To good wealth: why wine could be a tempting alternative investment

Fine wine is less susceptible to changes in inflation than many other financial assets

The return of inflation presents investors with a very real problem. In the UK, inflation reached 5.4% in December, its highest level for 30 years, and that rate is expected to accelerate over the months to come. Similar pressures are being felt in economies across Europe and in North America.

So how do investors protect their wealth from the erosion in value that inflation inevitably causes? For many investors, the answer is increasingly to turn to alternative assets such as fine wine. With interest rates stuck at historically low levels, and amid nervousness about the prospects for traditional assets such as shares and bonds, they are looking to reduce risk through diversification – to spread their bets. Research published by Connection Capital suggests more than two-thirds of high net-worth investors now dedicate more than 10% of their portfolios to alternative assets – with 30% expecting to increase such holdings.

The allure of wine

Wine, in particular, has a strong track record of providing inflation protection.Between its launch in 2004 and the end of last year, the Liv-ex 1000 index, the broadest measure of the performance of the fine wine market, delivered a total return of 339.3% [Liv-ex 1000 +339.3% 31/12/2003-31/01/2022 www.liv-ex.com]. And last year, as inflation spiked higher, so did the wine market – the Liv-ex 1000 rose 19.08% in 2021. [Liv-ex 1000 +19.08% 31/12/2020-31/12/2021 www.liv-ex.com]

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The allure of wine during a period of high inflation is similar to the attractions of gold, often seen as a good store of value when prices are rising. Like the precious metal, wine is a physical asset – something real, rather than an artificial financial construct. And like gold, supplies of wine – particularly fine wine – are limited. In fact, wine’s performance track record in recent years is superior to that of gold. [Liv-ex +22.5% 01/31/2021-01/31/2022 www.liv-ex.com; Gold -2.69 01/31/2021-01/31/2022 www.investing.com]

Over the past 10 years, a case of wines tracked by the fine wine broker Cult Wine Investment is up 59% compared to an increase of 17% from gold over the same period. Over the past 10 years, volatility in the gold market – the extent to which returns have varied month by month – has been 14.56%. Wine, by contrast, has an annualised volatility of 3.88% over the same period. [31/01/2012-31/01/2022. Gold prices calculated in USD; source: goldprice.org. Wine prices based on Liv-ex 1000, calculated in GBP. Performance may vary in other currencies. Source: Liv-ex.]

A growing appeal

Tom Gearing, CEO and founder of Cult Wine Investment, believes these attributes are set to capture more attention as concern about the economic backdrop rises further. “Inflation hit multi-year highs in several major economies in late 2021 and looks set to accelerate in the first half of 2022; this is causing more uncertainty in financial markets as central bank policy could shift faster than expected,” Gearing argues. “As a physical ‘passion asset’, the primary drivers of fine wine prices are internal factors, namely limited supply and persistent demand through different macro backdrops.

Fine wine is therefore less susceptible to changes in inflation or policy than many other financial assets.” While many investors may lack experience of investing in wine, the market is more accessible than they may realise. Companies such as Cult Wine Investment offer a portfolio approach with minimum investments starting at £10,000. The idea is that the Portfolio Managers builds a portfolio of wines on behalf of the investor, with a mix designed to reflect the appetite for risk and time horizons of the investor. While the investor owns their wine, the company takes responsibility for storing and insuring the bottles, which is important to protect their value.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Investors pay an annual management fee for these services. Effectively, they are paying for proper storage and insurance as well as the experience and expertise of the company as it builds the portfolio – wine is a specialist investment – as well as for practical support. The most comprehensive wealth management companies offer services such as online portals that enable investors to track how their wine is performing on a day-to-day basis. Wine is also a relatively liquid investment – no pun intended – with a lively secondary market that permits the selling of portfolios reasonably quickly. Cult Wine Investment says, for example, that a typical portfolio would take 10 weeks to sell in its entirety.

Nevertheless, investors do need to take care. It is important to understand that alternative assets, including fine wine, are not regulated by the Financial Conduct Authority, the chief City watchdog. And prices do fall as well as rise. While wine does offer an opportunity for portfolio diversification, investors need to be aware of the risk that their holdings could lose money. And it is vital to deal only with reputable companies.

Still, with inflation fears set to persist as the global economy continues to recover from the impacts of the Covid-19 pandemic – and supply chains remain disrupted – all investors should be thinking about how to protect their wealth in 2022 and beyond. For many, wine offers a different approach to fixed-income assets and shares, where there are genuine concerns about the potential for market setbacks.

