Is the American economy's Age of Suck finally over?

Blisteringly strong GDP growth is cause for some optimism

The American economy is a tricky beast. Just when pessimists on the left (Too much inequality!) and downers on the right (Too much Obama!) had written the economy off, it goes and posts its best showing in more than a decade. The nation's gross domestic product, adjusted for inflation, grew by a white-hot 5 percent in the third quarter — revised upward from a 3.9 percent initial estimate last month — according to the Commerce Department. That's the fastest growth since summer 2003, and comes right after an almost-as-strong 4.6 percent gain in the second quarter. Punch it, Chewie!

Alas, almost no one expects such a torrid pace to continue. Over the past generation, long periods of such ultrafast growth have only happened right after the deep 1981-82 recession and during the 1990s internet boom. And they've been really rare in the 2000s. From 1981 through 2000, there were 21 individual quarters where the economy grew by 5 percent or faster — but just two quarters of such fast growth since, including this most recent one. Indeed, the recovery from the Great Recession has been so anemic that many economists have wondered whether slow growth was the "new normal" or a "permanent slump."

So the big question is whether the economy's recent strong showing is a harbinger of something significantly better than the 2 percent average annual growth we've since 2009. And good news! It probably is for awhile, thanks to the American consumer.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

One big reason for the huge upward revision was better-than-expected consumer spending, thanks to more jobs, higher incomes, less personal debt, and lower gas prices. Going forward, there are already signs wallets will remain open. First, consumer sentiment now stands at the highest level since January 2007, which "should bolster big-ticket consumer purchases in the fourth quarter," according to Barclays. What's more, new government data shows real consumer spending rose 0.7 percent last month, "the strongest monthly gain since the cash-for-clunkers boost in August 2009," according to JP Morgan.

Second, oil prices continue to fall, down 50 percent since August. Citi estimates that the annual income boost to consumers is now $1,150 per household, or more than 2 percent of the median family income. And Goldman Sachs thinks cheaper energy means economic growth will be as much as a half a percentage point faster next year than it would have been otherwise. Cheap energy may slow the shale revolution, but it is great news for everybody who isn't a petro-state dictator.

All of this adds up to a pretty clear forecast: It's reasonable to expect the U.S. economy to grow next year at its fastest pace since before the 2007-2009 financial crisis, maybe around 3 percent or so.

Good news, to be sure, but that's really still just catch-up growth after the Not-So-Great Recovery, not mention that nasty storm last winter that sent the economy into the freezer.

Most economists think America's long-term potential growth rate will fall prey to slowing population growth and less innovation, outside of smartphone apps. And even higher GDP growth isn't a cure-all if most of the benefits go only to a few. Policymakers need to build on this recent economic upturn with policies to reform K-12 education, improve college access and completion, repair our infrastructure, and lower barriers to business startups.

Washington, you have your 2015 to-do list!

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

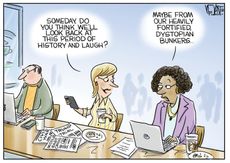

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published