The daily business briefing: May 11, 2023

Inflation falls to the lowest level in two years, Alphabet shares gain as Google unveils new AI products, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Inflation unexpectedly eases to lowest level in 2 years

Inflation edged down to an annual rate of 4.9 percent in April from 5.0 percent in March in the 10th straight decline, the Bureau of Labor Statistics reported Wednesday. The consumer price index rose 0.4 percent from the previous month. The increase was slightly lower than economists expected, nudging the annual rate to the lowest level in two years. Inflation has fallen dramatically since peaking at 9.1 percent last summer, but it remains significantly above the Federal Reserve's 2 percent target rate. Some pressures have eased, like the surge in energy prices after Russia invaded Ukraine. But rising rents and car prices are still hurting American households. "It's going to be a bumpy ride back down to 2 percent," Vanguard international economist Andrew Patterson said.

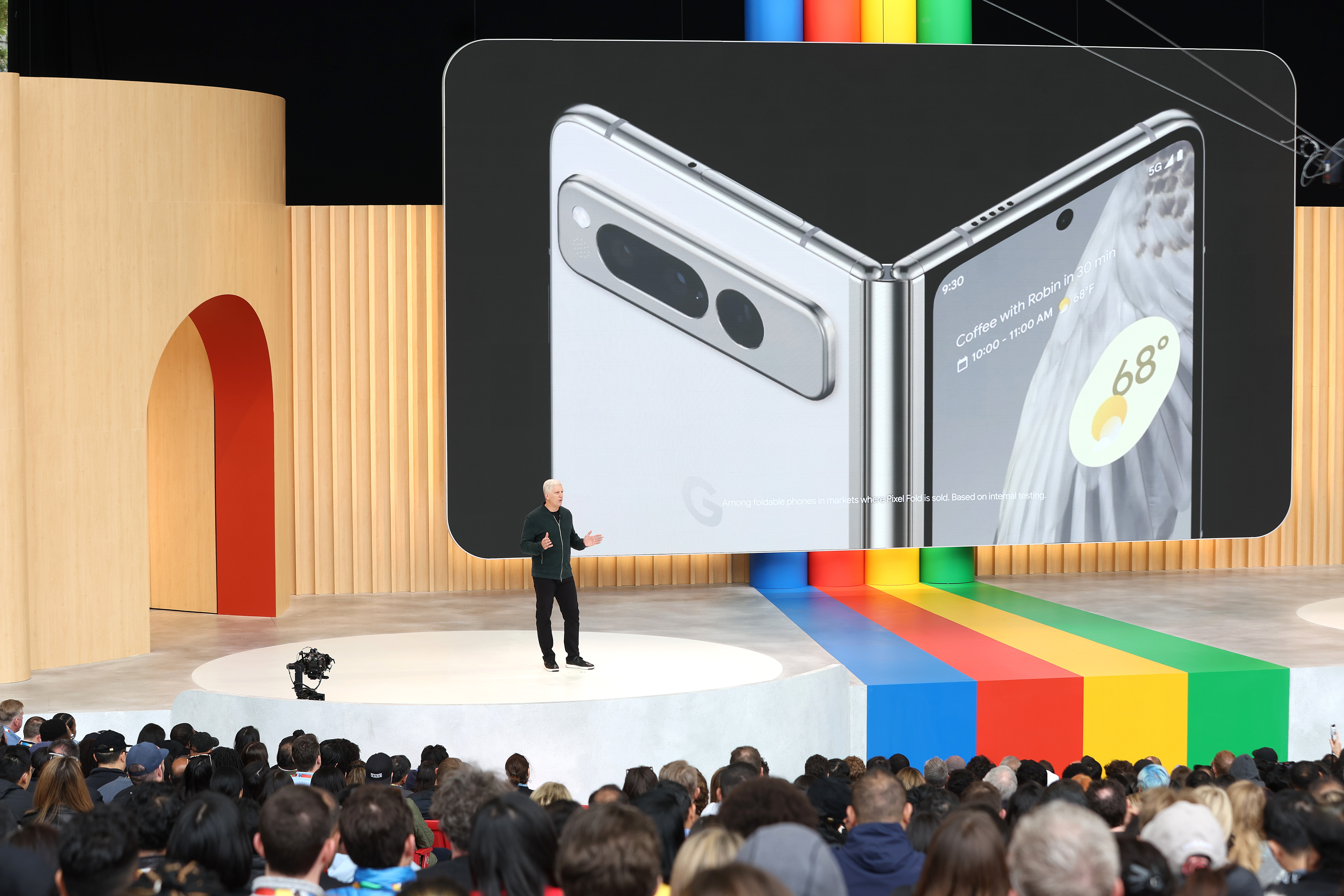

2. Alphabet shares rise after Google unveils new AI products

Google-parent Alphabet's shares gained more than 4 percent on Wednesday as Google unveiled conversational search-engine features and broadened availability of its Bard chatbot. Google, which is racing against Microsoft and other companies to woo users seeking artificial-intelligence tools, introduced Search Generative Experience features using AI programs to let users get lengthier query responses by asking follow-up questions, essentially holding a conversation with the search engine. Google didn't launch the product immediately, but opened a wait list under its new Search Labs program. "Looking ahead, making AI helpful for everyone is the most profound way we'll advance our mission," Google CEO Sundar Pichai said.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. EPA proposes tighter limits on power plant emissions

The Environmental Protection Agency on Thursday proposed new requirements that would force U.S. coal plants and the largest gas-fired facilities to contain nearly all of their carbon dioxide emissions. The proposed limits are the latest in a series of moves aiming to reduce pollution that is contributing to potentially catastrophic climate change. Utilities would have years — more than a decade, in some cases — to comply. The flexibility could help ensure power grids can meet demand in peak periods, and help the restrictions survive legal challenges. "We created a system that gives a ton of flexibility so that the power sector can make individual decisions based on available technology and the resources that they want to expend," EPA Administrator Michael Regan said.

4. Stock futures rise ahead of April producer price index

U.S. stock futures gained slightly early Thursday ahead of more inflation data after the consumer price index fell, bringing inflation to its lowest level in two years. Futures tied to the Dow Jones Industrial Average were flat at 7 a.m. ET, but S&P 500 and Nasdaq futures were up 0.2 percent. Economists polled by Dow Jones expect the producer price index scheduled to be released Thursday to show an increase of 0.3 percent in April. The Labor Department reported Wednesday that the consumer price index rose by 4.9 percent last month compared to a year earlier, slightly less than expected. Wall Street was mixed on Wednesday, with the Dow closing slightly lower but the tech-heavy Nasdaq and the S&P 500 rising 1 percent and 0.5 percent, respectively.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Disney reports streaming losses but strong theme park revenue

Disney on Wednesday reported quarterly earnings that fell just short of expectations as its Disney+ streaming service struggled as price hikes hurt subscriber numbers. Streaming losses narrowed to $659 million, better than the $850 million loss analysts expected. The entertainment giant's theme park division reported strong attendance that helped increase its profits by 20 percent to $2.2 billion. Disney CEO Bob Iger stepped up pushback against Florida Gov. Ron DeSantis. The company has accused DeSantis of "weaponizing" state government to retaliate against Disney for opposing Republicans' Parental Rights in Education legislation — the "don't say gay" law to its critics. "Does the state want us to invest more, employ more people and pay more taxes, or not?" Iger asked.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.