Visit wineinvestment.com to find out more. Past performance is not indicative of future results

-

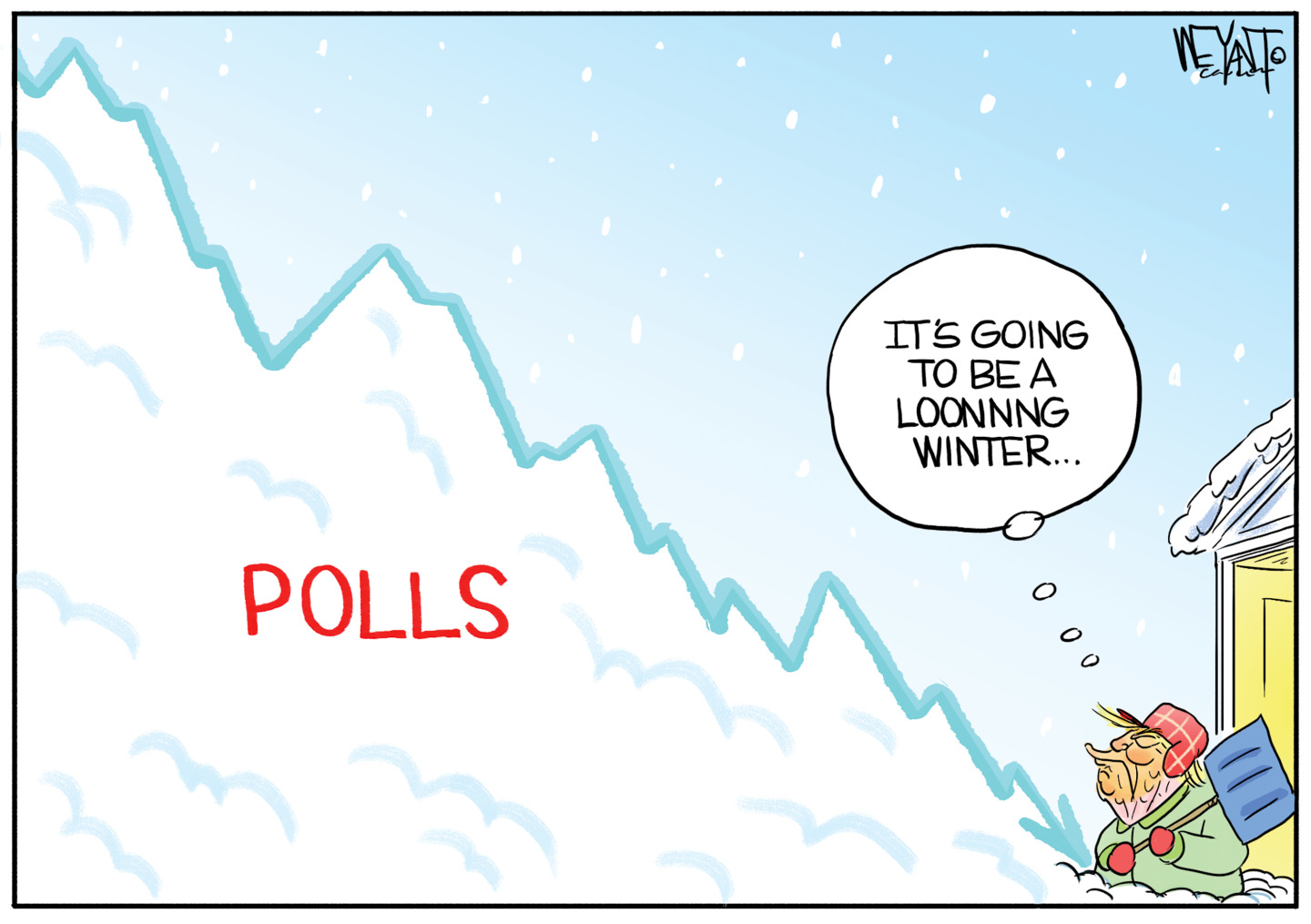

Political cartoons for February 28

Political cartoons for February 28Cartoons Saturday’s political cartoons include Trump's falling ratings, Dems' croaking, and Olympic hockey

-

Andrew Mountbatten-Windsor: ‘author of his own misfortunes’

Andrew Mountbatten-Windsor: ‘author of his own misfortunes’In The Spotlight Warning signs about the former prince’s profligacy and poor judgment predate Epstein associations

-

5 supremely funny cartoons about the Supreme Court striking down Trump’s tariffs

5 supremely funny cartoons about the Supreme Court striking down Trump’s tariffsCartoons Artists take on consent, icebergs, and more

-

Nine financial and retirement solutions to support your plans for the future

Nine financial and retirement solutions to support your plans for the futurefeature These companies could help boost your earnings while easing you into your golden years

-

A world of choice in uncertain markets

A world of choice in uncertain marketsfeature Why a globally diversified basket of equities might be worth the risk over the long term

-

UK cost of living crisis: what will increase in price from April?

UK cost of living crisis: what will increase in price from April?feature The new tax year will see a rise in outgoings for millions of households