6 tips for staying afloat financially during a strike

If you're in a situation where your regular paycheck suddenly isn't coming in, it's smart to know in advance what to do

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

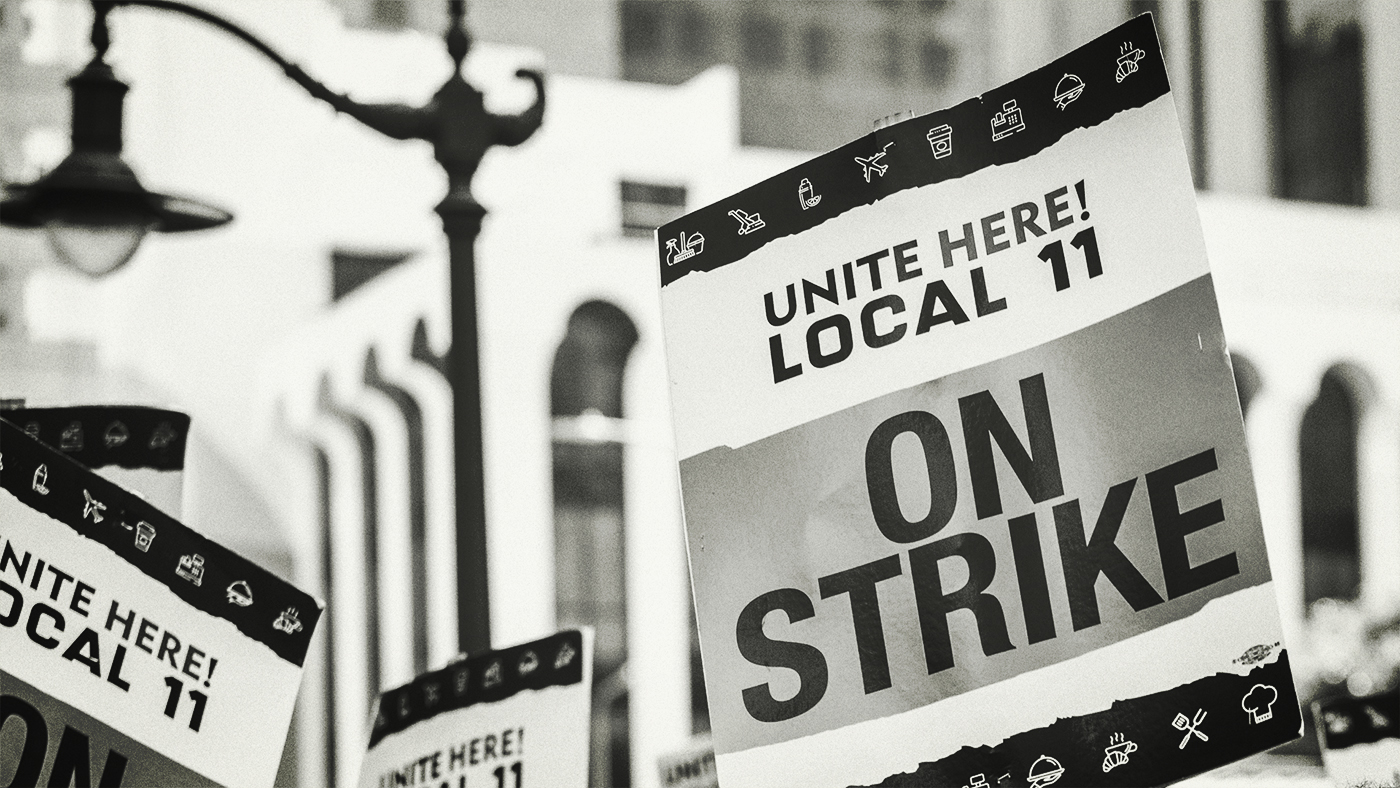

As The Washington Post described it, summer 2023 is the "summer of strikes." There's the double strike from writers and actors in Hollywood, alongside strikes actualized or threatened by digital news employees, brewery workers and unionized UPS workers. And come fall, the season of strikes could continue. United Auto Workers, which represents workers at Ford, GM and Stellantis, could go on strike when its new contract expires, Nerdwallet reported.

Even if you don't think your industry has plans to go on strike anytime soon, there's also the looming threat of a potential government shutdown, and furloughs and layoffs are always a possibility. If you're in a situation where your regular paycheck suddenly isn't coming in, it's smart to know in advance what to do.

1. Ensure you have funds to tap into

Financial experts always stress the importance of an emergency fund, and that savings becomes especially vital in the event of a strike. The general rule of thumb for saving is three to six months' worth of expenses, but that's not always within reach. Instead, the Post suggested aiming to "save enough to cover at least two missed paychecks." And then if that's even too much, the Post suggested aiming lower to just be able to "survive at least a month without a paycheck."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

When it comes to figuring out exactly how much money that requires stashing away, the Post suggests skipping the nitty-gritty calculations. Instead, "just focus on necessities, such as food and housing expenses," as there are some situations where you can "let some things go for a little while so that you can keep a roof over your head and food on the table," the Post said.

When you apply via our links, we may earn an affiliate commission.

2. Study up to determine what help is available

According to Nerdwallet, "Unions typically set up a strike fund to help members cope with the loss of income during a strike," and "each union has rules about how much members can draw from it." If you know a strike is imminent, it's helpful to have a handle on that in advance of your last paycheck.

Other matters to dig into in advance include what happens to your health insurance coverage if your employer stops covering its portion of the premiums. Per Nerdwallet, "Striking workers can elect to continue their health coverage on their own dime under COBRA, a federal law that temporarily requires employers to extend coverage after employment ends," and some unions may even help its members with these costs.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Last but not least, familiarize yourself with local laws on unemployment benefits. Even though it's not all that common, "some states allow striking workers to collect unemployment, depending on the circumstances," Nerdwallet reported.

3. Keep your eye out for new ways to cut spending

As you prepare for or adjust to a new financial reality, it's helpful to keep your spending as lean as possible. After all, you might not know how long you'll be in your current situation.

Per the Post, reviewing your budget for "bloating" is something you should be doing regularly already, but that practice becomes especially essential if your paychecks are no longer coming in. So sooner than later, look through your budget and find any unnecessary spending that you could cut out, such as from subscriptions you don't necessarily need, and then add those savings to that aforementioned emergency fund. Because as the Post pointed out, "Even tiny amounts add up and can have a big impact if you lose your job or have to weather a layoff or strike."

4. Consider fresh ways to earn income

Especially if an end isn't in sight, you might start looking out for new ways to start bringing in money. This doesn't necessarily mean getting a new full-time job either, especially if you're just waiting out a strike. For example, sell stuff you don't need or aren't using, sign on for a seasonal job, or turn to an app to get a flexible new gig, according to Nerdwallet.

5. Don't worry too much about debt for now

This might feel counterintuitive to every bit of financial advice you've ever received, but right before or during a pause in income is not the time to worry about paying down your debt. You'll want to make pay at least the minimum amount due to avoid adding late fees to your balance, but beyond that, hold off on an "aggressive push to get rid of your debt" in favor of maintaining a "sufficient cash cushion," per the Post. Indeed, in this situation, the only time you should consider making extra payments toward your debt is once your emergency fund is fully stocked, advised the Post.

6. Ask for help

Last but not least, don't hesitate to ask for help. This is understandably a tough time and one you shouldn't have to weather alone. You might consider "researching community resources that could help you stay afloat," as some "can help with bills or accessing food and mental health services," per Nerdwallet.

And while it might seem like an unlikely place to turn, it's also worthwhile to stay in touch with your creditors. According to the Post, it's helpful that you "don't wait until you get behind before notifying your creditors" and instead ask in advance for a "reprieve on your bill." Not sure how to approach that conversation? Here's what the Post suggested: "Explain your situation — I'm on strike, I've been furloughed — and see if you can get a month or even two months of forbearance." And as long as your situation drags on, keep on calling back to continue that conversation. At the end of the day, the worst they can say is 'no.'

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She has previously served as the managing editor for investing and savings content at LendingTree, an editor at SmartAsset and a staff writer for The Week.

Becca Stanek has worked as an editor and writer in the personal finance space since 2017. She previously served as a deputy editor and later a managing editor overseeing investing and savings content at LendingTree and as an editor at the financial startup SmartAsset, where she focused on retirement- and financial-adviser-related content. Before that, Becca was a staff writer at The Week, primarily contributing to Speed Reads.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day