How solar energy could be the key to reducing economic inequality

Thomas Piketty's Capital in the Twenty-First Century underestimates the global economy's potential for growth

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It is widely known that economic inequality — in terms of both income and wealth — has been getting more severe for most of the last 30 years.

At the start of his presidency, President Obama set out his intention to "spread the wealth around." But it hasn't really worked out the way Obama wanted. Inequality has continued to grow.

U.S. median household income in June 2013 was 4.4 percent below where it was in June 2009, when the recovery from the Great Recession began.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Meanwhile, the top 1 percent of Americans — those earning above $366,623 a year — has taken 81 percent of the fruits of the recovery. And the top 0.01 percent — earning about $8 million a year — has pocketed an astonishing 39 percent of the growth.

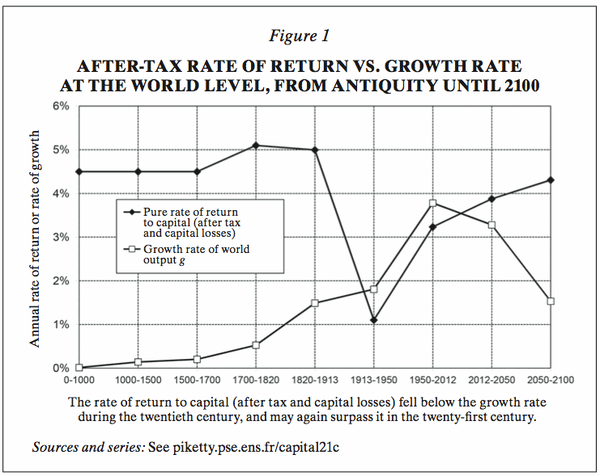

Thomas Piketty's landmark book Capital in the Twenty-First Century sets out a theoretical model to explain how inequality either grows or shrinks over time. Piketty identifies two key quantities: G, the level of economic growth in the entire economy, and r, the rate of return on capital in the economy. If G exceeds r, then inequality tends to shrink, as the growth in the wealth of capital holders is outpaced by growth in the economy at large. But if r exceeds G, then inequality tends to expand.

[Thomas Piketty]

Piketty's data on historical income — extrapolated from tax records — shows that for the bulk of the past 200 years, the rate of return on capital has vastly exceeded the level of growth. That has led to the kind of unequal society recorded in many of the novels of the 18th and 19th centuries, such as Honoré de Balzac's Père Goriot.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

For several decades in the middle of 20th century — in what could be seen as a historical anomaly — return on capital was lower, and growth shot up. Piketty sees the next century as returning to the premodern norm of much higher inequality.

From a policy perspective, what matters is the after-tax return on wealth. This means progressive taxation — particularly the taxation of wealth and inheritance — can be a powerful force in limiting inequality. The golden age of taxing high earners, from 1930 to 1975, accompanied the only reduction of inequality in the entirety of the era inaugurated by the Industrial Revolution. Absent high taxes on the rich, Piketty argues, the record shows that inequality in a capitalist system has always been massive — indeed, it is a feature of capitalism itself.

But remember, there are two variables to this: Growth as well as the return on capital. Growth depends on the total level of economic activity in the economy. As Piketty's data shows, economies have taken great leaps forward with technological progress and innovation, advances that began way before the era of progressive taxation. In other words, there is truth to the idea that the creation of wealth precedes its distribution. A proportionate swell in wealth creation may be just as good a remedy to inequality as redistribution.

And while there has definitely been a stagnation in growth in some countries, like Japan, in recent years, it is not necessarily true that the growth and wealth creation that brought down inequality in the middle of the last century will never return.

Take renewable energy, for example. Solar panels — the cost of which continues to massively decrease as the technology improves, and which are already as cheap as fossil fuels in some parts of the world — have the potential to create massive economic growth over the next two decades and beyond. The total solar energy hitting Earth each year is equivalent to 12.2 trillion watt-hours. That's over 20,000 times more than the total energy that all of humanity consumes each year, and far more in one year than the total quantities of fossil fuels that have yet to be extracted. That is a source of fuel for an awesome amount of potential growth.

Once solar is cheaper per watt than coal, oil, and natural gas, falling energy costs will provide massive relief to people squeezed in recent years by the rising cost of fossil fuel extraction, a burden passed on to the consumer. All else being equal, falling energy prices mean more disposable income to save and invest, or to spend. And because of the decentralized nature of solar energy, the benefits of cheap, plentiful energy can be realized by anyone with a solar panel, instead of being accrued by the capitalist who owns the coal mine, the power plant, or the oil well.

Having access to an independent energy supply would be highly empowering for individuals and local communities, allowing a higher degree of independence from governments and corporations. You could power your own lights, computers, and electric vehicles. You could even begin home- or community-based manufacturing in the form of 3D printers. With cheap, decentralized energy, the possibilities are endless for large-scale distribution of wealth.

In fact, it is eerily reminiscent of the initial Marxist vision of the means of production — energy and manufacturing — being taken out of the hands of capitalists and put into the hands of the masses. Solar represents a modern and (importantly) non-violent improvement upon the 19th- and 20th-century visions of workers seizing factories and farms with hammers and sickles. No cults of personality, dictatorships of the proletariat, or gulags necessary.

Of course, progressive taxation and redistribution from richer to poorer can still ease inequality in the short term, whether or not these effects eventually kick in.

And I could be completely wrong. But the current trends suggest that this vision of decentralization is much closer to the true story of capital in the 21st century than the redux of 19th-century-style inequality that Piketty imagines.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day