How long-term investing can offer a sustainable return

Taking a long-term view means your portfolio can ride out short-term fluctuations in value

The stock market can sometimes seem like a rollercoaster ride, but historically, it has delivered far superior returns over the long term when compared to other asset classes such as cash and bonds. If you've got a long-term savings goal, equities, whether held directly as shares or through a pooled fund i.e. a collective investment, could be an essential part of your portfolio.

Investing directly in equities can be a risky strategy if you don't properly do your homework. For many, it is important to avoid investing all of your money in just one company - the risks of losing everything are just too high. Instead, a collective investment, such as an open-ended fund or investment trust, could be worth considering. These 'funds' are managed by professionals who pool your money with other investors and spread it across a wide range of companies - thus spreading the risk and diversifying your investment. Typically, investors consider a basket of funds, so savings are diversified even further. Depending on your investment goals (for example, providing a decent level of income in retirement) it may be wise to consider a 'buy and hold' strategy: holding solid, sustainable companies with a long-term horizon, which could be a three to five year period (or longer), gives the investment time to ride out short-term market dips. Also regular saving schemes can help avoid buying at market peaks and averaging the cost of buying a particular stock or fund over a longer period of time.

If you've just taken the plunge, it can be tempting to constantly check up on your portfolio, and panic when your investment dips below the initial amount you invested, but taking a long-term view means your portfolio has the potential to smooth out the short-term fluctuations in value. You might be tempted to sell a holding as soon as it starts to lose money. Obviously it is important to keep an eye on it but don't forget that all companies are likely to have their ups and downs, if you are truly a long-term investor it might be worth holding tight. This is where having a good plan comes in handy. By defining the structure of your portfolio in advance, you remove the urge to make sudden changes to your investment. Don’t forget that each time you buy or sell a holding, you will be charged a transaction fee, which can quickly add up and significantly affect your portfolio.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Much of this comes back to diversification – spreading risk to ensure your money isn't held in just one place – which is the key to a solid long-term return. Risk and return go hand in hand, and once you understand how much risk you'd like to take with your money, you can think about spreading your money across a variety of asset classes, such as cash, equities and bonds. This is why it's important to take a big-picture view of your portfolio and understand how the different asset classes work together and off-sets one another in different market conditions. You also need to have patience.

Dividends and distributions can also be a significant part of your investment returns. By reinvesting dividends and income you will benefit from the power of compounding – the 8th wonder of the world according to Einstein! There is certainly no doubt reinvesting any income or dividends paid can have a significant impact on long-term returns. Read our article on the power of compounding to learn more.

Nobody can predict how the various asset classes – cash, bonds, equities and alternative investments – might perform in the future, but historically there is a precedent. Over the long term, equities will generally outperform bonds and almost always outperform cash returns. For example, since the FTSE 100 index started in 1984, it has returned over 600 per cent (as of 22 March 2015).

A self-directed fund supermarket, such as Alliance Trust Savings, is the most convenient and low-cost way to begin your portfolio. As well as being the cheapest way to invest in pooled funds and individual stocks and shares, fund supermarkets offer an easy way for you to hold all your investments in one place. Many will provide guides, tools and regular investment research to help you make the right choices about where to invest your money, and some will even offer model portfolios if you need further guidance.

If you're investing for long-term growth, it's important to stay informed about the fund and trust universe so you can make the right decisions for your portfolio. Alliance Trust Savings’ Investment Selector tool collates information on funds, trusts and UK companies where you can check past performance, prices and recent news, to help investors make informed decisions. If you are stuck, then it might be wise to talk to a financial adviser - details of how to find an adviser near you can be found at www.unbiased.co.uk.

To find out more about investment themes and how to get started with your portfolio, check out Alliance Trust's Investment Focus, which offers insight and knowledge into all areas of investment.

Remember that the value of your investments can go down as well as up and you may get back less than you originally invested. Alliance Trust does not give advice. You need to ensure that you understand the risks and the commitments before investing. If you are unsure, do consult a financial adviser

Illustration by Sue Macartney-Snape

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Kharg Island: Iran’s ‘Achilles heel’

Kharg Island: Iran’s ‘Achilles heel’The Explainer The vital Gulf oil hub has been untouched so far by US attacks

