The daily business briefing: October 4, 2022

The Biden administration prepares more chip restrictions on Chinese firms, Kim Kardashian to pay $1.26 million crypto settlement, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Reports: U.S. preparing new limits on China access to advanced chips

The Biden administration is considering more export controls to restrict Chinese companies' access to high-performance semiconductors, Reuters and The New York Times reported Monday, citing three people briefed on the matter. The Times said the administration could announce the measures as soon as this week. In recent weeks, the Biden administration has placed restrictions on exporting U.S. chips used for artificial intelligence applications, as well as equipment used to make them. The new rules would target high-end memory-chip manufacturing capabilities and advanced quantum computing, the latest moves "aimed at hobbling Beijing's ambitions to craft next-generation weapons and automate large-scale surveillance systems," according to the Times.

2. Kim Kardashian to pay $1.26 million to settle crypto charges

The Securities and Exchange Commission announced Monday that reality TV star Kim Kardashian would pay $1.26 million to settle charges that she recommended her 330 million Instagram followers buy a crypto security without revealing she was paid to pitch it. The penalty includes a $1 million fine and the forfeiture of $250,000, plus interest, that Kardashian was paid to make the post about Ethereum Max tokens. Kardashian is the latest celebrity penalized for failing to abide by regulations requiring full disclosure from people promoting financial products. As part of the settlement, Kardashian is barred from promoting financial products for three years. Actor Steven Seagal agreed to a similar ban and a $300,000 payment as part of an SEC settlement in 2020.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Trump sues CNN for defamation

Former President Donald Trump on Monday filed a defamation lawsuit against CNN, accusing the network of conducting a "campaign of libel and slander" against him and seeking $475 million in damages. The lawsuit, filed in federal court in Fort Lauderdale, Florida, focuses largely on CNN's use of the term "The Big Lie" to refer to Trump's false claims that the 2020 election was stolen from him through widespread fraud benefiting President Biden. Trump claims CNN used the phrase, which has Nazi connotations, to "aggravate, scare, and trigger people." He alleges that the network has tried to "tilt the political balance to the left," and to "taint" Trump with "a series of ever-more scandalous, false, and defamatory labels of 'racist,' 'Russian lackey,' 'insurrectionist,' and ultimately 'Hitler.'" CNN did not immediately comment.

4. Futures rise after Monday's relief rally

Stock futures jumped early Tuesday after the Dow Jones Industrial Average kicked off October trading with a gain of 768 points, or 2.7 percent, on Monday. Futures tied to the Dow were up were up 1.6 percent at 6:45 a.m. ET. Futures tied to the S&P 500 and the Nasdaq were up 1.9 percent and 2.3 percent, respectively. Monday's rally followed big losses in September, the worst month since March 2020 for the Dow and the S&P 500. Stocks have struggled in recent weeks due to concerns that the Federal Reserve's aggressive interest rate hikes, designed to fight high inflation, could tip the economy into a recession. "There was a relief rally," said Jon Maier, chief investment officer at Global X ETFs. "I don't think one day of relief changes the story."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Credit Suisse shares rattled by concerns over turnaround prospects

Credit Suisse shares dropped by as much as 11.5 percent on Monday before recovering some of the losses. Rumors among traders that the firm might not have enough cash to deal with a crisis sent Credit Suisse's credit default swaps — a key measure of a company's perceived financial health — surging to a record high. Credit Suisse said in a talking point given to executives that "speculating that we have a liquidity issue simply would be completely false." Some analysts said the turmoil stemmed partly from investor concerns that the bank might not be able to pull off its turnaround strategy, which it is scheduled to reveal on Oct. 27.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

El Paso airspace closure tied to FAA-Pentagon standoff

El Paso airspace closure tied to FAA-Pentagon standoffSpeed Read The closure in the Texas border city stemmed from disagreements between the Federal Aviation Administration and Pentagon officials over drone-related tests

