The daily business briefing: May 27, 2022

Macy's and Dollar Tree report strong sales despite inflation, Broadcom agrees to acquire VMware in potential $61 billion deal, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Macy's, Dollar Tree report strong sales

Shares of major retailers surged on Thursday after Macy's and Dollar Tree reported strong quarterly sales despite high inflation. Shoppers increased spending on clothes for work and special occasions, and bought necessities at discount stores to save as fuel and food costs jumped. Dollar General reported flat sales but raised its full-year outlook. Shares of Dollar General and Dollar Tree jumped 14 percent and 22 percent, respectively. Retailers said despite the strong quarter, rising prices remained a growing threat. "Consumers are still spending, but headwinds are getting increasingly fierce," Macy's Chief Executive Jeff Gennette told The Wall Street Journal.

2. Broadcom agrees to buy VMware in $61 billion deal

Semiconductor maker Broadcom announced Thursday it has agreed to buy the software company VMware. The $61 billion deal would be the world's second-biggest proposed acquisition of the year behind Microsoft's $75 billion offer for video game maker Activision Blizzard, according to Dealogic data. Buying VMware would give Broadcom computing tools popular with many corporations, and give it a strong position in data-center and cloud computing technology. VMware has more than 500,000 global customers, including cloud-computing giants Amazon, Microsoft, and Google.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Stock futures rise as Wall Street aims to break losing streak

Stock futures rose early Friday as all three of the main U.S. indexes remained on track to finish the week with gains, aiming to break a seven-week losing streak. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up 0.1 percent and 0.3 percent, respectively, at 6:30 a.m. ET. Nasdaq futures were up 0.5 percent. The Dow and the S&P 500 were up 4.4 percent and 4 percent on the week as of Thursday's close, after jumping 1.6 percent and 2 percent, respectively, on Thursday. The tech-heavy Nasdaq surged by 2.7 percent and was up 3.4 percent on the week, although it's still 27.6 percent below its record high. The S&P 500 is 15.8 percent below its record.

4. N.Y. court denies Trump appeal to avoid testimony on business

A New York state appeals court ruled Thursday that former President Donald Trump and two of his adult children, Donald Trump Jr. and Ivanka Trump, must submit to questioning under oath as part of a civil investigation into their business practices. Trump's lawyers had sought to block the testimony, arguing that the investigation being conducted by New York Attorney General Letitia James' office was politically motivated. Trump's legal team also said he and his children shouldn't have to talk to James' investigators because the operations of the family property business, the Trump Organization, also are the subject of a criminal investigation. The court found that the Trumps are not being unfairly singled out.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Home supply rises as owners rush to sell before market cools

The supply of homes for sale increased by 9 percent last week compared to the same time a year ago as sharply higher mortgage rates triggered a sudden drop in home sales, according to Realtor.com. "Rising mortgage rates have caused the housing market to shift, and now home sellers are in a hurry to find a buyer before demand weakens further," said Daryl Fairweather, chief economist at real estate brokerage Redfin. Numerous signs have indicated recently that the market is softening after people seeking more space during the pandemic took advantage of low mortgage rates and drove prices higher. Pending home sales dropped nearly 4 percent in April compared to March.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

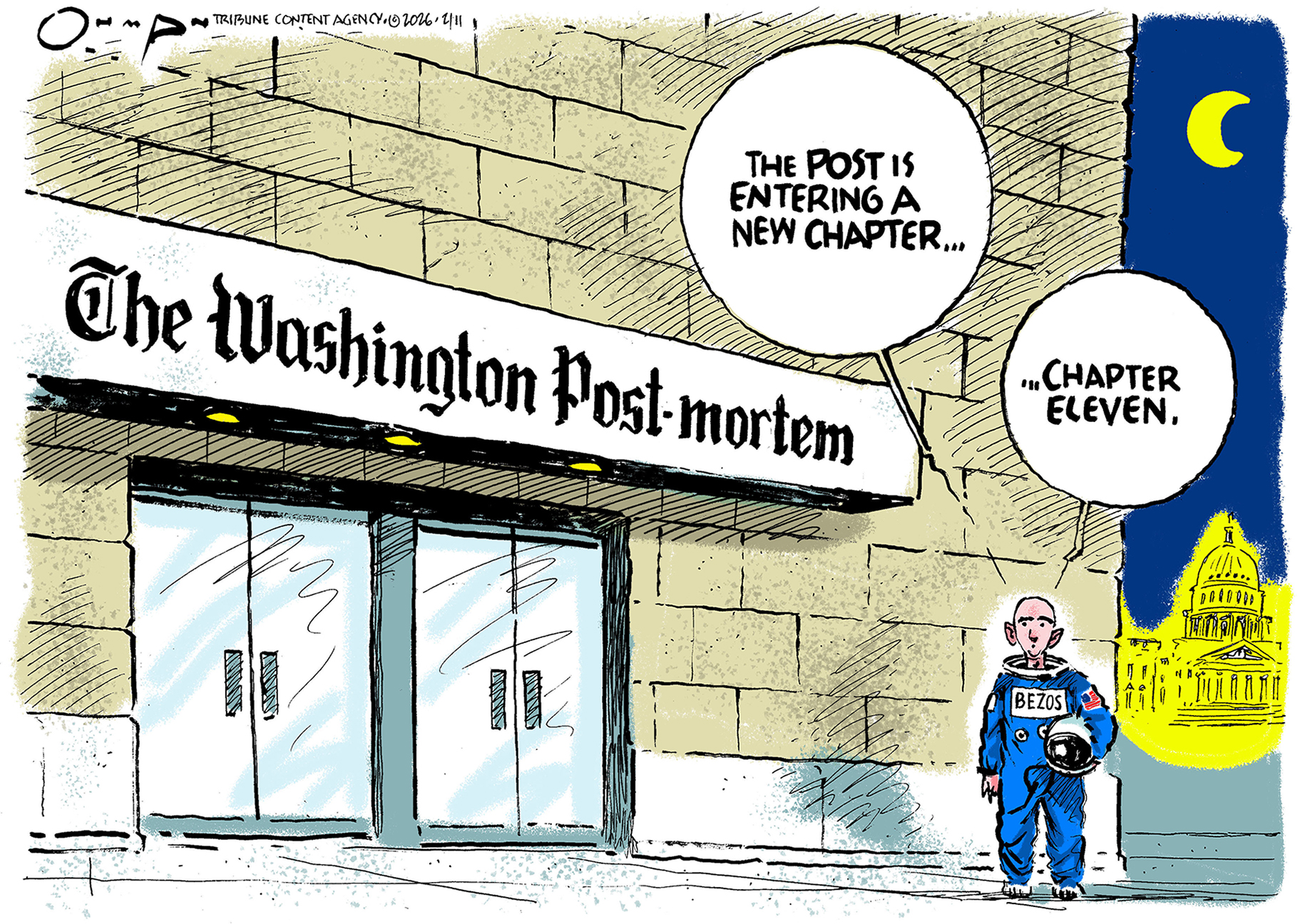

5 calamitous cartoons about the Washington Post layoffs

5 calamitous cartoons about the Washington Post layoffsCartoons Artists take on a new chapter in journalism, democracy in darkness, and more

-

Political cartoons for February 14

Political cartoons for February 14Cartoons Saturday's political cartoons include a Valentine's grift, Hillary on the hook, and more

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more