How to talk about money with your partner

Six smart financial tips for couples

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Whether you and your significant other are planning to sign your first lease together or you're about to walk down the aisle, talking about money is a must. Even if everything seems rosy right now, an undiscussed financial situation could lead to issues down the road. In fact, "financial problems are one of the main reasons why couples separate," reported Kiplinger.

To make sure money doesn't come in the middle of your relationship, here are six things you and your partner should discuss sooner than later.

1. Be open about your financial past

It's critical to an honest starting point that you and your partner share your financial histories with one another.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Not sure what that chat should entail? Mark Reyes, a senior financial advice manager at personal finance app Albert, shared with CNN the conversation he and his now-wife had "a few months into dating." "We had an honest discussion about, how does money make you feel, who do you trust with money and what kind of financial situation are you in, including debt and income," said Reyes.

Other areas to touch on include your habits around spending and saving, as well as your credit history and score, per CNN.

And if you're finding the conversation hard to navigate on your own, you can always enlist help. "Working with a financial planner who understands financial therapy, or a financial therapist, can help you have these conversations," Michael Kothakota, CFP, CEO of WolfBridge Wealth, told Insider.

2. Get familiar with your income vs. expenditures

"Figuring out your budget is the first step when discussing finances with your partner," Kiplinger said. But to do that, you'll need to familiarize yourself with "what money is coming in and how it's being spent," CNN added. That means "means tracking all your spending (yes, all of it) for a few months."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Once you have a clear idea of how both of you spend each month, you can compare that against your combined monthly income. You might also identify areas where you can easily cut back. From there, see how much is leftover each month and determine where that can go, whether that's paying down debt or saving for an upcoming purchase like a house or car.

3. Come to an agreement on spending

"For some couples, interest and priorities for spending are not the same," Kiplinger said. And even if this isn't your situation, it's still important to understand what each other's habits are when it comes to spending (as well as saving).

"The biggest issue I see for couples is a lack of education and communication about income and expenses. Since financial stress is one of the top reasons couples get divorced, the advice I give everyone is [to understand] their personal budget as well as their assets, both shared and separate," Lori Lustberg, a CFP with Pathway Financial Advisors, told Insider.

4. Create a plan to tackle debt

Beyond addressing future spending, you'll also want to take a look at any past spending you may have done that led to the accrual of debt, whether that's student loans or outstanding credit card balances. And if you've taken on debt together, that may become a shared responsibility for the two of you to pay off.

In either case, it's important to come up with a plan together, as individual and joint debt can affect your finances. Approach your debt by first organizing it according to "due date, minimum payment amount and interest rate," Kiplinger suggested. Once you have a complete picture of your debt, you can decide how best to pay it off.

Two common debt payoff methods are the snowball method and the avalanche method. With the snowball method, you pay off your debt with the lowest balance first, which allows you to build momentum through small wins. The avalanche method, on the other hand. "is all about tackling the debt with the highest interest rate first," said Kiplinger, which can lead to the most interest savings over time.

5. Will you combine finances?

Over the course of a relationship, your finances are bound to get increasingly entangled, whether due to a pet you're co-parenting or an apartment you're renting together. As such, it's important to come up with a plan for how you'll manage your money and navigate shared expenses. There are "three main ways that couples manage their finances: separately, jointly, or with a combination of separate and joint accounts," said Investopedia.

Each setup has its pros and cons. While opening a joint account can require less planning than keeping separate accounts, the setup "can lead to more conflicts if partners' spending habits don't mesh," said Investopedia. Separate accounts can help partners dodge those conflicts, but "you may lose out on the best way to manage your family money." With a combination of the two, you'll get some of the best of each, though you will need to deal with having multiple bank accounts and determining where to allot money and how much.

6. Set shared financial goals

If you and your partner are in it for the long haul, you might as well sync up your long-term financial goals as well. This could be a vision you have for your retirement together or a home you hope to someday purchase.

When it comes to setting these goals, it's critical "to be specific," CNN stressed. "There can be different goals, but have the conversation and document the goals to make sure spending habits stay in line with short- and long-term goals," Mary-Charles Nassif, a financial adviser for Edward Jones Financial, told CNN.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She has previously served as the managing editor for investing and savings content at LendingTree, an editor at SmartAsset and a staff writer for The Week. This article is in part based on information first published on The Week's sister site, Kiplinger.com.