-

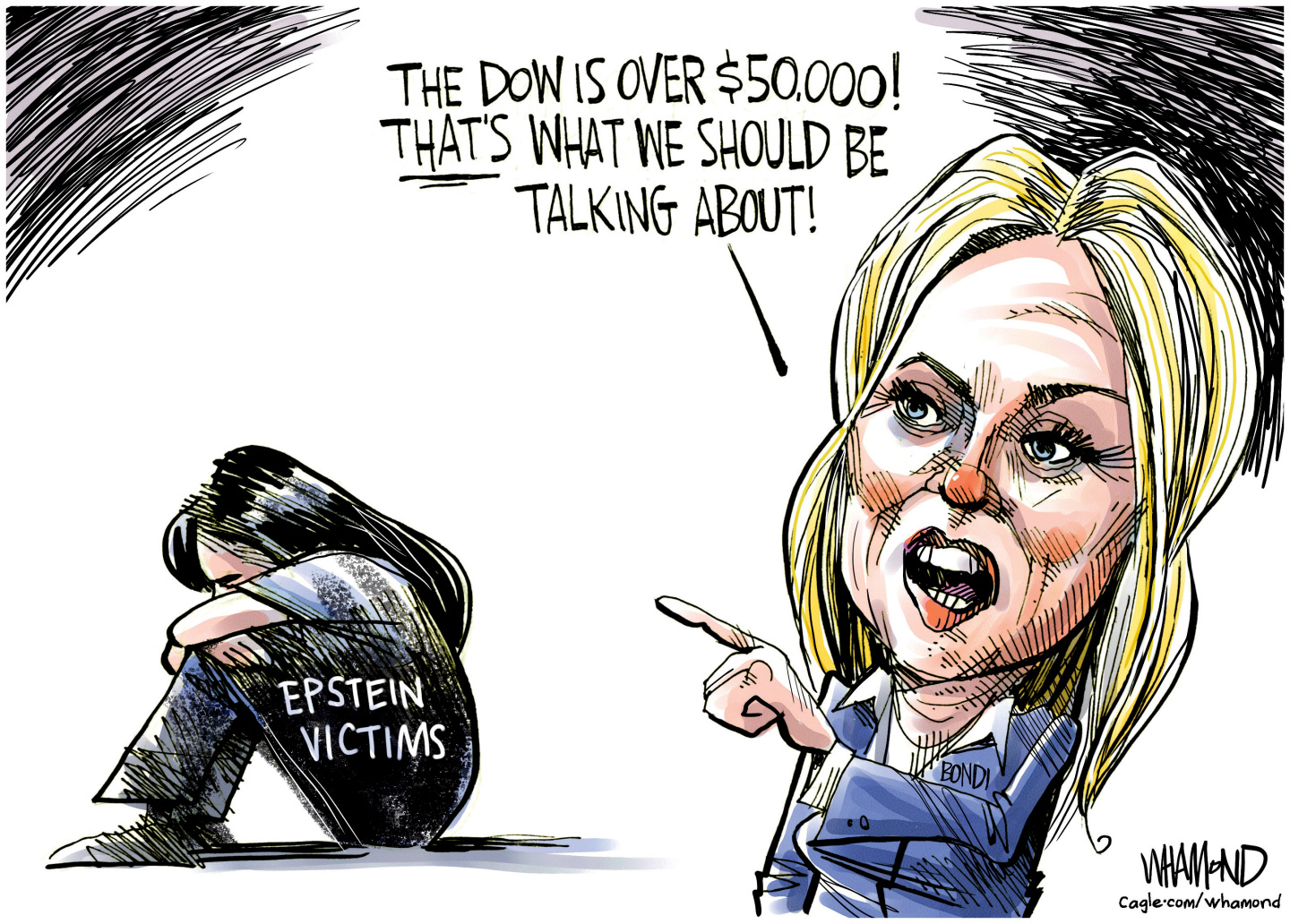

Political cartoons for February 12

Political cartoons for February 12Cartoons Thursday's political cartoons include a Pam Bondi performance, Ghislaine Maxwell on tour, and ICE detention facilities

-

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ return

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ returnThe Week Recommends Carrie Cracknell’s revival at the Old Vic ‘grips like a thriller’

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more