Mark Carney steps in to cool house prices

Bank of England governor Mark Carney announces caps on high-risk mortgage lending

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Mark Carney has stepped in to cap mortgages and restrain the housing market amid concerns that house price rises could derail Britain's economic recovery.

The Governor of the Bank of England introduced a raft of new measures to limit riskier mortgages and "prevent a build-up of consumer debt", Bloomberg reports.

Under the new rules, loans of 4.5 times the borrower's income or more will be limited to no more than 15 per cent of a bank's mortgage book. Currently 11 per cent of loans exceed that earnings multiple, more than at any time in history, The Times says.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Carney told reporters that the mortgage caps would help cement the country's economic recovery. "With recovery in the UK gaining momentum, the Bank of England is now focused on turning that recovery in to a durable expansion," he said.

Britain has a long legacy of indebtedness that "if left unchecked could undermine that durability", he said. "The biggest risks relate to the housing market."

But Carney insisted that the new measures would not harm individuals' chances of getting on to the housing ladder."These actions will have a minimal impact in the future if – and it's an important if – if the housing market evolves in line with the Bank's central view," Carney said.

"The 15 per cent cap... could quickly become relevant if house prices grow more than we expect, if incomes grow less rapidly than we expect, or if underwriting standards slip."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The BBC's economics editor Robert Peston said that such "modest constraints" will have little effect. "It is highly unlikely that these will have any significant impact on the health of the housing market in any part of the UK, including the booming markets in London and the South East," Peston said.

Rather, Peston concluded, the changes seem to be " an insurance policy" to prevent banks from becoming "much more reckless" in the years ahead.

-

Political cartoons for February 22

Political cartoons for February 22Cartoons Sunday’s political cartoons include Black history month, bloodsuckers, and more

-

The mystery of flight MH370

The mystery of flight MH370The Explainer In 2014, the passenger plane vanished without trace. Twelve years on, a new operation is under way to find the wreckage of the doomed airliner

-

5 royally funny cartoons about the former prince Andrew’s arrest

5 royally funny cartoons about the former prince Andrew’s arrestCartoons Artists take on falling from grace, kingly manners, and more

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Would a 50-year mortgage make home ownership attainable?

Would a 50-year mortgage make home ownership attainable?Today's Big Question Trump critics say the proposal is bad policy

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

What are stablecoins, and why is the government so interested in them?

What are stablecoins, and why is the government so interested in them?The Explainer With the government backing calls for the regulation of certain cryptocurrencies, are stablecoins the future?

-

Mortgages: The future of Fannie and Freddie

Mortgages: The future of Fannie and FreddieFeature Donald Trump wants to privatize two major mortgage companies, which could make mortgages more expensive

-

Will the housing slump ever end?

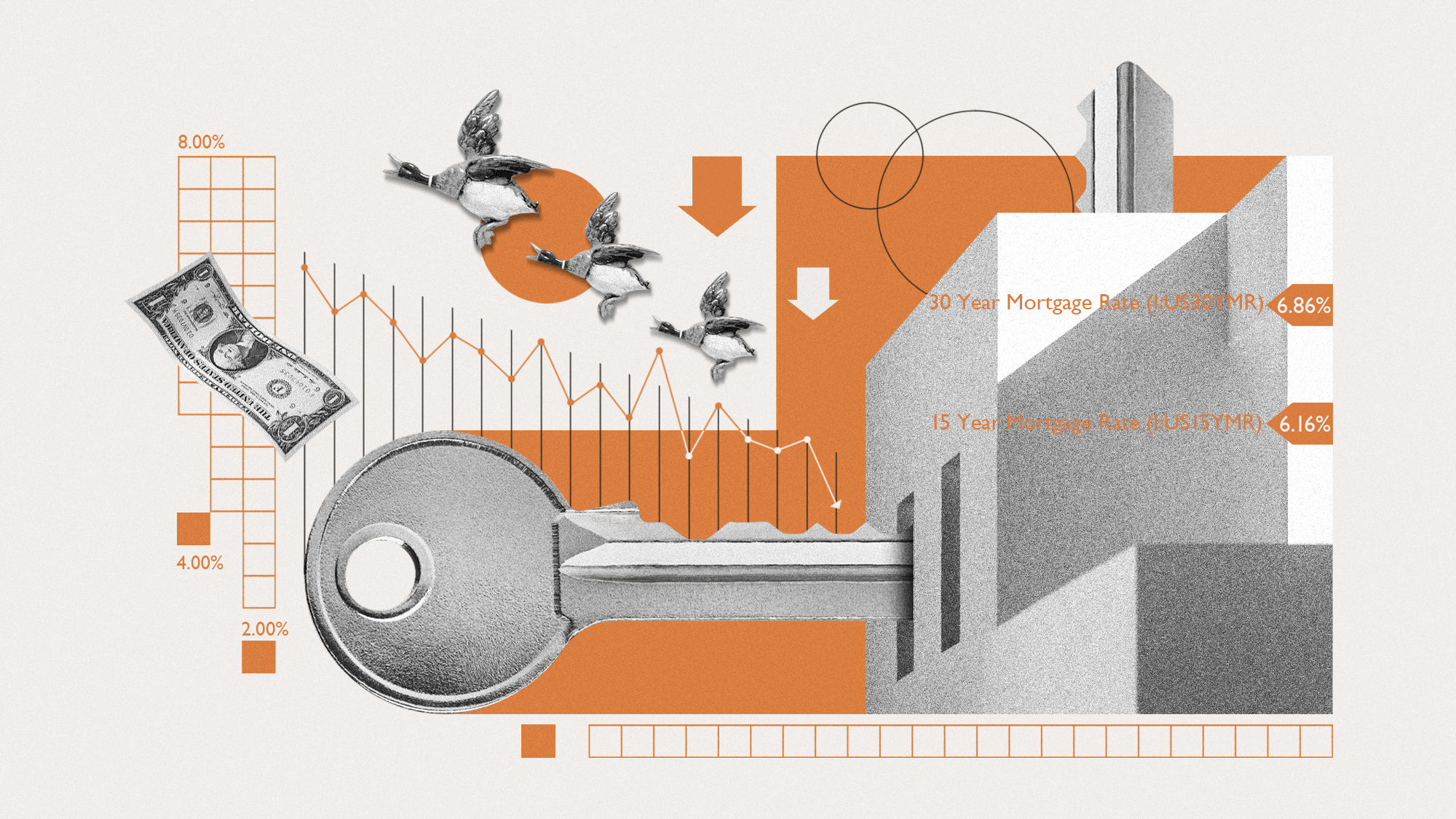

Will the housing slump ever end?Today's Big Question Probably not until mortgage rates come down

-

Will the UK economy bounce back in 2024?

Will the UK economy bounce back in 2024?Today's Big Question Fears of recession follow warning that the West is 'sleepwalking into economic catastrophe'