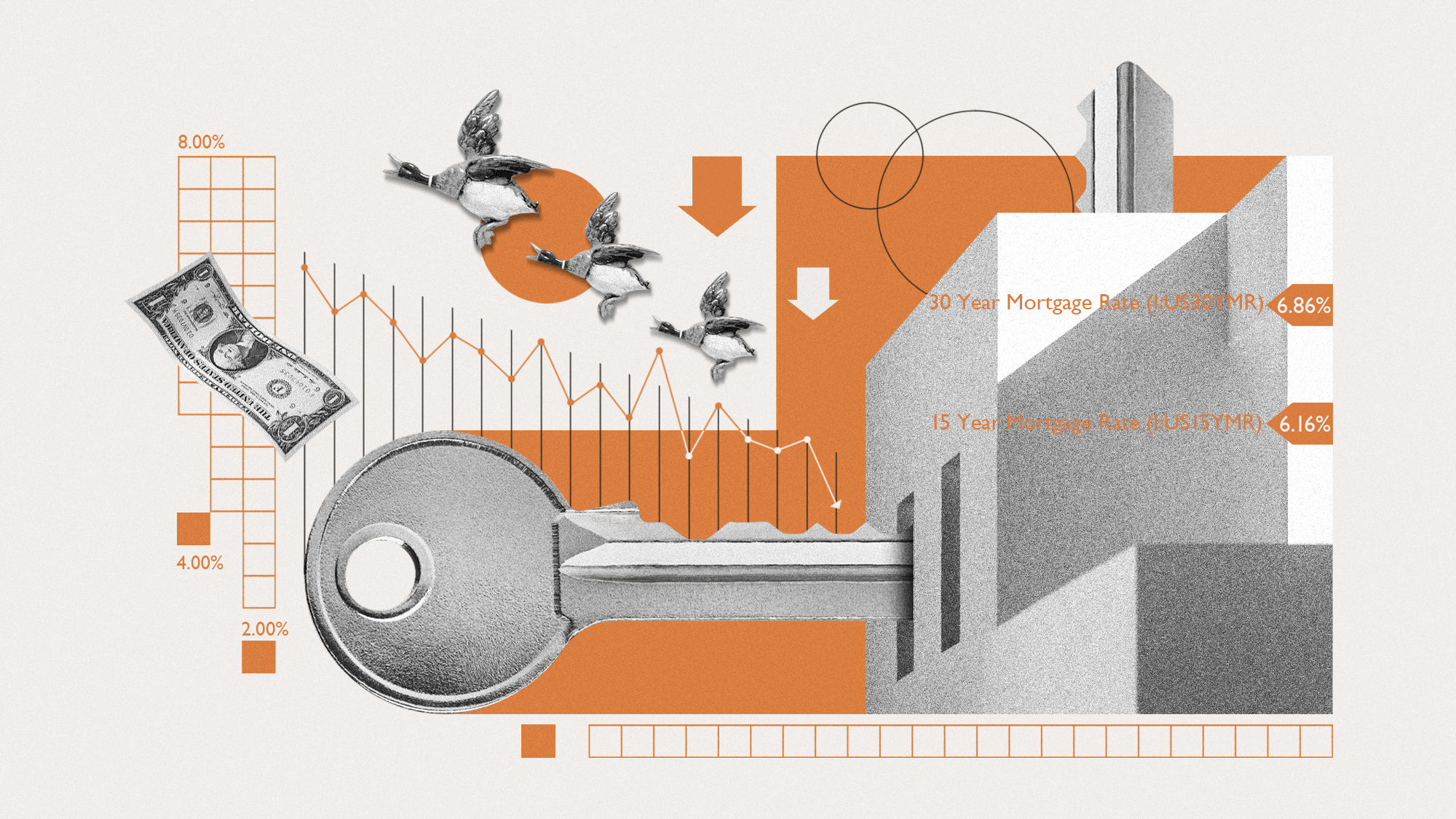

Will the housing slump ever end?

Probably not until mortgage rates come down

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The post-pandemic housing slump isn't going away. "Home shoppers came into 2024 with optimism," said The Associated Press. But mortgage rates remain high and are expected to stay that way after "stronger-than-expected data on inflation" cast a pall on the likelihood that the Federal Reserve will lower interest rates. But it's not just the costs of a mortgage that are a problem: The supply of homes for sale is "historically low" while the prices have hit "record highs." Buyers can't buy. Sellers won't sell. Nobody's happy.

That combination of factors means the housing market is "poised to become a major drag on the economy heading into the election," said Politico. Home sales typically make up nearly a fifth of the economy, so the bad times can have major effects. "Home sales activity is at a 30-year low," said one economist. That means "all of the economic activity associated with home sales is at a depressed level." And it's not clear what it will take to shake the sector out of its funk. Said one industry analyst: "It could take a decade."

What did the commentators say?

"As Gen Z enters the housing market, many say they've given up on buying a home," Troy Palmquist said at HousingWire. Many of those young people see the process as an "insurmountable financial burden." This means it's time for real estate professionals to reframe those challenges. Yes, prices are high, but that means homes are "valuable long-term investments." And yes, interest rates are also on the high side, but historically they're "not as extreme as they seem." Perhaps most importantly, though, "homeownership remains a worthy and achievable goal."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

One way to make the goal achievable? Change how we think about mortgages. The housing market is "frozen," said Peter McCoy at The New York Times, "because people who have 3 percent mortgage loans don't want to give them up for 7 percent loans on new homes." We can solve that by making mortgages "portable" — the loan you take out to buy your first house could be used to buy the next one, too, with the "same balance, interest rate and time remaining." The mechanics are complicated, but allowing portability could be a "'win-win' for borrowers and investors."

What next?

Any turnaround in the housing market is "still a year off," said The Orange County Register. Home prices have risen 5.7% in 2024, up from 3.9% a year ago. That could slow with an increase in the number of homes for sale combined with that mortgage-induced drop in demand — but that might not be enough for a real breakthrough. The biggest challenge is that "typical homes are no longer affordable to a middle-income household in the U.S.," said Zillow economist Skylar Olsen.

Any reduction in mortgage rates "might still be some time away," Hardika Singh said at The Wall Street Journal. The Federal Reserve isn't quite ready to start cutting rates. "We're looking for something that gives us confidence that inflation is moving sustainably down," said Chair Jerome Powell. Until that happens, America's housing market will probably continue to slump.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Is the US in a hiring recession?

Is the US in a hiring recession?Today's Big Question The economy is growing. Job openings are not.

-

Trump wants a weaker dollar, but economists aren’t so sure

Trump wants a weaker dollar, but economists aren’t so sureTalking Points A weaker dollar can make imports more expensive but also boost gold

-

The end for central bank independence?

The end for central bank independence?The Explainer Trump’s war on the US Federal Reserve comes at a moment of global weakening in central bank authority

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

The longevity economy booms as people live longer

The longevity economy booms as people live longerThe Explainer The sector is projected to reach $27 trillion by 2030