Why the poor's investment of choice is so alarming

Rich people prefer productive companies while the poor prefer shiny lumps of metal. That's bad news.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

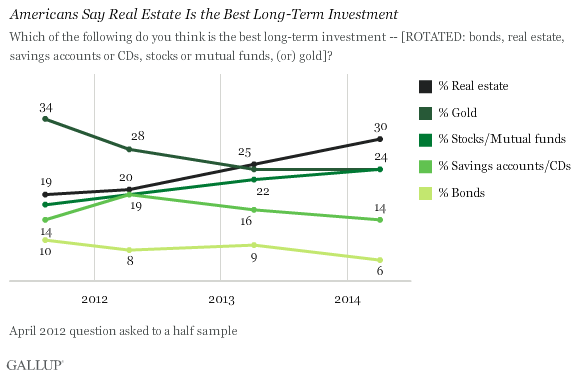

Gallup's poll on Americans' favorite investments always makes fascinating reading.

Every year, Gallup asks Americans to choose the best investment from the following choices: Real estate, stocks and mutual funds, gold, savings accounts and certificates of deposit, or bonds. In the years since the 2008 financial crisis and housing bust — after which Americans as a group briefly ranked gold as their favorite investment — real estate has once again swung back into favor:

[Gallup]

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But as Barry Ritholtz notes over at Bloomberg View, the most interesting thing is that there are some serious differences between the investment styles of the poor and the rich. First, the rich love real estate and stocks:

Upper-income Americans are much more likely to say real estate and stocks are the best investment, possibly because of their experience with these types of investments. Upper-income Americans are most likely to say they own their home, at 87 percent, followed by middle (66 percent) and lower-income Americans (36 percent). Gallup found that homeowners (33 percent) are slightly more likely than renters (24 percent) to say real estate is the best choice for long-term investments. [Gallup]

But lower-income Americans tend to favor gold:

Lower-income Americans, those living in households with less than $30,000 in annual income, are the most likely of all income groups to say gold is the best long-term investment choice, at 31 percent. Upper-income Americans are the least likely to name gold, at 18 percent. [Gallup]

Now, as it happens, the investments favored by the rich have performed vastly better in the last century than those favored by the poor. As I've described before, over the last 200 years, stock indexes have been by far the best performing asset class, easily outperforming bonds, real estate, and, especially, cash and gold.

And there are pretty good reasons for that. Gold is a shiny lump of metal that pays no dividends and collects no rents. In fact, it can cost money to hold — such as security and storage costs, for example. The only way to make a profit from gold is if someone is willing to pay more than you did for it at a later time. Sometimes, when people in the gold market are buying, gold does very well — as it did from 2000 to 2012 — but if people stop wanting to buy at a higher price, then the price can fall a lot. On the other hand, real estate (both residential and land) yields rents, and stocks in productive companies yield dividends. Even bonds and savings accounts pay an interest rate.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So why do some investors still go for gold? Well, not everyone has access to the same information. Lots of people are still scared by stocks and real estate because of the 2008 bust (just look at falling rates of stock ownership), and aren't looking at the bigger picture, in which stocks in particular outperform everything, especially gold.

But Ritholtz suggests the key is people's attitudes:

[Investing in real estate] reflects a faith in the legitimacy of the local property laws and legal system; that you will be secure in that property, and no one can illegally take it from you. Stocks are similar: Investing in them reflects a long-term faith that the nation will continue expanding its production of goods and services. Stocks are an optimistic asset class almost by definition. [ Bloomberg View]

And gold? Ritholtz sees it as a disaster currency:

Gold is more or less portable; it often can be traded extra-legally. It is a disaster currency that will have value even in a Mad Max era when society breaks down. Gold reflects a hedge against the potential collapse of the existing order; it is a pessimistic investment. [Bloomberg View]

On the surface, this makes sense: Rich people are by definition those who are doing well within the current economic system, while poor people are by definition not doing so well within it. So it's totally unsurprising that the rich are expressing higher levels of confidence in a system they are doing well within, and the poor are expressing lower levels of confidence. It is just a reflection of their situation.

But there's another strong possibility as well: Lower income individuals tend to be less financially literate. Many of the poor surveyed by Gallup might simply not be as well-educated about stocks, bonds, and real estate investment trusts as the rich. After all, only 11 percent of those who make less than $25,000 a year have a non-retirement investment, compared with 60 percent of those who make more than $75,000. Gold, on the other hand, might seem like an attractive investment option if only because it is fairly synonymous with wealth.

Tied to financial literacy is familiarity. Because the poor have little money to spend, productive investments like stocks, bonds, etc. are out of reach. Gold, however, is the one of the few investments that are not. As Terrance Odean, a professor of finance at the University of California, Berkeley, tells CNBC:

Why don't people own real estate beyond their home? It takes a lot of money and it takes a loan from a bank to buy this.... The barrier to having a bank account is a dollar. Essentially, you need a couple of dollars to put in a bank account, but it's not a hard barrier. What's the barrier to buying gold? The threshold at which you can buy gold is much lower. [CNBC]

Another trouble, however, is that how the rich and poor understand investments isn't just reflective of wealth inequality; the differences will widen it as well. While the poor have little money to invest (almost all goes to putting food on the table, rent, and other day-to-day expenses), the little they do won't be put to productive use. Most of the last 200 years of human history has very much been a story of human ingenuity overcoming adversity and humans increasingly thriving on the back of technological and social innovation. Betting against the continuation of that narrative will likely only result in being left further out in the cold.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

A dreamy long weekend on the Amalfi Coast

A dreamy long weekend on the Amalfi CoastThe Week Recommends History, pasta, scenic views – this sun-drenched stretch of Italy’s southern coast has it all

-

Can foster care overhaul stop ‘exodus’ of carers?

Can foster care overhaul stop ‘exodus’ of carers?Today’s Big Question Government announces plans to modernise ‘broken’ system and recruit more carers, but fostering remains unevenly paid and highly stressful

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts