Elizabeth Warren reportedly wants to enact a 'wealth tax'

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Sen. Elizabeth Warren (D-Mass.) is set to propose a new tax on the wealthiest Americans as she plots her 2020 campaign.

Emmanuel Saez, an economist who has advised Warren on the plan, told The Washington Post the senator will propose an annual "wealth tax" of 2 percent on Americans with more than $50 million in assets and 3 percent on Americans with more than $1 billion in assets. He said the proposal, which would affect approximately 75,000 families, would bring in $2.75 trillion over the next decade.

“The Warren wealth tax is pretty big," Saez told the Post. "We think it could have a significant [effect] on wealth concentration in the long run." Warren has reportedly considered a variety of different proposals, including a 1 percent tax on income above $10 million.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Massachusets senator, who in December announced an exploratory committee ahead of the 2020 presidential race, has not confirmed any of the details of this reported plan. In announcing her committee, Warren made clear that income inequality will be a key issue in her campaign, saying that "America's middle class is under attack" because of "billionaires and big corporations" who "decided they wanted more of the pie."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Brendan worked as a culture writer at The Week from 2018 to 2023, covering the entertainment industry, including film reviews, television recaps, awards season, the box office, major movie franchises and Hollywood gossip. He has written about film and television for outlets including Bloody Disgusting, Showbiz Cheat Sheet, Heavy and The Celebrity Cafe.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

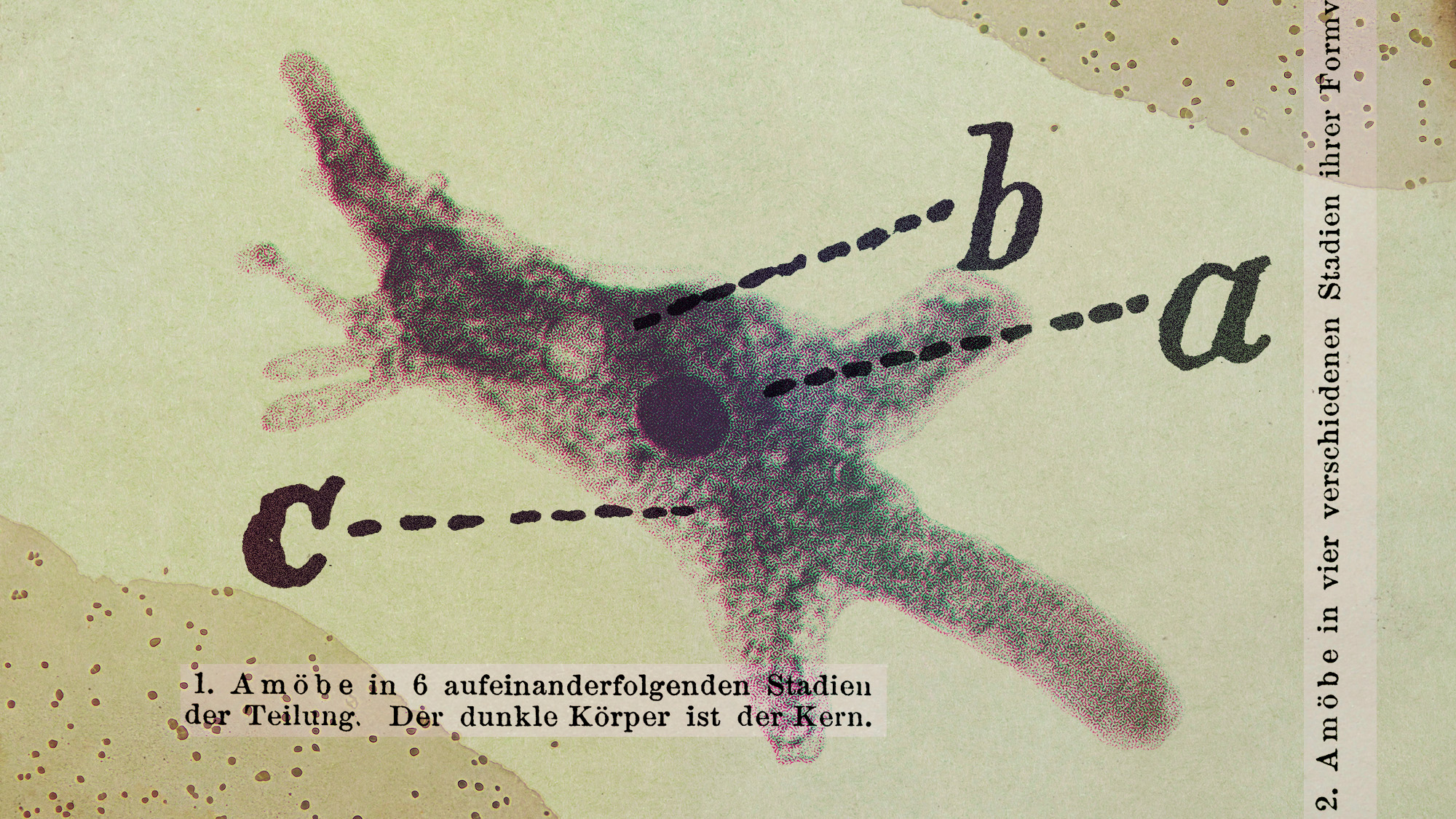

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’

-

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstances

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstancesSpeed Read

-

Western mountain climbers allegedly left Pakistani porter to die on K2

Western mountain climbers allegedly left Pakistani porter to die on K2Speed Read

-

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governor

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governorSpeed Read

-

Los Angeles city workers stage 1-day walkout over labor conditions

Los Angeles city workers stage 1-day walkout over labor conditionsSpeed Read

-

Mega Millions jackpot climbs to an estimated $1.55 billion

Mega Millions jackpot climbs to an estimated $1.55 billionSpeed Read

-

Bangladesh dealing with worst dengue fever outbreak on record

Bangladesh dealing with worst dengue fever outbreak on recordSpeed Read

-

Glacial outburst flooding in Juneau destroys homes

Glacial outburst flooding in Juneau destroys homesSpeed Read

-

Scotland seeking 'monster hunters' to search for fabled Loch Ness creature

Scotland seeking 'monster hunters' to search for fabled Loch Ness creatureSpeed Read