The daily business briefing: June 15, 2023

The Fed pauses interest rate hikes but signals more to come, E.U. antitrust regulators call for breaking up Google's ad business, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

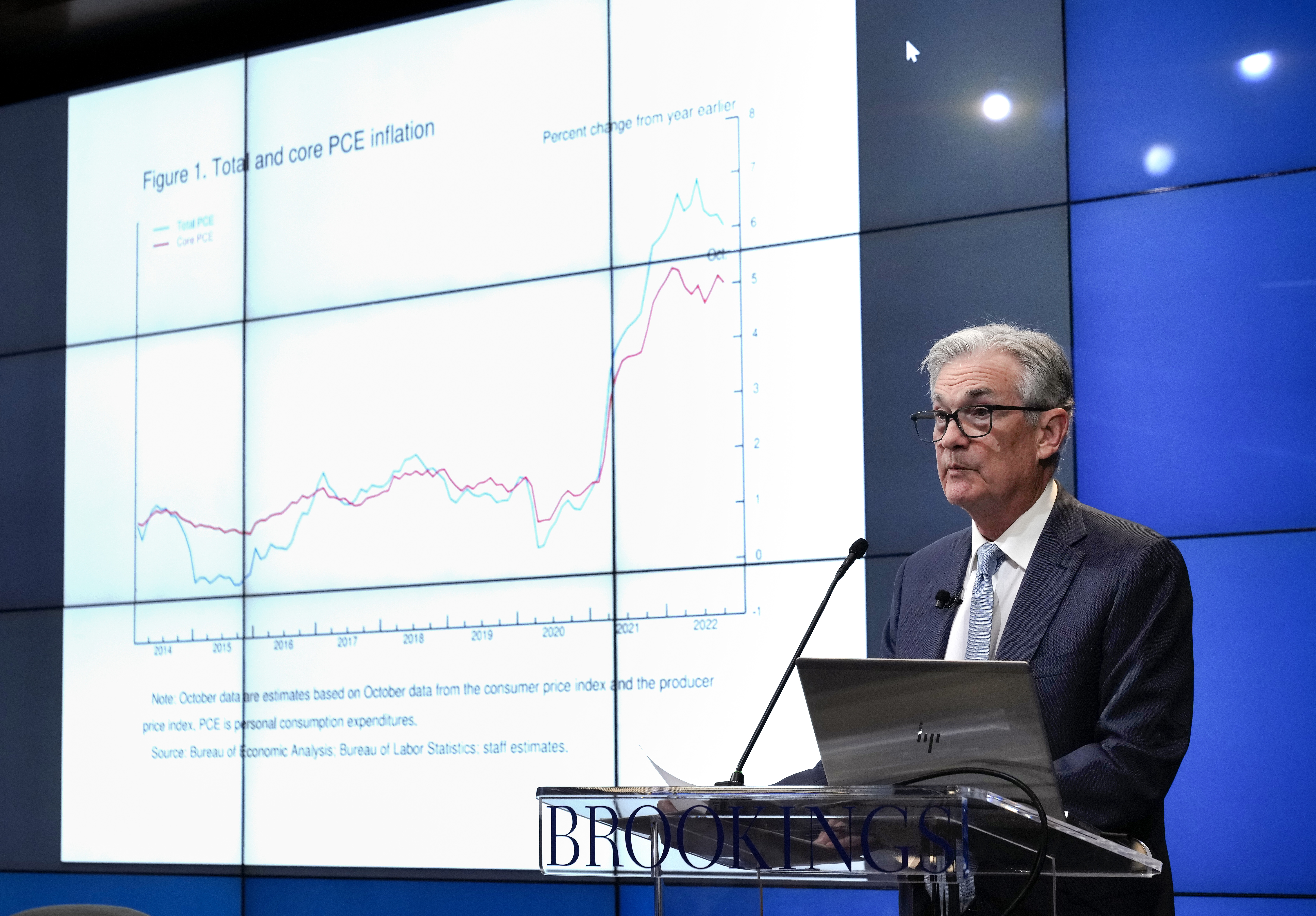

1. Fed pauses interest rate hikes, for now

The Federal Reserve on Wednesday paused its aggressive campaign to raise interest rates — but indicated it's likely to raise rates two more times this year to continue fighting high inflation. The decision leaves the Fed's benchmark short-term lending rate at 5.1%, its highest level in 16 years. The central bank's leaders said the pause will give them time to determine how the higher borrowing costs have affected the economy. The Fed hiked rates at its last 10 meetings. Data have shown that the economy remains stronger than expected. Inflation has fallen steadily, meanwhile, but not as sharply as hoped, and remains near 5%, excluding volatile food and energy costs, far above the Fed's 2% target.

2. E.U. antitrust regulators push for breakup of Google ad business

European Union regulators on Wednesday accused Google of abusing its dominant position in online ad sales to favor its own services and hurt competitors. In their preliminary finding, E.U. competition regulators want Google to sell off part of its online advertising business to reduce anti-competition concerns. Google's vice president of global ads, Dan Taylor, responded in a blog post, saying the E.U. complaints are "not new" and only involve a "narrow part of our advertising business." The E.U. case came as Google faces antitrust challenges from regulators around the world, including in the United States. It's also part of a broad campaign by European authorities to check the power of U.S. tech giants.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Washington Post Fox Business

3. China's economic recovery sputtered in May

China's industrial output and retail sales growth fell short of expectations in May. Industrial output grew 3.5% in May compared to the same month last year, down from a 5.6% increase in April, Beijing's National Bureau of Statistics said Thursday. Analysts polled by Reuters had expected 3.6% growth. The slowdown increased expectations that Beijing would take more steps to stimulate its pandemic recovery. China's economy bounced back earlier this year after it abruptly lifted restrictions it had imposed to limit the spread of Covid-19, but the momentum fizzled in the second quarter. "The post-Covid recovery appears to have run its course, an economic double dip is nearly confirmed," analysts at Nomura said in a research note.

4. Stock futures slip after Fed meeting

U.S. stock futures fell early Thursday after the Federal Reserve paused its aggressive interest rate hikes Wednesday but said it could have to raise rates later this year to continue fighting high inflation. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down 0.2% and 0.4%, respectively, at 6:45 a.m. ET. Nasdaq futures were down 0.7%. Fed Chair Jerome Powell's indication after the central bank's two-day policy meeting that more hikes would be necessary later this year "indicated more hawkishness than expected," and that "shocked markets," said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. Stocks fell initially but recovered. The Dow closed down 0.7% Wednesday, but the S&P 500 and the Nasdaq closed up 0.1% and 0.4%, respectively.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Mexico's Modelo dethrones Bud Light as top-selling U.S. beer

Mexican-made Modelo Especial passed Bud Light to become the top-selling beer in the U.S. in the four weeks that ended June 3, according to Nielsen IQ data analyzed by the consulting firm Bump Williams. Modelo, sold by Constellation Brands, accounted for 8.4% of U.S. retail beer sales in May, while Bud Light fell to 7.3% as it faced a conservative-led boycott. Bud Light, still the leading beer in the first half of 2023, has seen its share of sales fall 3% since the boycott started in April after Dylan Mulvaney, a transgender influencer, posted an Instagram video promoting a Bud Light contest. Modelo Especial also got a bump from last month's Cinco de Mayo holiday.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more