-

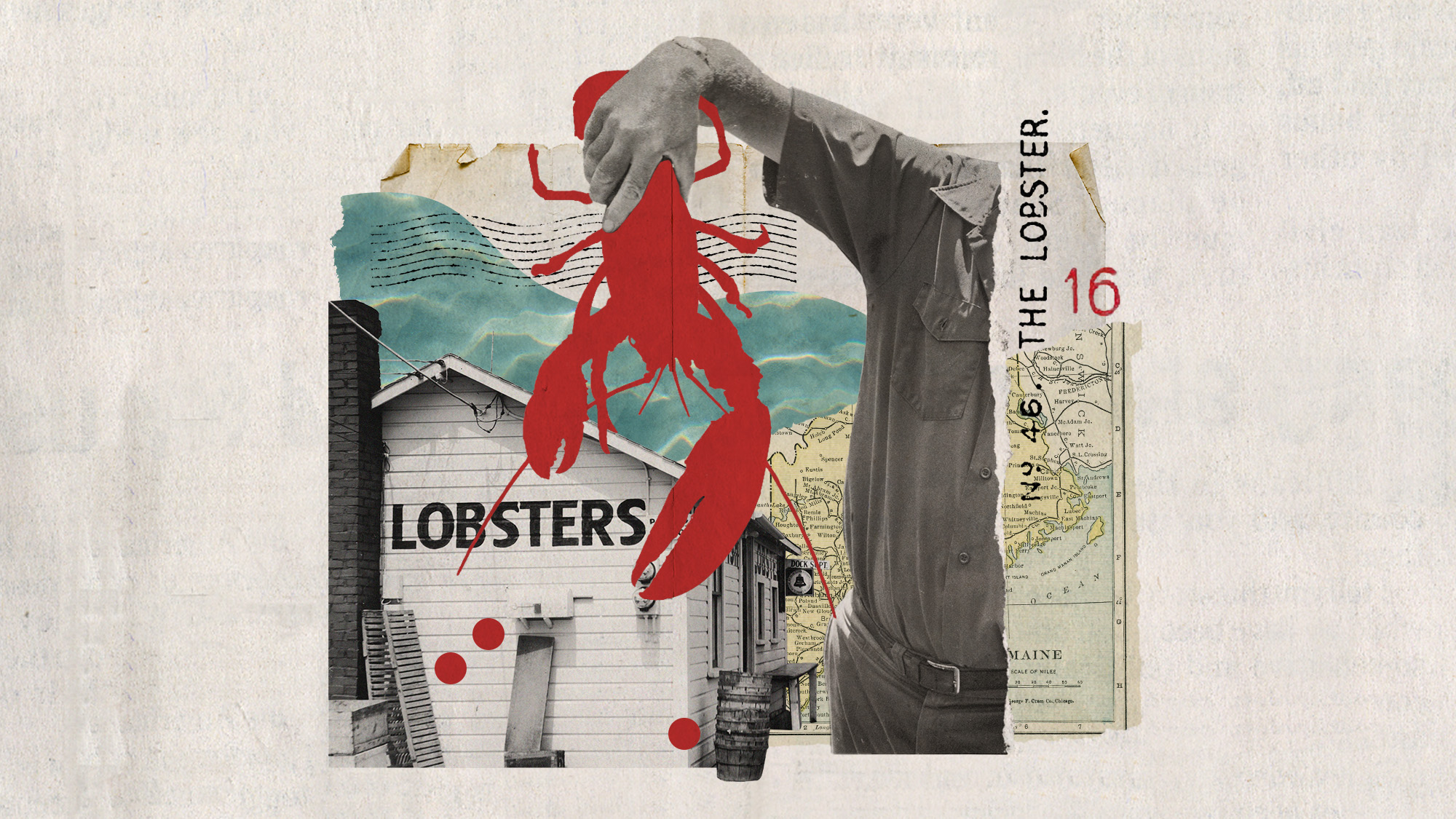

Surf and dearth: Maine’s lobster industry faces a reckoning

Surf and dearth: Maine’s lobster industry faces a reckoningunder the radar A shifting economy and climate change are causing issues for Mainers

-

Bone-chilling podcasts you may have missed this winter

Bone-chilling podcasts you may have missed this winterThe Week Recommends Environmental conflict, uncomfortable history and true crime encompassed the season’s best podcasts

-

Labor market strong as inflation sinks

Labor market strong as inflation sinksFeature And more of the week's best financial insight

-

Older workers stay in the labor force

Older workers stay in the labor forceFeature And more of the week's best financial insight

-

Currency: the long reign of the mighty dollar

Currency: the long reign of the mighty dollarFeature Argentina is planning to drop the peso in favor of the US dollar

-

For Gen Z, money is not a taboo topic

For Gen Z, money is not a taboo topicFeature And more of the week's best financial insight

-

401(k) hardship withdrawals rise

401(k) hardship withdrawals riseFeature And more of the week's best financial insight

-

Companies cut back on benefits

Companies cut back on benefitsFeature And more of the week's best financial insight

-

Bank accounts caught up in red tape

Bank accounts caught up in red tapeFeature And more of the week's best financial insight

-

Don’t count on working forever

Don’t count on working foreverFeature And more of the week's best financial insight