Personal finance tips: Why you shouldn't raid your 401(k), and more

Three top pieces of financial advice — from planning a career change to what to know about secured cards

Don't raid your 401(k)

Quit treating your retirement savings like "a piggy bank," says John Schmoll at Daily Finance. More and more Americans are "pilfering from their 401(k) accounts." In 2011, American workers withdrew $57 billion from their 401(k)s prematurely — a 37 percent increase from 2003. The trend has been fueled in part by younger workers cashing out of their company-backed savings plans when they change jobs. But early withdrawals are not good. In fact, the best thing to do when switching jobs is to either open an IRA or roll your existing 401(k) into your new employer's plan. "Not only will this allow you to avoid losing money due to early withdrawal penalties, but it will also keep the power of compound growth on your side as you build up a retirement nest egg."

Planning a career change

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Changing careers can be "terrifying," but there are ways to ease the transition, says AJ Smith at Credit.com. First of all, "remember that the grass isn't always greener," so be sure to learn as much as possible about your new career before ditching your current one. Once you decide to move, "make yourself a good fit." If more education or training is required, you'll need to "look carefully at how this will affect your finances." If possible, land a part-time job or internship "to get your feet wet" while you're still employed, and "get that added degree or certification at night or on weekends." It's also best to build up an emergency fund, since starting a new career may mean taking an initial pay cut or even going into debt while you hunt for a job.

What to know about secured cards

If you're trying to rebuild your credit, consider a secured credit card, says Michael Estrin at Bankrate. "Unlike traditional credit cards, secured cards require the cardholder to put down a cash deposit that serves as collateral if the bill isn't paid on time." But don't forget to read the fine print. Secured cards can carry higher interest rates, and often charge fees for exceeding the credit limit or making late payments. And keep an eye on your deposit. While some issuers will refund your down payment and convert the account to an unsecured card, others simply "close the secured account and offer the cardholder the opportunity to open a new unsecured account." That's good news if you need your cash back, but remember that closing accounts can also impact your credit score.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

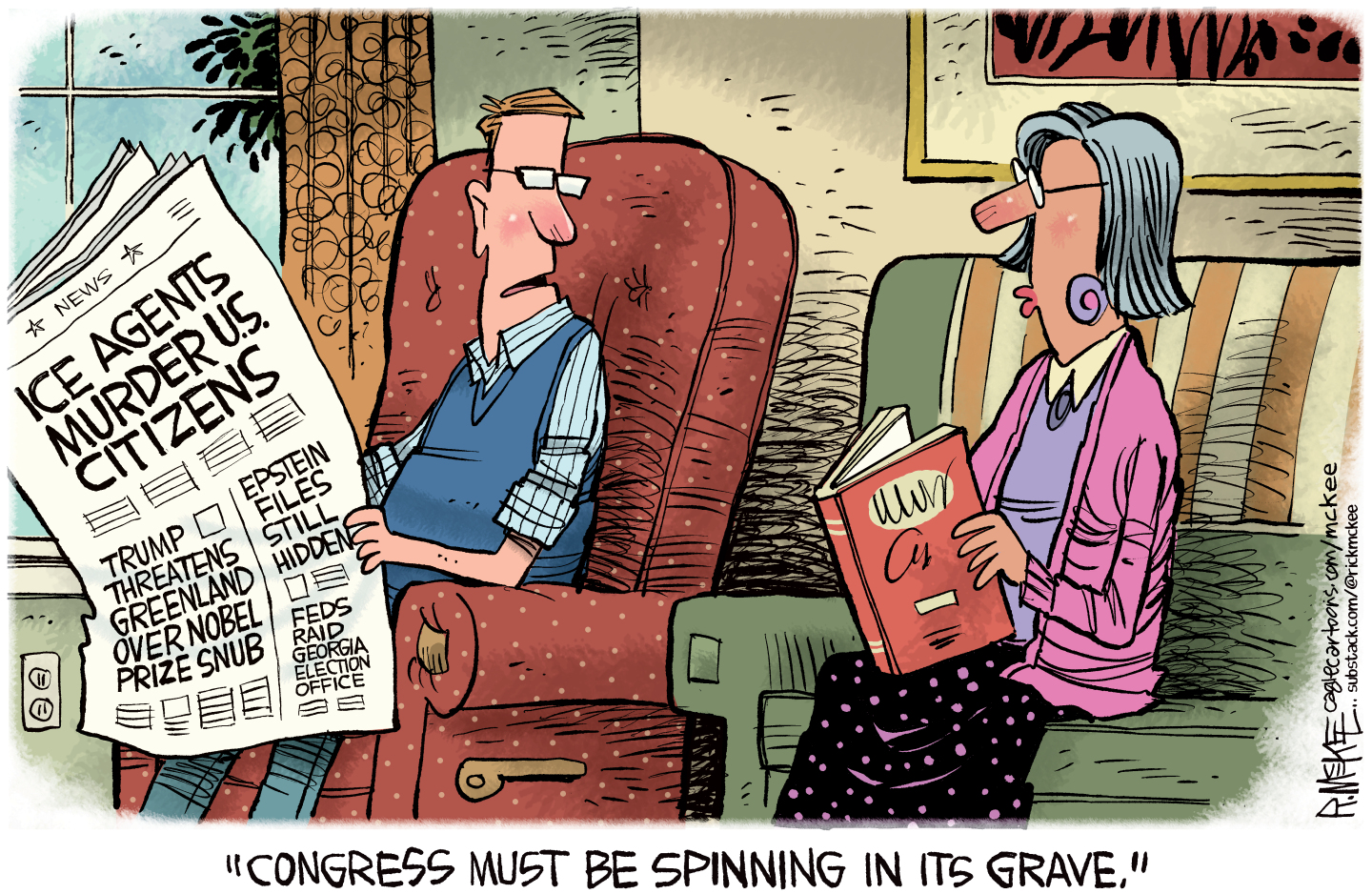

31 political cartoons for January 2026

31 political cartoons for January 2026Cartoons Editorial cartoonists take on Donald Trump, ICE, the World Economic Forum in Davos, Greenland and more

-

Political cartoons for January 31

Political cartoons for January 31Cartoons Saturday's political cartoons include congressional spin, Obamacare subsidies, and more

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities