The risks and rewards of investing outside market hours

Global stock markets don't really sleep, so why should your investment portfolio? Here is why you should consider out-of-hours trading

Most stock markets have standard trading windows during working hours, but investing and trading doesn’t necessarily just have to be a daytime activity.

There is plenty that can affect the movement of a stock and your portfolio outside of market hours, making it worth considering overnight or weekend trading.

Here is what you need to know.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What is out-of-hours trading?

Stock markets have standard working hours for trading activity.

For example, the London Stock Exchange is open for share trading from 8am to 4.30pm, while the New York Stock Exchange runs from 9.30am to 4pm. That means any shares you buy or sell through an investment platform or broker will typically only be processed during a stock market’s opening times.

But the news cycle and economic events don’t care about the time and plenty can happen before or after opening hours to impact a company’s share price.

Out-of-hours trading lets you take advantage of events that happen outside of a market’s operating hours so you can protect your portfolio or prepare for gains.

Who can trade out-of-hours?

The London Stock Exchange doesn’t allow out-of-hours trading but the US markets recognise that investors and traders may want round-the-clock access.

Platforms such as IG let users trade US stocks – as well as indices and forex – before the market opens, when it closes and also on weekends. IG customers can take a position on more than 70 key US stocks over extended hours including popular brands such as Apple, Amazon and Tesla.

This means that while while most UK traders can only access US stock markets from 2.30pm to 9pm GMT, pre-market trading lets you access these markets hours before they open and while other investors in the US are still sleeping – known as pre-market trading.

Late-night traders could even carry on once the US market closes at 9pm UK time, having digested a full day of news and global economic events – in post-market trading. There is even a weekend market if you fancy bolstering your portfolio on a Saturday or Sunday.

Why might you want to trade out-of-hours?

Most market activity and events take place during working hours, making it easier to make changes to your portfolio. But there may be breaking news that arrives before or after a market closes that your portfolio isn’t prepared for.

For example, most US companies release their earnings outside of the main session. This means the majority of trading usually takes place in the pre- and post-market sessions so traders can react fast to avoid losses or make the most of potential gains in their portfolio.

Other events such as interest rate changes or unexpected political news may take time to filter to companies and affect share prices the following day, while some economic updates are published before the markets open, so it could pay to be prepared.

The globalised world we live in also means an event taking place in a different timezone can impact your investments, especially with plenty of geopolitical tension going on in the Middle East and Russia at the moment. Rather than waiting for the markets to open, trading out-of-hours helps you get your portfolio prepared as soon as possible.

How to trade out-of-hours

There are a few different ways to trade out of hours, and the options and choice of stocks will depend on the broker or investment platform.

For example, IG lets traders use spread betting, where you bet on whether a market’s price will go up or down or contracts for difference (CFD), where you trade on the difference between the opening and closing price of a markets. It also supports share dealing.

The pros and cons of out-of-hours trading

Trading out of hours helps investors get ahead of the competition and prepare their portfolio if news has broken outside of trading hours. This could help hedge against losses or mean using spread betting to estimate what the share price will be once a market opens or closes based on economic or company events.

But there is lower liquidity out-of-hours, meaning fewer people or firms to trade with so you may not get the best price. The lower levels of choice also mean that prices can be volatile and swing wildly.

Additionally, spread betting and CFD products are very risky and can lead to big losses if your bets go against you, so may only be appropriate for those with a high risk appetite.

You should consider if an event or news announcement requires a change in your portfolio or if it is better to invest for the long-term if you are happy with a company's prospects. It is also worth checking the fees you are charged for these trades as they can differ among platforms and may take away the benefits of being active after hours.

You will get more choice and possibly better prices if trading during working hours but if you understand and are comfortable with the risks, then having the option to trade out of hours means your investments – and ultimately your future wealth such as your retirement – can be looked after throughout the day and night.

Your capital is at risk. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

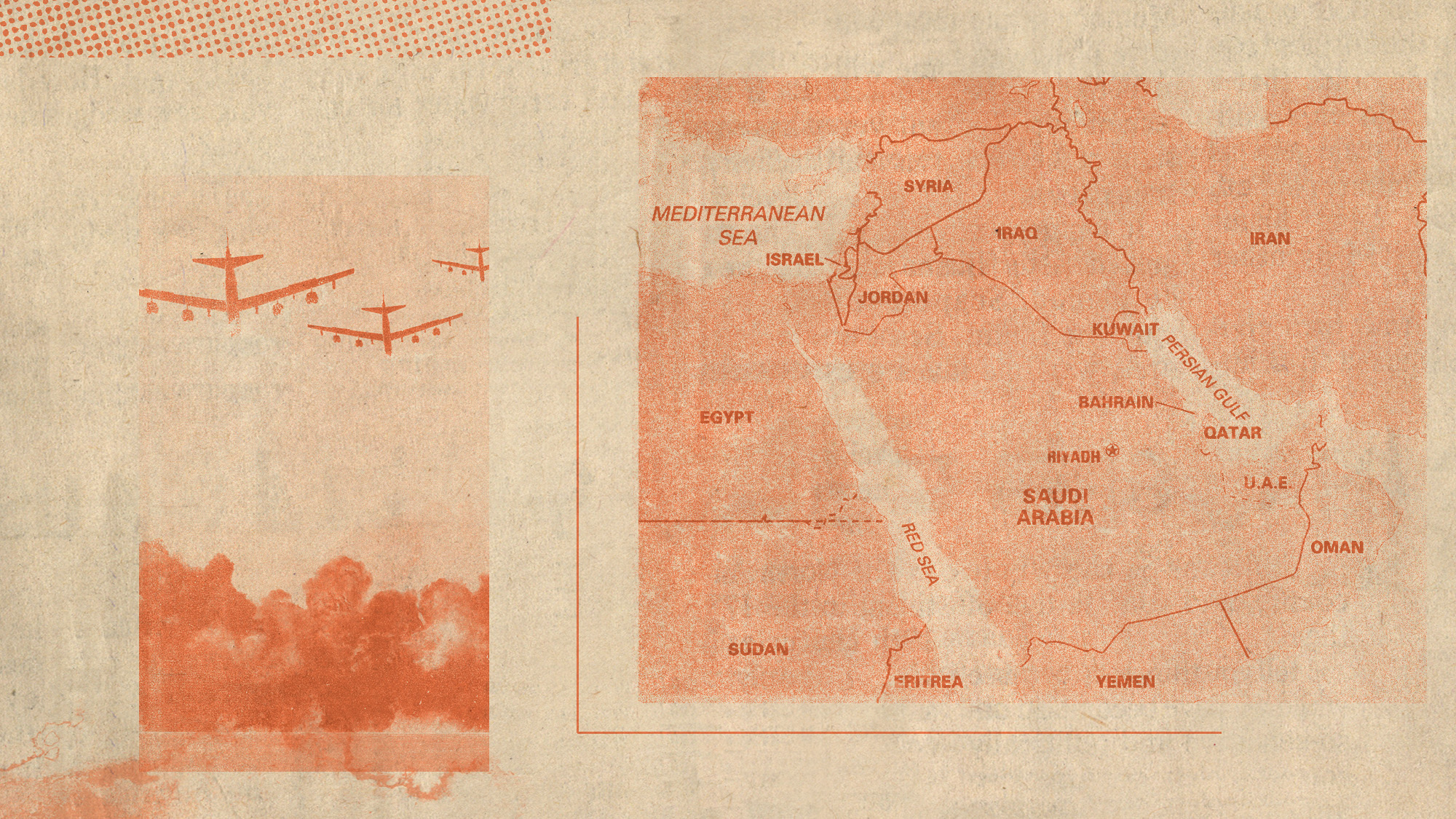

Will the Gulf states enter the Iran conflict?

Will the Gulf states enter the Iran conflict?Today’s Big Question Regional powers could transition from ‘defensive posture’ to ‘waging active war’ if Iranian aggression continues

-

The ‘golden age’ of HIV treatment

The ‘golden age’ of HIV treatmentThe Explainer Single-pill treatment proves as effective at suppressing virus as multi-pill therapy, while long-acting preventive injections are increasingly available

-

Underrated Italian gems for a memorable city break

Underrated Italian gems for a memorable city breakThe Week Recommends Ditch the crowds for a relaxing trip to one of these lesser-known spots