New Tax Rules for 2023: Download your free issue of The Kiplinger Tax Letter today. No information is required from you.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

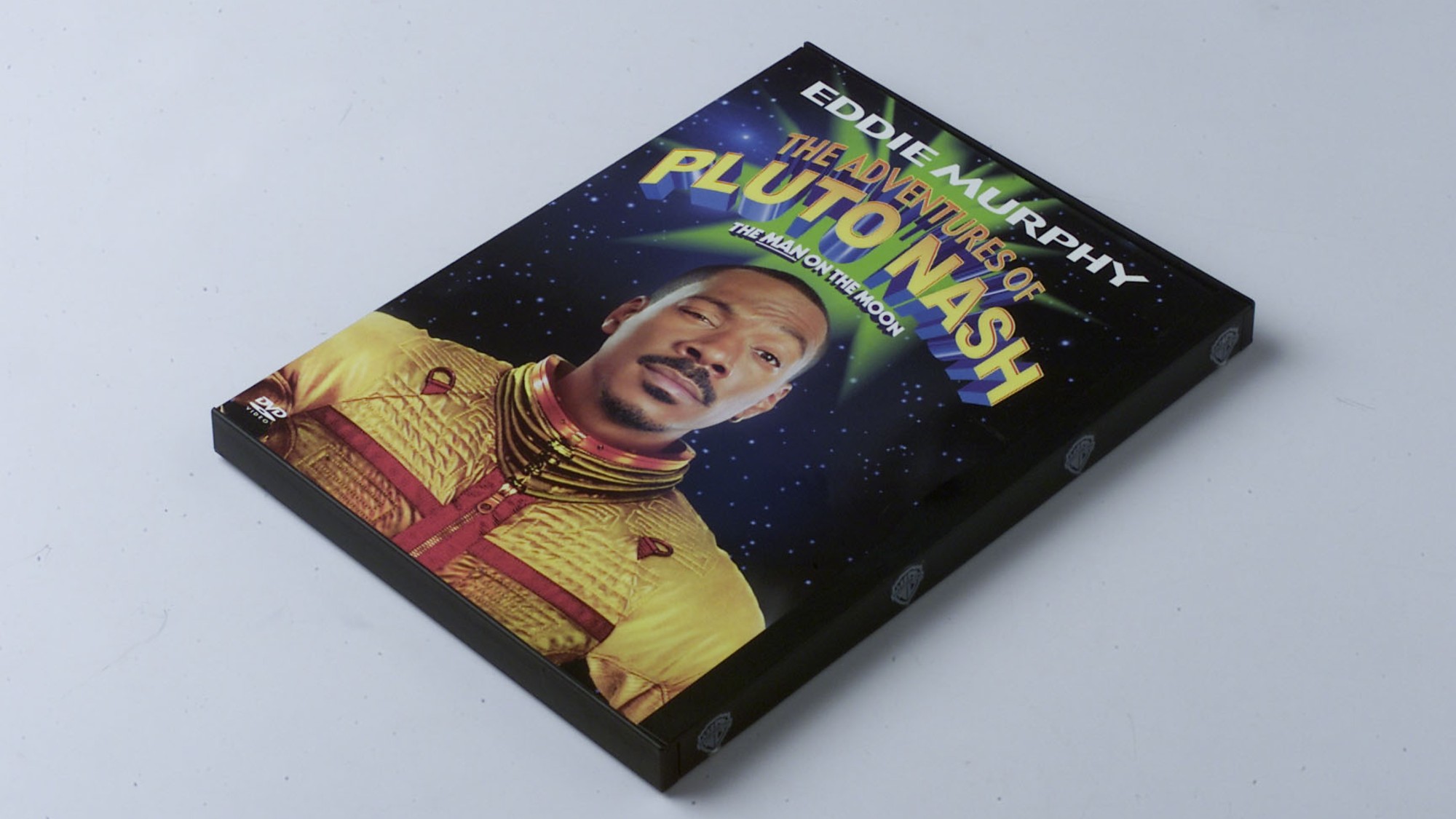

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

The 10 most infamous abductions in modern history

The 10 most infamous abductions in modern historyin depth The taking of Savannah Guthrie’s mother, Nancy, is the latest in a long string of high-profile kidnappings