.

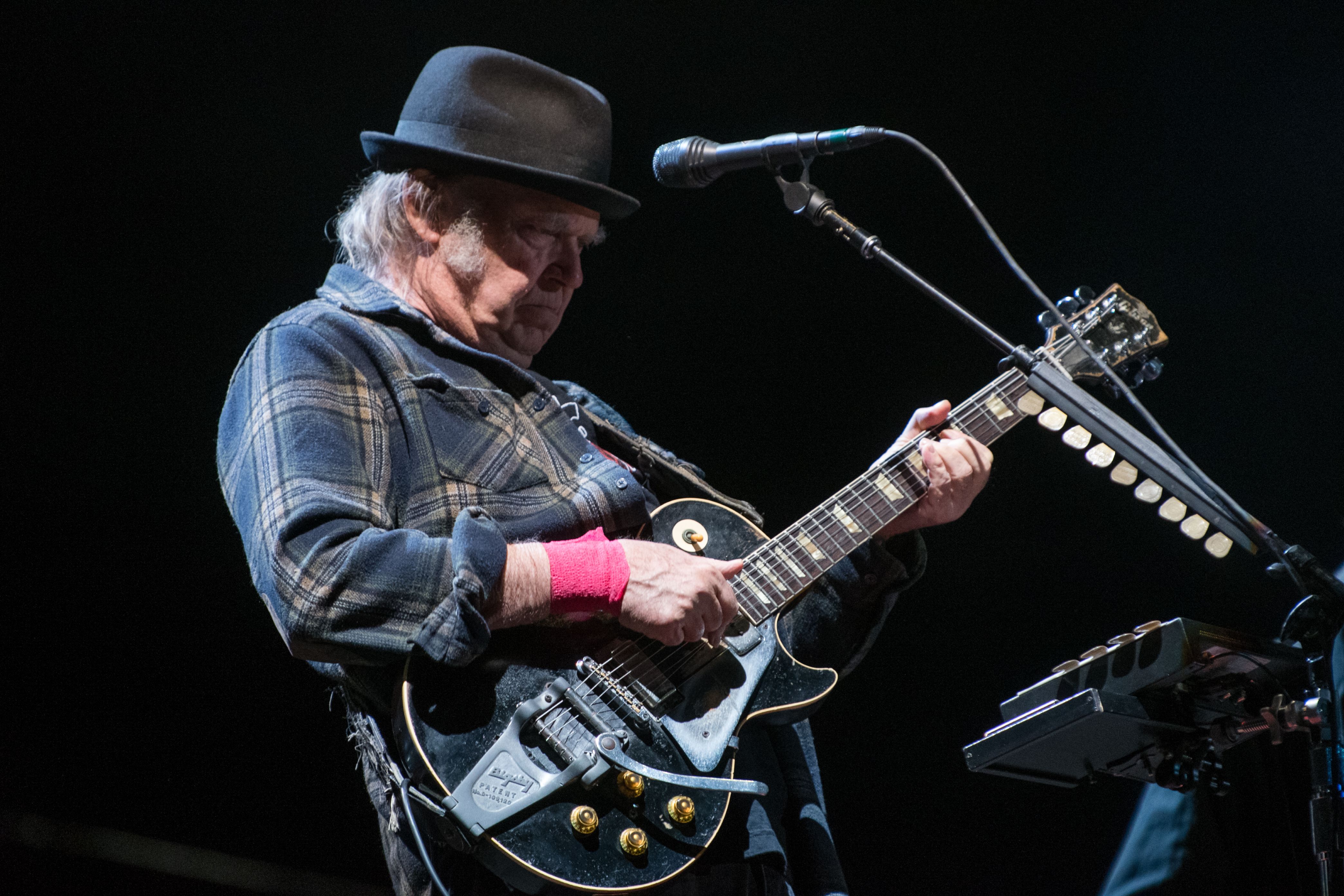

2. Spotify removes Neil Young's music after singer's Joe Rogan objections

Spotify on Wednesday removed Neil Young's music from its streaming service after he posted a letter on his website saying he would not allow his catalog on the same platform as podcast host Joe Rogan's "fake information" about coronavirus vaccines. "They can have Rogan or Young. Not both," Young said in the letter to his manager and record label. He said people spreading bogus information about vaccines could be killing people who believe it. Rogan, who hosts one of the most popular podcasts on Spotify, has faced frequent criticism for his statements on the pandemic, including that healthy young people shouldn't get vaccinated. "We regret Neil's decision to remove his music from Spotify, but hope to welcome him back soon," a Spotify spokesperson told The Washington Post.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Tesla beats expectations but said supply-chain problems persist

Tesla on Wednesday reported fourth-quarter results that beat analysts' expectations, but its shares struggled in extended trading after the electric-car maker said supply-chain problems could continue through 2022. The stock fell by as much as 5 percent before climbing back into positive territory. Tesla reported quarterly earnings of $2.52 per share, beating expectations of $2.36 per share among analysts surveyed by Refinitiv. Revenue came in at $17.72 billion, compared to expectations of $16.57 billion. Overall revenue was up by 65 percent compared to the same period a year earlier. Energy generation and storage revenue was down by 8 percent, but automotive revenue reached $15.97 billion, up 71 percent.

4. Boeing reports 3rd straight annual loss

Boeing on Wednesday reported its third straight annual loss, and said 787 Dreamliner jet production problems and delivery delays would cost it another $4.5 billion. Factory defects and regulatory issues have slowed Dreamliner deliveries for more than a year. Boeing said it lost $4.3 billion in 2021, including 4.16 billion in the last quarter of the year. Boeing's troubles came as airlines struggle to recover from damage caused by travel restrictions and other problems caused by the coronavirus pandemic. Boeing CEO David Calhoun said 2021 was a "rebuilding year for us." The aircraft maker said it expects to resolve the problems this year, and increase deliveries of 737 MAX and Dreamliner jets. Boeing shares rose 2 percent overnight.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures mixed after Fed remarks

Stock futures rose slightly early Thursday following the Federal Reserve's statement indicating a likely interest rate hike in March. Futures tied to the Dow Jones Industrial Average were down by 0.1 percent at 6:45 a.m. ET, after climbing back from a sharp decline. Futures for the S&P 500 stayed flat, while those of the Nasdaq were up by 0.1 percent. The Fed's statement at the end of its two-day meeting was expected, but Chair Jerome Powell rattled markets when he said that the central bank had "quite a bit of room" to raise rates to fight high inflation before negatively affecting employment. Stocks struggled and the benchmark 10-year Treasury yield rose above 1.8 percent after Powell's remark, as traders priced in five quarter-percentage-point interest-rate hikes this year.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Buffett: The end of a golden era for Berkshire Hathaway

Buffett: The end of a golden era for Berkshire HathawayFeature After 60 years, the Oracle of Omaha retires

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

SiriusXM hopes a new Howard Stern deal can turn its fortunes around

SiriusXM hopes a new Howard Stern deal can turn its fortunes aroundThe Explainer The company has been steadily losing subscribers

-

How will the Warner Bros. bidding war affect the entertainment industry?

How will the Warner Bros. bidding war affect the entertainment industry?Today’s Big Question Both Netflix and Paramount are trying to purchase the company

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

How could worsening consumer sentiment affect the economy?

How could worsening consumer sentiment affect the economy?Today’s Big Question Sentiment dropped this month to a near-record low