The daily business briefing: August 10, 2022

Biden signs bill seeking to boost U.S. chip production, Ford says it will start taking F-150 Lightning orders again with a price hike, and more

- 1. Biden signs bill to boost U.S. semiconductor chip production

- 2. Ford to start taking F-150 Lightning orders again, with price hike

- 3. Elon Musk sells $6.9 billion in Tesla stock

- 4. Stock futures rise ahead of report expected to show cooling inflation

- 5. Judge approves Blue Cross Blue Shield antitrust settlement

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

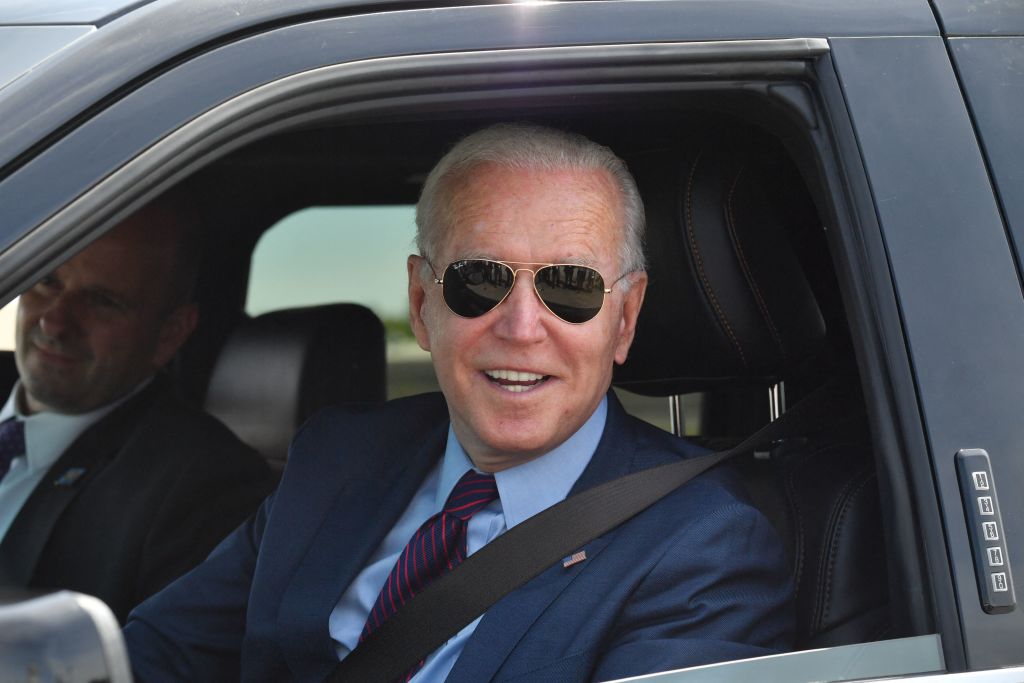

1. Biden signs bill to boost U.S. semiconductor chip production

President Biden on Tuesday signed the CHIPS and Science Act, which seeks to boost U.S. semiconductor chip manufacturing with more than $200 billion in investments over five years. The legislation aims to lower the cost of goods and make the U.S. less dependent on foreign chip makers, which could ease supply-chain disruptions like those triggered by the coronavirus pandemic. Biden called the bipartisan measure a "once-in-a-generation investment in America itself." The White House said earlier this week that companies had committed to nearly $50 billion in new investments in American semiconductor production in response to Congress' recent approval of the bill.

2. Ford to start taking F-150 Lightning orders again, with price hike

Ford Motor Co. says it plans to start taking orders again for its all-electric F-150 Lightning pickup truck this week, with a price hike. The automaker, citing "significant material cost increases and other factors," said the price of the popular base model will rise by $7,000, or 17.5 percent, to $47,000, with higher-end versions increasing by $8,500. Ford started Lightning production in April, and initially capped reservations at 200,000 as it focused on boosting production capacity. Semiconductor chip shortages caused by the coronavirus pandemic have hurt many automakers. The new F-150 Lightnings for the 2023 model year will have a slightly longer battery range, with standard versions getting 240 miles per charge, up from 230.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Elon Musk sells $6.9 billion in Tesla stock

Tesla CEO Elon Musk said Tuesday that he had sold $6.9 billion worth of shares in the electric vehicle maker to raise cash in case he loses a legal fight and is forced to go through with his April deal to buy Twitter for $44 billion. Musk tried to back out of the agreement in July, saying the social media company had misled him about how many of its accounts are fake, and Twitter has sued to force him to complete the deal. "In the (hopefully unlikely) event that Twitter forces this deal to close *and* some equity partners don't come through, it is important to avoid an emergency sale of Tesla stock," Musk tweeted late Tuesday. The case is scheduled for trial in October.

4. Stock futures rise ahead of report expected to show cooling inflation

U.S. stock futures rose slightly early Wednesday ahead of a key inflation report. Futures tied to the Dow Jones Industrial Average, the S&P 500, and the Nasdaq were up just over 0.2 percent at 6:30 a.m. ET. The Dow and the S&P 500 fell 0.2 percent and 0.4 percent, respectively, on Tuesday. The tech-heavy Nasdaq plunged 1.2 percent. Economists expect the latest consumer price index report to show that inflation has cooled slightly thanks to falling gasoline prices. Economists expect the report to show that the consumer price index rose 0.2 percent compared to June, down from a 1.3 percent spike a month earlier. The CPI inflation rate is expected to fall to 8.7 percent from 9.1 percent in June, a 40-year high.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

CNBC Investor's Business Daily

5. Judge approves Blue Cross Blue Shield antitrust settlement

A federal judge on Tuesday approved an antitrust settlement involving Blue Cross Blue Shield companies that calls for the insurers to pay $2.67 billion and change some allegedly anti-competitive practices. The approval by U.S. District Judge R. David Proctor in Alabama puts the settlement on track to take effect in 30 days. A group of employers and individual policyholders with Blue Cross Blue Shield coverage filed the lawsuit as a proposed class action in 2012. The suit accused the Blue Cross Blue Shield providers, which hold rights to the Blue Cross and Blue Shield names within their territory, of unfairly driving up prices by illegally conspiring to carve up markets so they wouldn't have to compete against one another.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more