The daily business briefing: November 18, 2022

Hundreds of Twitter employees leave after Musk's ultimatum, Ticketmaster cancels ticket sales for Taylor Swift's tour, and more

- 1. Engineer exodus after Musk ultimatum leaves Twitter on brink

- 2. Ticketmaster cancels sales for Taylor Swift's U.S. tour

- 3. Mortgage rates take biggest weekly dive in decades

- 4. New FTX CEO describes 'complete failure' of controls at crypto firm

- 5. Stock futures rise after two days of losses

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Engineer exodus after Musk ultimatum leaves Twitter on brink

Hundreds of Twitter employees resigned Thursday before a 5 p.m. deadline Elon Musk had given for people to decide whether to leave or sign a pledge to work "long hours" at a new, "hardcore" version of the social media company. More key engineers left than anticipated, which one employee said could cause the system to "stop" if it hits a problem, The Washington Post reported. Musk, who last month completed his $44 billion deal to acquire Twitter, and some of his advisers met with some "critical" employees, hoping to get them to stay, The New York Times reported, citing four people with knowledge of the discussions. Musk earlier laid off half of the company's staff and fired internal critics.

The Washington Post The New York Times

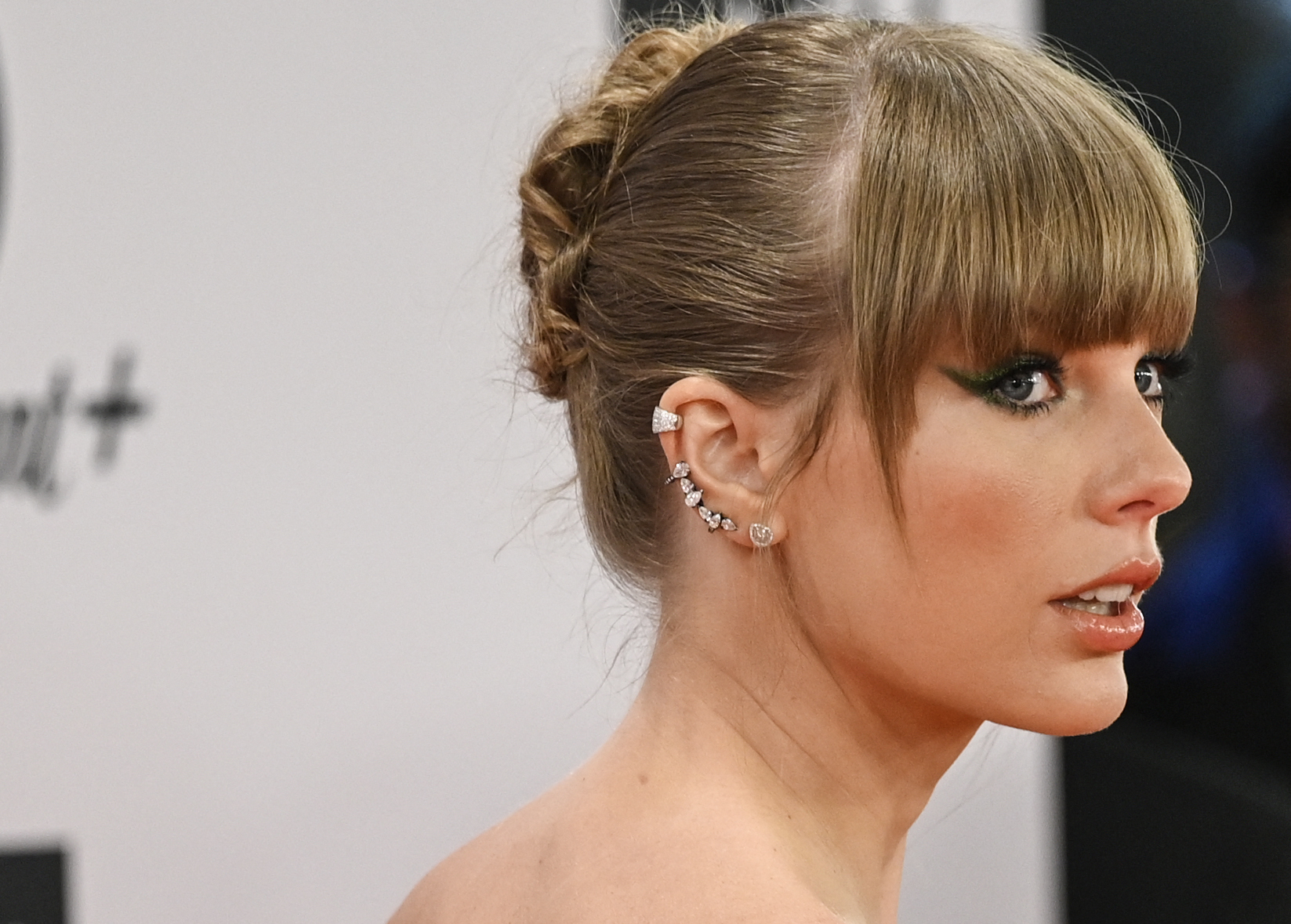

2. Ticketmaster cancels sales for Taylor Swift's U.S. tour

Ticketmaster said in a Thursday tweet that it was canceling Friday's public ticket sales for singer Taylor Swift's U.S. tour, citing "extraordinarily high demands on ticketing systems and insufficient remaining ticket inventory." The move came after fans complained earlier in the week that the company's website crashed after Swift's Eras tour in the United States opened Tuesday. Fans swamped the Ticketmaster website, resulting in long waits. Many never managed to get tickets for the tour, Swift's first in five years. The troubles came as Sen. Amy Klobuchar (D-Minn.), chair of the Senate antitrust committee, sent Ticketmaster parent Live Nation Entertainment a letter expressing "serious concern" that the company's industry dominance could be hurting consumers.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Mortgage rates take biggest weekly dive in decades

Mortgage rates fell over the past week in their largest weekly decline since 1981 as recent economic reports suggested inflation might have peaked and started easing. The rate for the popular 30-year fixed-rate mortgage averaged 6.61 percent in the week that ended Nov. 17, down from 7.08 percent the previous week, according to Freddie Mac. The rate was 3.10 percent a year ago. "While the decline in mortgage rates is welcome news, there is still a long road ahead for the housing market," said Sam Khater, Freddie Mac's chief economist. "Inflation remains elevated, the Federal Reserve is likely to keep interest rates high and consumers will continue to feel the impact."

4. New FTX CEO describes 'complete failure' of controls at crypto firm

John Ray III, the new CEO appointed to lead collapsed cryptocurrency firm FTX through bankruptcy, said he found evidence of improper fund transfers and a "complete failure" of corporate control. "From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated, and potentially compromised individuals, this situation is unprecedented," said Ray, who has been a bankruptcy specialist for 40 years, and cleaned up Enron. The problems included the use of business funds to buy employees homes. The crypto exchange platform collapsed after founder Sam Bankman-Fried used $10 billion in client funds to prop up his hedge fund, Alameda Research.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures rise after two days of losses

U.S. stock futures rose early Friday, rebounding after two days of losses. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up 0.4 percent and 0.8 percent, respectively, at 6:30 a.m. ET. Nasdaq futures were up 0.8 percent. Gap stock gained about 7 percent after the clothing retailer reported an unexpected profit. The Dow was little changed on Thursday; the S&P 500 and the Nasdaq fell 0.3 percent and 0.4 percent, respectively, after St. Louis Federal Reserve President James Bullard said interest rates were "not yet in a zone that may be considered sufficiently restrictive" to bring down high inflation, suggesting the central bank had a way to go before ending its aggressive rate hikes.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.